Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You purchased 5 shares of Marriott stock for $205.50 per share. During the year you received $1.50 per share in dividends. At the end

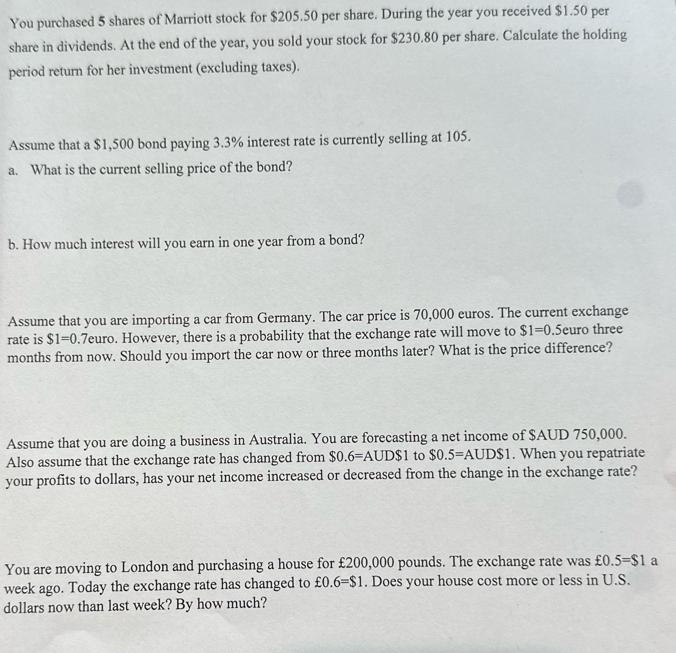

You purchased 5 shares of Marriott stock for $205.50 per share. During the year you received $1.50 per share in dividends. At the end of the year, you sold your stock for $230.80 per share. Calculate the holding period return for her investment (excluding taxes). Assume that a $1,500 bond paying 3.3% interest rate is currently selling at 105. a. What is the current selling price of the bond? b. How much interest will you earn in one year from a bond? Assume that you are importing a car from Germany. The car price is 70,000 euros. The current exchange rate is $1=0.7euro. However, there is a probability that the exchange rate will move to $1=0.5euro three months from now. Should you import the car now or three months later? What is the price difference? Assume that you are doing a business in Australia. You are forecasting a net income of $AUD 750,000. Also assume that the exchange rate has changed from $0.6-AUD$1 to $0.5=AUD$1. When you repatriate your profits to dollars, has your net income increased or decreased from the change in the exchange rate? You are moving to London and purchasing a house for 200,000 pounds. The exchange rate was 0.5=$1 a week ago. Today the exchange rate has changed to 0.6-$1. Does your house cost more or less in U.S. dollars now than last week? By how much?

Step by Step Solution

★★★★★

3.64 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the holding period return for the investment in Marriott stock we need to consider the initial investment dividends received and the proceeds from the sale 1 Initial investment N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started