Question

You predict that UQVaccy (UQV), a pharmaceutical firm, will enter into a highly volatile period in the next 3 months due to its vaccine development

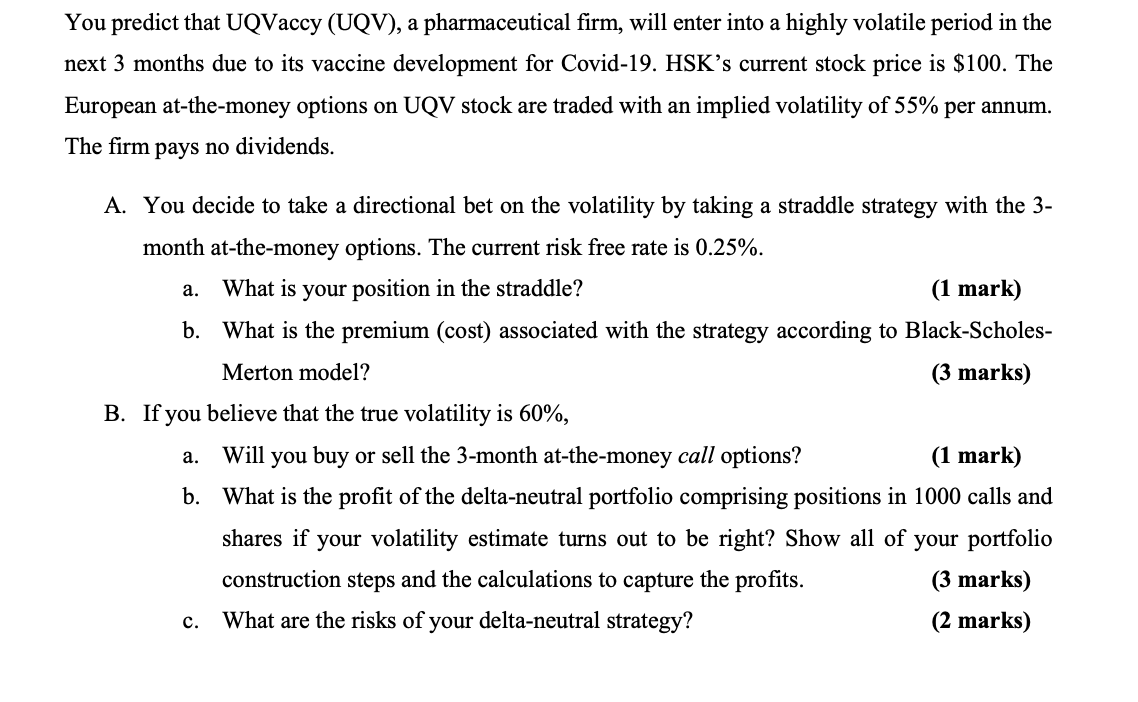

You predict that UQVaccy (UQV), a pharmaceutical firm, will enter into a highly volatile period in the next 3 months due to its vaccine development for Covid-19. HSKs current stock price is $100. The European at-the-money options on UQV stock are traded with an implied volatility of 55% per annum. The firm pays no dividends. A. You decide to take a directional bet on the volatility by taking a straddle strategy with the 3- month at-the-money options. The current risk free rate is 0.25%. a. b. B. If you a. b. c. What is your position in the straddle? (1 mark) What is the premium (cost) associated with the strategy according to Black-Scholes- Merton model? (3 marks) believe that the true volatility is 60%, Will you buy or sell the 3-month at-the-money call options? (1 mark) What is the profit of the delta-neutral portfolio comprising positions in 1000 calls and shares if your volatility estimate turns out to be right? Show all of your portfolio construction steps and the calculations to capture the profits. (3 marks) What are the risks of your delta-neutral strategy? (2 marks)

You predict that UQVaccy (UQV), a pharmaceutical firm, will enter into a highly volatile period in the next 3 months due to its vaccine development for Covid-19. HSKs current stock price is $100. The European at-the-money options on UQV stock are traded with an implied volatility of 55% per annum. The firm pays no dividends. A. You decide to take a directional bet on the volatility by taking a straddle strategy with the 3- month at-the-money options. The current risk free rate is 0.25%. a. b. B. If you a. b. c. What is your position in the straddle? (1 mark) What is the premium (cost) associated with the strategy according to Black-Scholes- Merton model? (3 marks) believe that the true volatility is 60%, Will you buy or sell the 3-month at-the-money call options? (1 mark) What is the profit of the delta-neutral portfolio comprising positions in 1000 calls and shares if your volatility estimate turns out to be right? Show all of your portfolio construction steps and the calculations to capture the profits. (3 marks) What are the risks of your delta-neutral strategy? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started