Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You plan to save every year and accumulate $150,000 in 6 years to make the down payment for your house. To achieve your financial

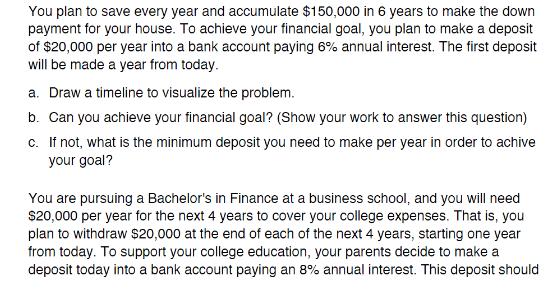

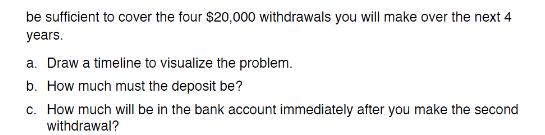

You plan to save every year and accumulate $150,000 in 6 years to make the down payment for your house. To achieve your financial goal, you plan to make a deposit of $20,000 per year into a bank account paying 6% annual interest. The first deposit will be made a year from today. a. Draw a timeline to visualize the problem. b. Can you achieve your financial goal? (Show your work to answer this question) c. If not, what is the minimum deposit you need to make per year in order to achive your goal? You are pursuing a Bachelor's in Finance at a business school, and you will need $20,000 per year for the next 4 years to cover your college expenses. That is, you plan to withdraw $20,000 at the end of each of the next 4 years, starting one year from today. To support your college education, your parents decide to make a deposit today into a bank account paying an 8% annual interest. This deposit should

Step by Step Solution

★★★★★

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 a b To determine if you can achieve your financial goal you need to calculate the future value of your annual deposits with 6 annual interest over 6 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started