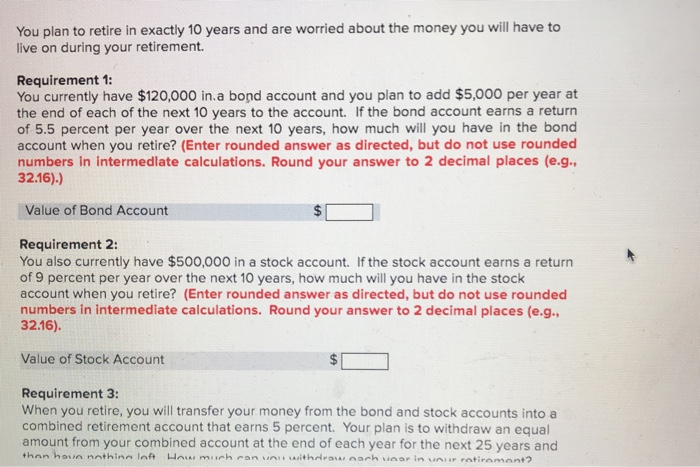

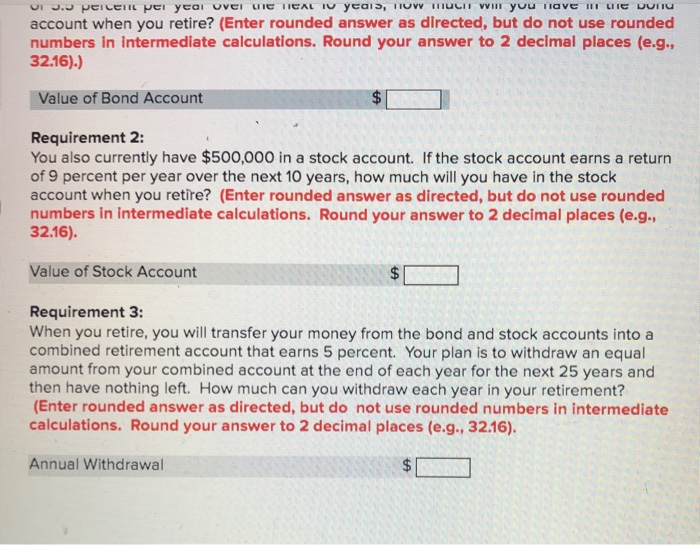

You plan to retire in exactly 10 years and are worried about the money you will have to live on during your retirement Requirement 1: You currently have $120,000 in a bond account and you plan to add $5,000 per year at the end of each of the next 10 years to the account. If the bond account earns a return of 5.5 percent per year over the next 10 years, how much will you have in the bond account when you retire? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Value of Bond Account Requirement 2: You also currently have $500,000 in a stock account. If the stock account earns a return of 9 percent per year over the next 10 years, how much will you have in the stock account when you retire? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16). Value of Stock Account Requirement 3: When you retire, you will transfer your money from the bond and stock accounts into a combined retirement account that earns 5 percent. Your plan is to withdraw an equal amount from your combined account at the end of each year for the next 25 years and than houn nothing Inft Hamurron va thermorhunsrin var retirement? DI 3.3 percent per year over de TICAL 10 years, HOW MUCHI Will you have " Le Dune account when you retire? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Value of Bond Account Requirement 2: You also currently have $500,000 in a stock account. If the stock account earns a return of 9 percent per year over the next 10 years, how much will you have in the stock account when you retire? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16). Value of Stock Account $ $ Requirement 3: When you retire, you will transfer your money from the bond and stock accounts into a combined retirement account that earns 5 percent. Your plan is to withdraw an equal amount from your combined account at the end of each year for the next 25 years and then have nothing left. How much can you withdraw each year in your retirement? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16). Annual Withdrawal $