Answered step by step

Verified Expert Solution

Question

1 Approved Answer

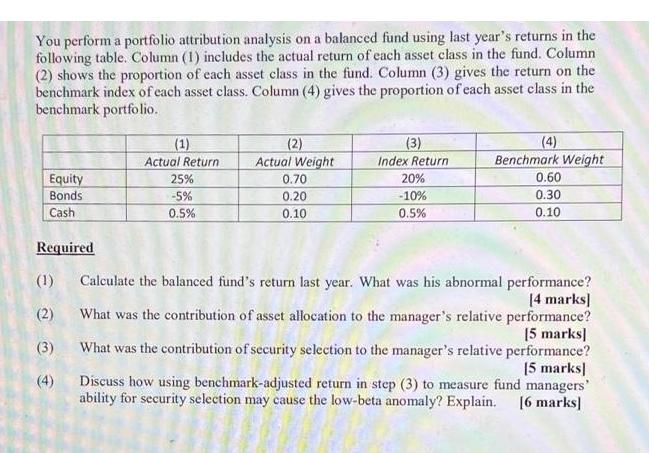

You perform a portfolio attribution analysis on a balanced fund using last year's returns in the following table. Column (1) includes the actual return

You perform a portfolio attribution analysis on a balanced fund using last year's returns in the following table. Column (1) includes the actual return of each asset class in the fund. Column (2) shows the proportion of each asset class in the fund. Column (3) gives the return on the benchmark index of each asset class. Column (4) gives the proportion of each asset class in the benchmark portfolio. Equity Bonds Cash Required (1) (2) (3) (4) (1) Actual Return 25% -5% 0.5% (2) Actual Weight 0.70 0.20 0.10 (3) Index Return 20% -10% 0.5% (4) Benchmark Weight 0.60 0.30 0.10 Calculate the balanced fund's return last year. What was his abnormal performance? [4 marks] What was the contribution of asset allocation to the manager's relative performance? [5 marks] What was the contribution of security selection to the manager's relative performance? [5 marks] Discuss how using benchmark-adjusted return in step (3) to measure fund managers' ability for security selection may cause the low-beta anomaly? Explain. [6 marks]

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the balanced funds return last year we need to calculate the weighted average return of each asset class based on their proportions in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started