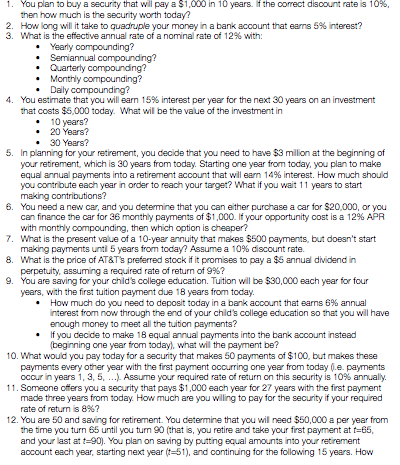

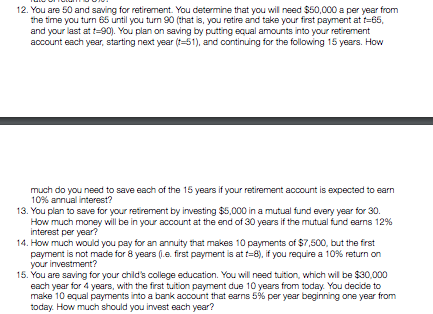

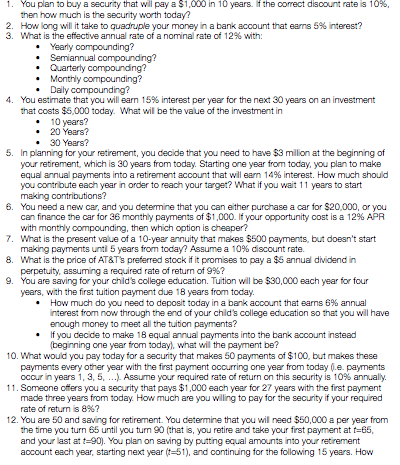

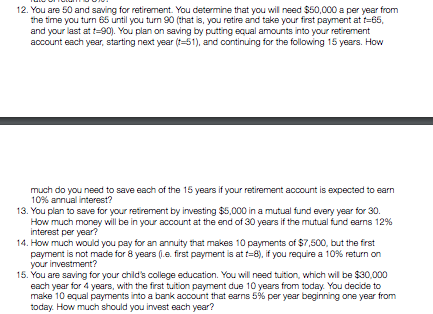

You plan to buy a security that will pay a $1,000 in 10years. fthe oorect discount rate is 10%. then how much is the security worth today How long will it take to quadruple your money n a bank account that earns 5% interest? What is the effective annual rate of a nominal rate of 12% with: I. 2. 3, Yearly compounding? Quarterly compounding? Monthly compounding? .Daily compounding? You estimate that you will earn 15% interest per year for the next 30 years on an investment that costs $5,000 today. What will be the value of the investment in 4. 10 years? 20 Years? - 30 Years? 5. In planning for your retirement, you decide that you need to have $3 million at the beginning of yor retirement, which is 30 years from today. Starting one year from today, you plan to make equal annual payments into a retirement account that wil earn 14% interest. How much should you contribute each year in order to reach your targat? What if you wait 11 years to start making contributions? 6. You need a new car, and you determine that you can either purchase a car for $20,000, or you can finance the car for 36 monthly payments of $1 ,000. If your opportunity cost is a 12% APR with monthly compounding, then which option is cheaper? 7. What is the present value of a 10-year annuity that makes $500 payments, but doesn't start 8. What is the price of AT&Ts preferred stock if it promises to pay a $6 annual dividend in 9. You are saving for your child's collage education. Tuition will be $30,00 ach year for four making payments unti 5 years from today? Assume a 10% discount rate. perpetuity, assuming a required rate of return of 9%? years, with the first tuition payment due 18 years from today. How much do you need to deposit today in a bank account that earns 6% annual nterest from now through the end of your chld's college education so that you will have enough money to meet all the tuiton payments? you decde to make 18 equal annual payments into the bank account nstead beginning one year from today), what will the payment be? 10. What would you pay today for a security that makes 50 payments of $100, but makes these payments every other year with the first payment occurring one year from today e. payments ocar n years 1, 3, 5. ). Assume your required rate of return on this security is 10% annually 11. Someone offers you a security that pays $1,000 each year for 27 years with the first payment mada three years from today. How much are you wlling to pay for the security if your required rate of return 8%? 12. You are 50 and saving for retirement. You determine that you will need $50,000 a per year from the time you turn 65 until you tun 90 (that is, you retire and take your first payment at t-65, and your last at t-90). You plan on saving by putting equal amounts into your retirement account each year, starting next year 51), and continuing for the following 15 years. How