Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You plan to purchase a building for $150,000. Its annual maintenance expense is estimated $5,000 per year and $1,790 per year on roof repairs.

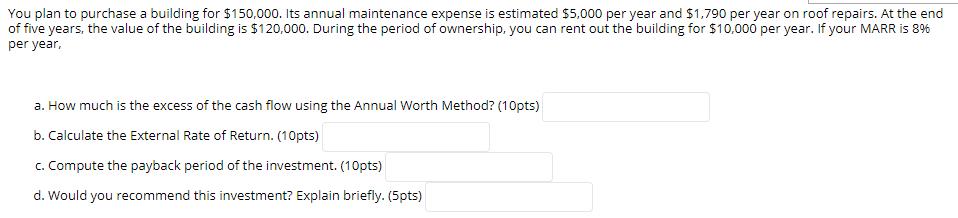

You plan to purchase a building for $150,000. Its annual maintenance expense is estimated $5,000 per year and $1,790 per year on roof repairs. At the end of five years, the value of the building is $120,000. During the period of ownership, you can rent out the building for $10,000 per year. If your MARR is 8% per year, a. How much is the excess of the cash flow using the Annual Worth Method? (10pts) b. Calculate the External Rate of Return. (10pts) c. Compute the payback period of the investment. (10pts) d. Would you recommend this investment? Explain briefly. (5pts)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

It appears that youre asking me to perform an economic analysis of an investment using various methods Based on the information youve provided here are the calculations for each part Initial Data Buil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started