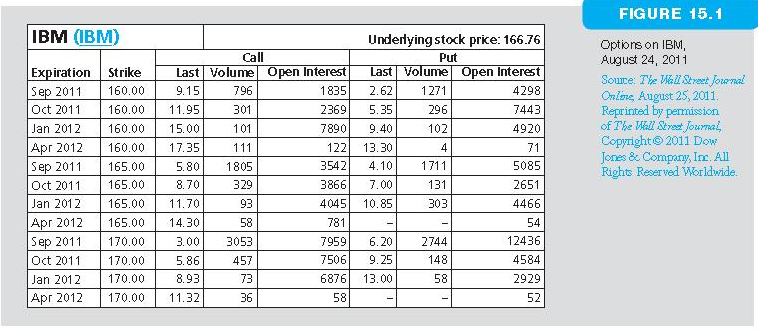

Question: You purchase one IBM October 160 put contract for a premium of $5.35. What is your maximum possible profit? (See Figure 15.1.) Assume each contract

You purchase one IBM October 160 put contract for a premium of $5.35. What is your maximum possible profit? (See Figure 15.1.) Assume each contract is for 100 units.

PLEASE SHOW ALL STEPS, THANK YOU!

Potential Profit= $??

FIGURE 15.1 IBM IBM) Undelyingstock prke: 166.76 Options on IBM, August 24, 2011 Soure: Te Wall Street Jonal Cnlns August 25, 2011 Reprinted by permission of The Wll &treet Journal Copyright 2011 Dow Jones & Compary, Irr. All Rights Reserved Worldwide. Call Put n Interest Expiration Strike ep 2011 Oct 2011 Last Volume 796 301 101 1835 2.62 2369535 7890 9.40 ast VolumeOpen Interest 4298 7443 4920 160.00 9.15 160.00 11.95 Jan 2012 160.00 15.00 Apr 2012 160.007.35 5.80 8. 70 Jan 201 2 165.00 11.70 Apr 2012 165.0014.30 1271 296 102 122 13.30 3542 4.10 3866 7.00 4045 10.85 1805 329 93 58 3.00 3053 457 73 36 5085 2651 4466 54 12436 4584 2929 52 ep 2011 165.00 165.00 131 303 Oct 2011 781 5.86 8.93 Apr 2012 170.00 11.32 Sep 2011 Oct 2011 Jan 2012 170.00 170.00 170.00 7506 9.25 6876 13.00 79596.20 2744 148 58 58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts