Answered step by step

Verified Expert Solution

Question

1 Approved Answer

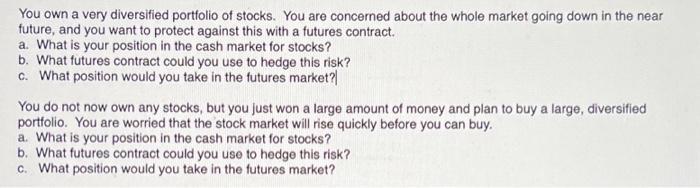

You own a very diversified portfolio of stocks. You are concerned about the whole market going down in the near future, and you want

You own a very diversified portfolio of stocks. You are concerned about the whole market going down in the near future, and you want to protect against this with a futures contract. a. What is your position in the cash market for stocks? b. What futures contract could you use to hedge this risk? c. What position would you take in the futures market? You do not now own any stocks, but you just won a large amount of money and plan to buy a large, diversified portfolio. You are worried that the stock market will rise quickly before you can buy. a. What is your position in the cash market for stocks? b. What futures contract could you use to hedge this risk? c. What position would you take in the futures market?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a If you already own a diversified port...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started