Answered step by step

Verified Expert Solution

Question

1 Approved Answer

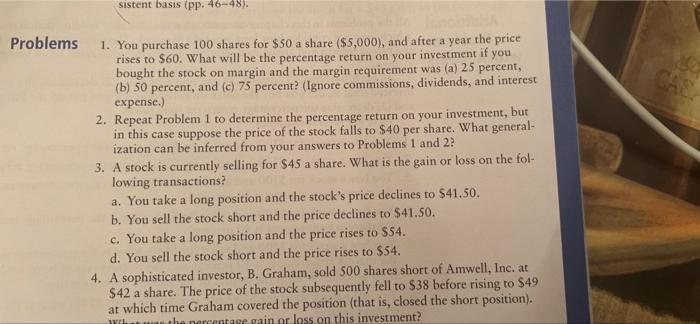

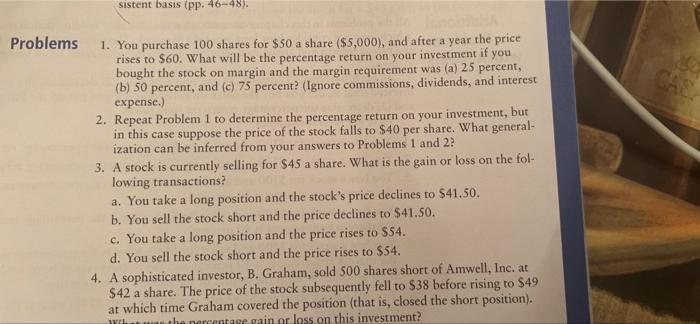

you purchase hundred shares for $50 a share and after year the price raises to $60 what will be the percentage return on your investment

you purchase hundred shares for $50 a share and after year the price raises to $60 what will be the percentage return on your investment if you bought the stock on margin and the margin requirement was a)25 percent

sistent basis (pp. 46-48). Problems 1. You purchase 100 shares for $50 a share ($5,000), and after a year the price rises to $60. What will be the percentage return on your investment if you bought the stock on margin and the margin requirement was (a) 25 percent, (b) 50 percent, and (e) 75 percent? (Ignore commissions, dividends, and interest expense.) 2. Repeat Problem 1 to determine the percentage return on your investment, but in this case suppose the price of the stock falls to $40 per share. What general- ization can be inferred from your answers to Problems 1 and 2? 3. A stock is currently selling for $45 a share. What is the gain or loss on the fol- lowing transactions? a. You take a long position and the stock's price declines to $41.50. b. You sell the stock short and the price declines to $41.50. c. You take a long position and the price rises to S54. d. You sell the stock short and the price rises to $54. 4. A sophisticated investor, B. Graham, sold 500 shares short of Amwell, Inc. at $42 a share. The price of the stock subsequently fell to $38 before rising to $49 at which time Graham covered the position (that is, closed the short position). What the percentage vain or loss on this investment b) 50 percent

c) 75 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started