Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You pay $1,092 for a 10yr bond today with a semi-annual coupon of 6%. You re- invest all coupon payments at an annual rate

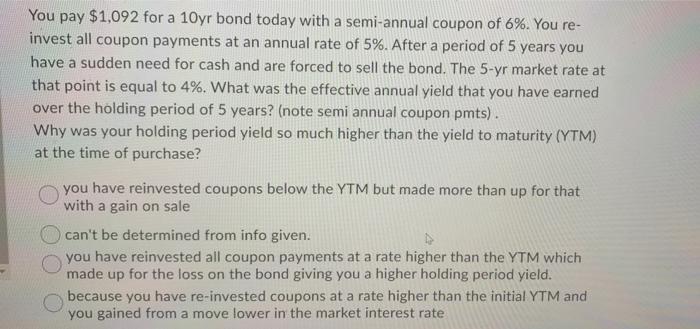

You pay $1,092 for a 10yr bond today with a semi-annual coupon of 6%. You re- invest all coupon payments at an annual rate of 5%. After a period of 5 years you have a sudden need for cash and are forced to sell the bond. The 5-yr market rate at that point is equal to 4%. What was the effective annual yield that you have earned over the holding period of 5 years? (note semi annual coupon pmts). Why was your holding period yield so much higher than the yield to maturity (YTM) at the time of purchase? you have reinvested coupons below the YTM but made more than up for that with a gain on sale can't be determined from info given. you have reinvested all coupon payments at a rate higher than the YTM which made up for the loss on the bond giving you a higher holding period yield. because you have re-invested coupons at a rate higher than the initial YTM and you gained from a move lower in the market interest rate

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Explanation The coupon rate is the annual income an investor can expect to receive while hold...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started