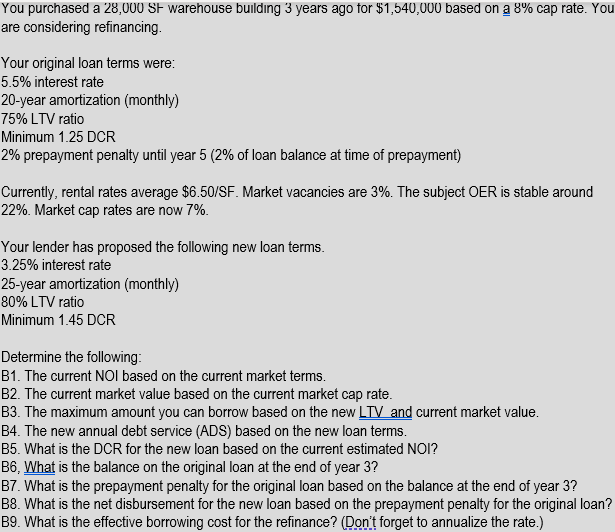

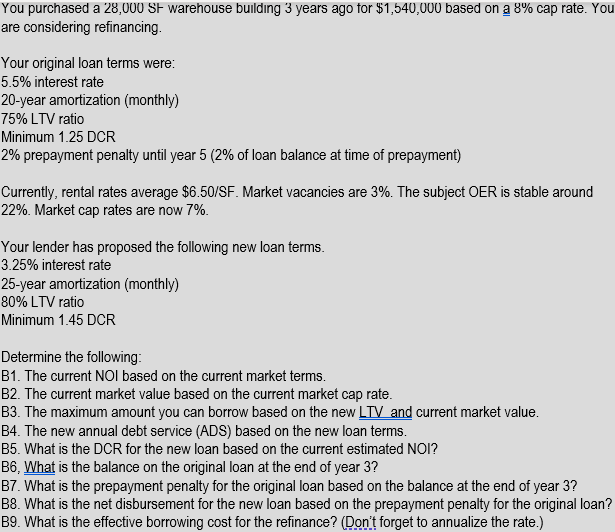

You purchased a 28,000 SF warehouse building 3 years ago for $1,540,000 based on a 8% cap rate. You are considering refinancing. Your original loan terms were: 5.5% interest rate 20-year amortization (monthly) 75% LTV ratio Minimum 1.25 DCR 2% prepayment penalty until year 5 (2% of loan balance at time of prepayment) Currently, rental rates average $6.50/SF. Market vacancies are 3%. The subject OER is stable around 22%. Market cap rates are now 7%. Your lender has proposed the following new loan terms. 3.25% interest rate 25-year amortization (monthly) 80% LTV ratio Minimum 1.45 DCR Determine the following: B1. The current NOI based on the current market terms. B2. The current market value based on the current market cap rate. B3. The maximum amount you can borrow based on the new LTV and current market value. B4. The new annual debt service (ADS) based on the new loan terms. B5. What is the DCR for the new loan based on the current estimated NOI? B6, What is the balance on the original loan at the end of year 3? B7. What is the prepayment penalty for the original loan based on the balance at the end of year 3? B8. What is the net disbursement for the new loan based on the prepayment penalty for the original loan? B9. What is the effective borrowing cost for the refinance? (Don't forget to annualize the rate.) You purchased a 28,000 SF warehouse building 3 years ago for $1,540,000 based on a 8% cap rate. You are considering refinancing. Your original loan terms were: 5.5% interest rate 20-year amortization (monthly) 75% LTV ratio Minimum 1.25 DCR 2% prepayment penalty until year 5 (2% of loan balance at time of prepayment) Currently, rental rates average $6.50/SF. Market vacancies are 3%. The subject OER is stable around 22%. Market cap rates are now 7%. Your lender has proposed the following new loan terms. 3.25% interest rate 25-year amortization (monthly) 80% LTV ratio Minimum 1.45 DCR Determine the following: B1. The current NOI based on the current market terms. B2. The current market value based on the current market cap rate. B3. The maximum amount you can borrow based on the new LTV and current market value. B4. The new annual debt service (ADS) based on the new loan terms. B5. What is the DCR for the new loan based on the current estimated NOI? B6, What is the balance on the original loan at the end of year 3? B7. What is the prepayment penalty for the original loan based on the balance at the end of year 3? B8. What is the net disbursement for the new loan based on the prepayment penalty for the original loan? B9. What is the effective borrowing cost for the refinance? (Don't forget to annualize the rate.)