Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You purchase a bond with an invoice price of $ 1,100. The bond has a coupon rate of 7.2 percent , and there are 3

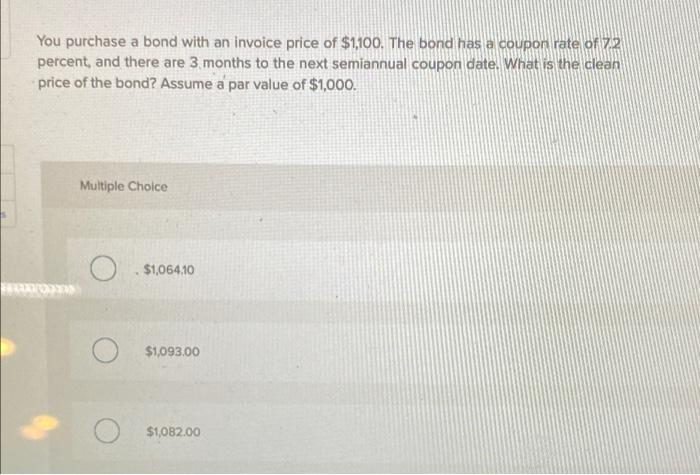

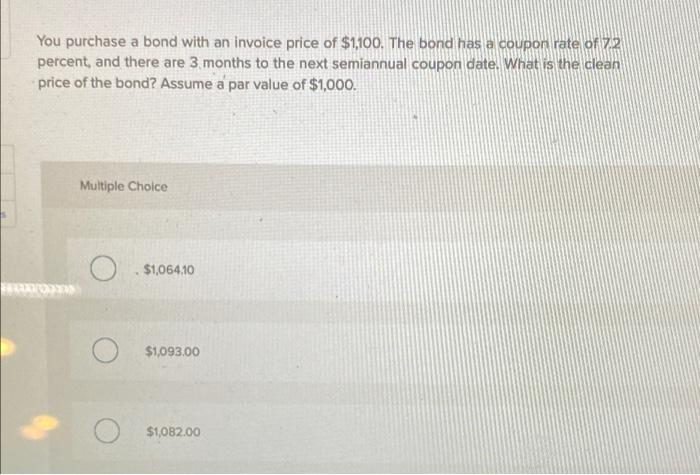

You purchase a bond with an invoice price of $ 1,100. The bond has a coupon rate of 7.2 percent , and there are 3 months to the next semiannual coupon date . What is the clean price of the bond? Assume a par value of $1,000 .

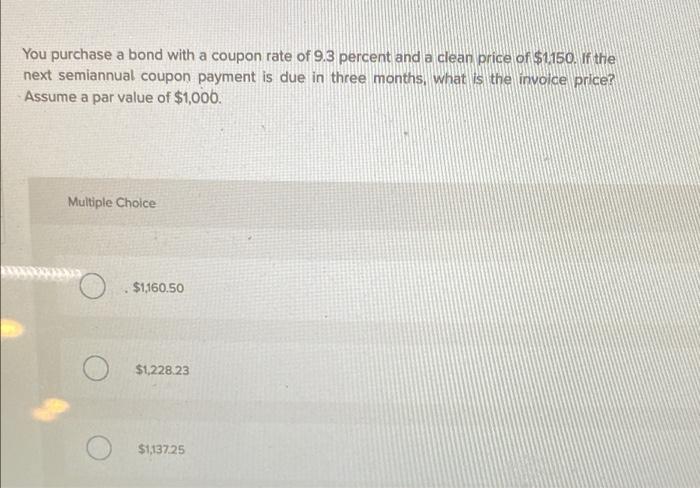

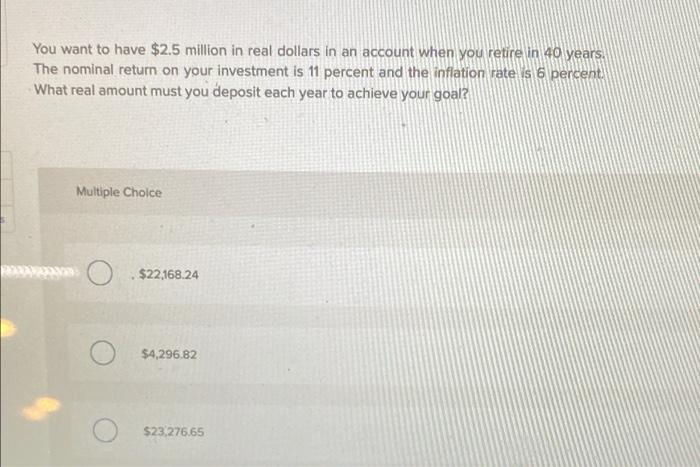

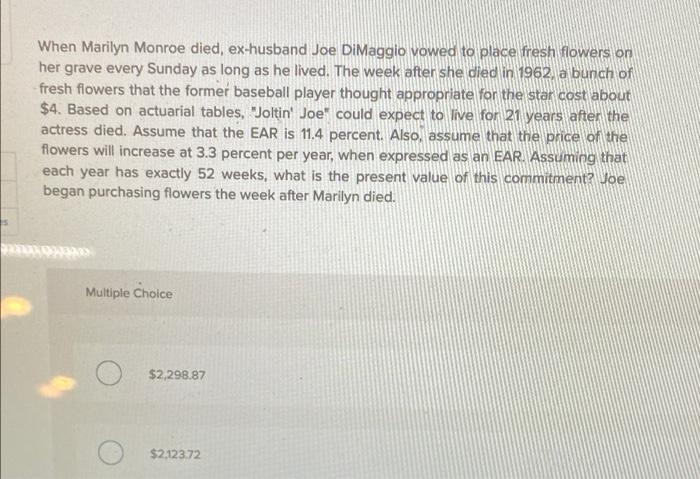

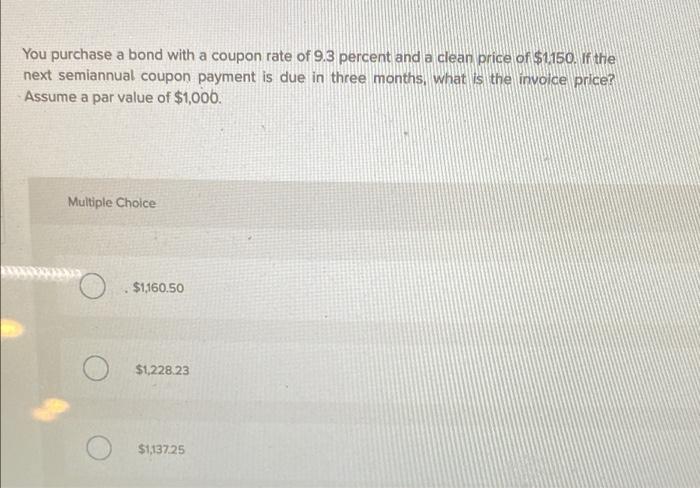

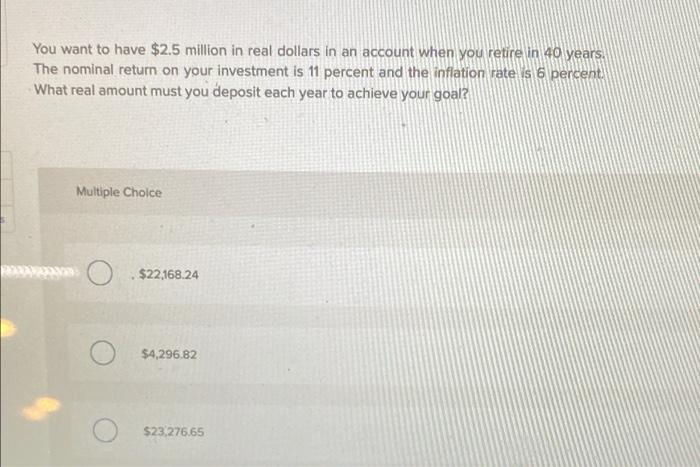

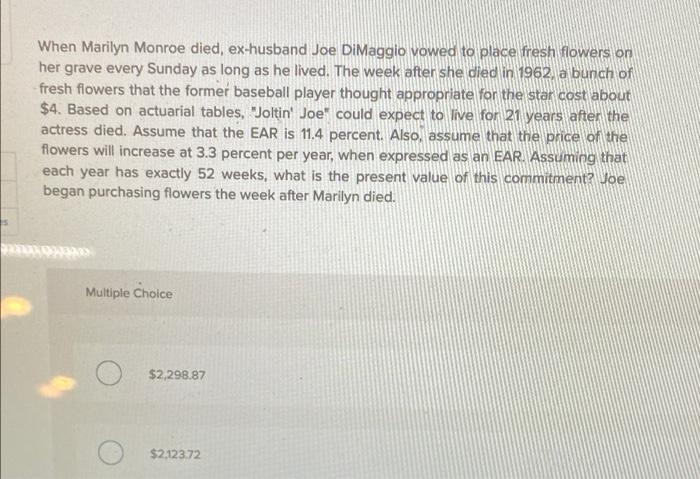

You purchase a bond with an invoice price of $1,100. The bond has a coupon rate of 72 percent, and there are 3 months to the next semiannual coupon date. What is the clean price of the bond? Assume a par value of $1,000. Multiple Choice $1,064.10 $1,093.00 $1,082.00 You purchase a bond with a coupon rate of 9.3 percent and a clean price of $1150. If the next semiannual coupon payment is due in three months, what is the involce price? Assume a par value of $1,006. Multiple Choice $1,160.50 $1,228.23 $1,13725 You want to have $2.5 million in real dollars in an account when you retire in 40 years. The nominal return on your investment is 11 percent and the inflation rate is 6 percent What real amount must you deposit each year to achieve your goal? Multiple Choice $22,168.24 $4,296.82 $23.276.65 When Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place fresh flowers on her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of fresh flowers that the former baseball player thought appropriate for the star cost about $4. Based on actuarial tables, "Joltin' Joe" could expect to live for 21 years after the actress died. Assume that the EAR is 11.4 percent. Also, assume that the price of the flowers will increase at 3.3 percent per year, when expressed as an EAR. Assuming that each year has exactly 52 weeks, what is the present value of this commitment Joe began purchasing flowers the week after Marilyn died. Multiple Choice $2,298.87 $2,123.72

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started