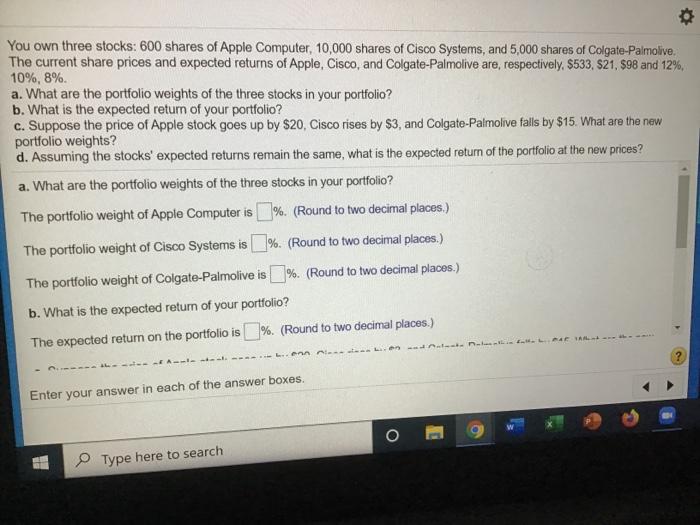

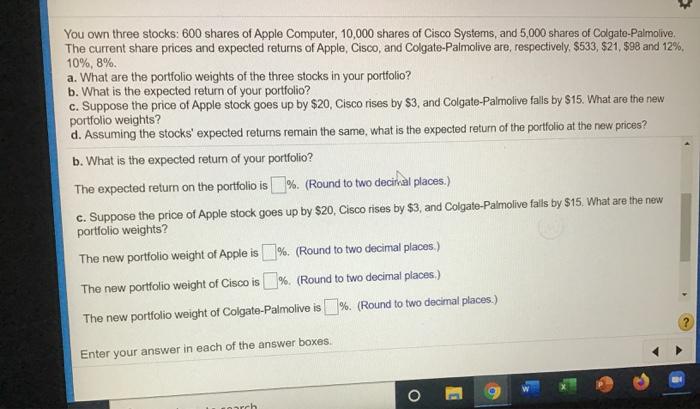

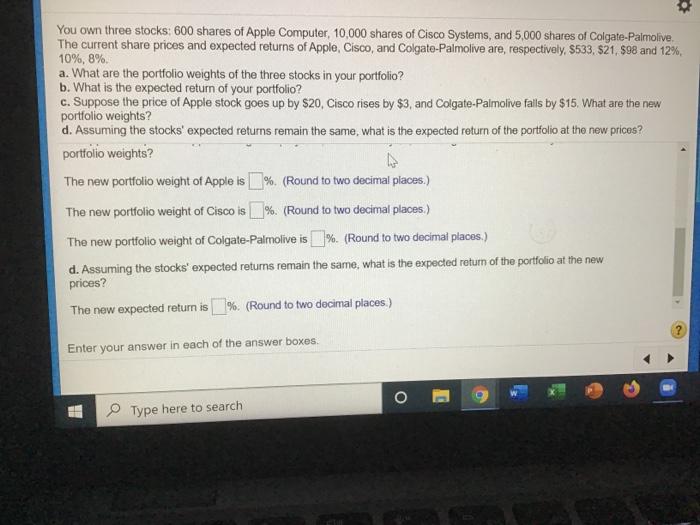

You own three stocks: 600 shares of Apple Computer, 10,000 shares of Cisco Systems, and 5,000 shares of Colgate-Palmolive. The current share prices and expected returns of Apple, Cisco, and Colgate-Palmolive are, respectively, $533, $21. $98 and 12%, 10%, 8%. a. What are the portfolio weights of the three stocks in your portfolio? b. What is the expected return of your portfolio? c. Suppose the price of Apple stock goes up by $20, Cisco rises by S3, and Colgate-Palmolive falls by $15. What are the new portfolio weights? d. Assuming the stocks' expected returns remain the same, what is the expected return of the portfolio at the new prices? a. What are the portfolio weights of the three stocks in your portfolio? The portfolio weight of Apple Computer is %. (Round to two decimal places.) The portfolio weight of Cisco Systems is %. (Round to two decimal places.) The portfolio weight of Colgate-Palmolive is %. (Round to two decimal places.) b. What is the expected return of your portfolio? The expected return on the portfolio is % (Round to two decimal places.) NEL Enter your answer in each of the answer boxes. O Type here to search You own three stocks: 600 shares of Apple Computer, 10,000 shares of Cisco Systems, and 5,000 shares of Colgate-Palmolive. The current share prices and expected returns of Apple, Cisco, and Colgate-Palmolive are, respectively, $533, $21.998 and 12% 10%, 8%. a. What are the portfolio weights of the three stocks in your portfolio? b. What is the expected return of your portfolio? c. Suppose the price of Apple stock goes up by $20, Cisco rises by $3, and Colgate-Palmolive falls by $15. What are the new portfolio weights? d. Assuming the stocks' expected retums remain the same, what is the expected return of the portfolio at the new prices? b. What is the expected retum of your portfolio? The expected return on the portfolio is %. (Round to two decimal places.) c. Suppose the price of Apple stock goes up by $20, Cisco rises by $3, and Colgate-Palmolive falls by S15. What are the new portfolio weights? The new portfolio weight of Apple is %. (Round to two decimal places.) The new portfolio weight of Cisco is % (Round to two decimal places.) The new portfolio weight of Colgate-Palmolive is %. (Round to two decimal places.) Enter your answer in each of the answer boxes o narch . You own three stocks: 600 shares of Apple Computer. 10,000 shares of Cisco Systems, and 5,000 shares of Colgate-Palmolive, The current share prices and expected returns of Apple, Cisco, and Colgate-Palmolive are, respectively, $533, $21.998 and 12% 10%, 8%. a. What are the portfolio weights of the three stocks in your portfolio? b. What is the expected return of your portfolio? c. Suppose the price of Apple stock goes up by $20, Cisco rises by $3, and Colgate-Palmolive falls by $15. What are the new portfolio weights? d. Assuming the stocks' expected returns remain the same. what is the expected return of the portfolio at the new prices? portfolio weights? The new portfolio weight of Apple is % (Round to two decimal places.) The new portfolio weight of Cisco is %. (Round to two decimal places.) The new portfolio weight of Colgate-Palmolive is % (Round to two decimal places.) d. Assuming the stocks' expected returns remain the same, what is the expected return of the portfolio at the new prices? The new expected return is % (Round to two decimal places.) Enter your answer in each of the answer boxes. O Type here to search