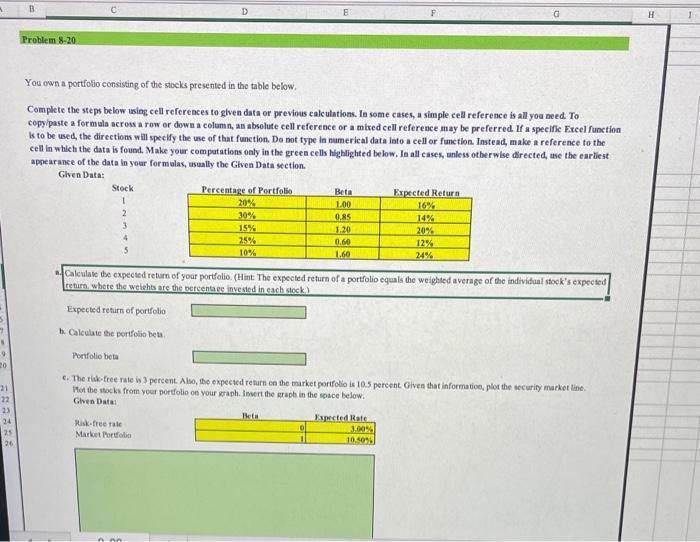

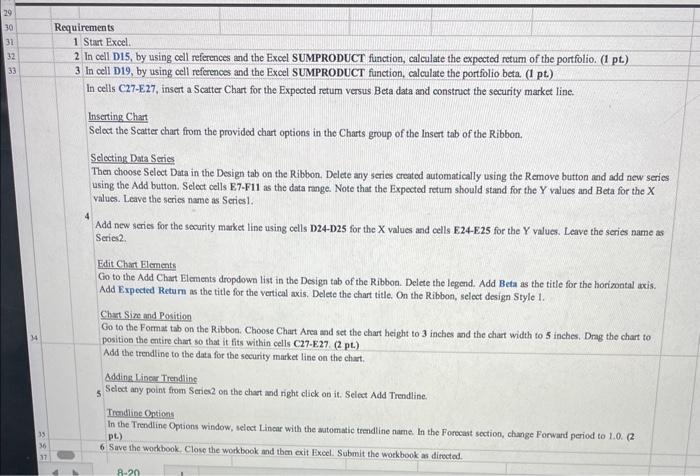

You own a portifotio consisting of the stocks presented in the table below, Complete the steps below using cell references to glven data or previous calculations. In some cases, a simple cell reference is all you need. To copyipaste a formula acrows a row or down a column, as absolute cell reference or a mixed cell reference may be preferred. If a specific Fixcel function Is to be used, the dircctions will speclfy the use of that function. Do not type in numerical data iato a cell or function. Instead, make a reference to the celli in which the data is found. Make your compatations only in the green cells highlighted below, In all cases, unless otherwise directed, ase the earliest appearance of the data in your formalas, usually the Glven Data section. Glven Data: stock 1 2 3 4 5 -. Calculake the expected return of your portfolio. (Hint The expected retura of a portfolio equals the weighted average of the indivitual stock's expected) teturn, whete the weiehts are the percentage invested in each slock) Expected return of portsolio b. Calculate the porifotio beta. Pertfolio beta c. The risk-free rate is 3 percent Also, the expected return en the market porifolio is 10.5 percent, Given that information, plot the iccurify market line. Ghen Data: Start Excel: In cell D15, by using cell references and the Excel SUMPRODUCT function, calculate the expected retum of the portfolio. (1 pt.) In cell D19, by using cell references and the Excel SUMPRODUCT function, calculate the portfolio beta. (1 pt.) In cells C27-E27, insert a Scatter Chart for the Expected retum versus Beta data and construct the security market line. Inserting Chart Selot the Scatter chart from the provided chart options in the Charts group of the Insert tab of the Ribbon. Selecting Data Series Then choose Select Data in the Design tab on the Ribbion. Delete any series created automatically using the Remove button and add new series using the Add button. Select cells E7.F11 as the data nange. Note that the Expected retum should stand for the Y values and Beta for the X values. Leave the series name as Seriesl. 4dd new series for the soxurity market line using cells D24-D25 for the X values and cells E24-E25 for the Y values. Lave the series name as Serie2. Edit Chat Elements Go to the Add Chart Elements dropdown list in the Design tab of the Ribbon. Delete the legend. Add Beta as the title for the horizonal axis. Add Expected Retum as the title for the vertical axis. Delete the chart title. On the Ribbon, select design Style I. Chart Sire and Position Go to the Format tab on the Ribbon. Choose Chart Area and set the chart height to 3 inches and the chart width to 5 inches, Drag the chart to position the entire chart so that it fits within cells C27-E27. (2 pL) Add the trendline to the data for the security market line on the chart. Adding Lineas Trendline 5 Seloct any point from Seriee2 on the chast and right click on it. Select Add Trendline. Trendlice Ontions In the Trendline Options window, seloct Lincar with the automatic trendline name In the Forocast section, change Fonward period to 1.0. (2 pt.) 6 Save the wodkbook. Clove the workbook and then exit Exeel. Submit the workbook as ditrectat