Answered step by step

Verified Expert Solution

Question

1 Approved Answer

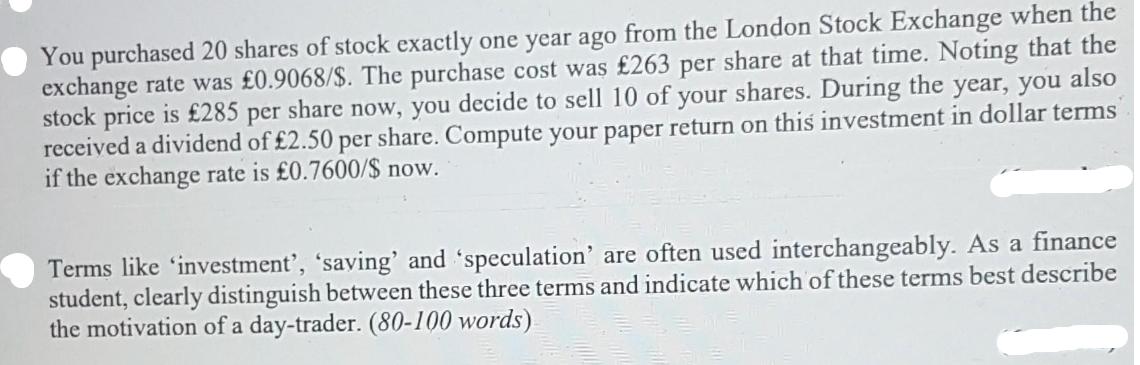

You purchased 20 shares of stock exactly one year ago from the London Stock Exchange when the exchange rate was 0.9068/$. The purchase cost

You purchased 20 shares of stock exactly one year ago from the London Stock Exchange when the exchange rate was 0.9068/$. The purchase cost was 263 per share at that time. Noting that the stock price is 285 per share now, you decide to sell 10 of your shares. During the year, you also received a dividend of 2.50 per share. Compute your paper return on this investment in dollar terms if the exchange rate is 0.7600/$ now. Terms like 'investment', 'saving' and 'speculation' are often used interchangeably. As a finance student, clearly distinguish between these three terms and indicate which of these terms best describe the motivation of a day-trader. (80-100 words)

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Investment saving and speculation are different concepts Investment refers to committing money or ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started