Question

You purchase equipment for $176,301. This cost will be depreciated straight-line to zero over the project's 10-year life. Based on past information, you believe

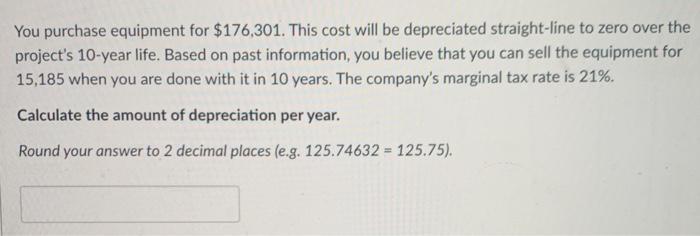

You purchase equipment for $176,301. This cost will be depreciated straight-line to zero over the project's 10-year life. Based on past information, you believe that you can sell the equipment for 15,185 when you are done with it in 10 years. The company's marginal tax rate is 21%. Calculate the amount of depreciation per year. Round your answer to 2 decimal places (e.g. 125.74632 = 125.75).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amount of depreciation per year using the straightline method ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

10th edition

1260013955, 1260013952, 978-1260013955

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App