Answered step by step

Verified Expert Solution

Question

1 Approved Answer

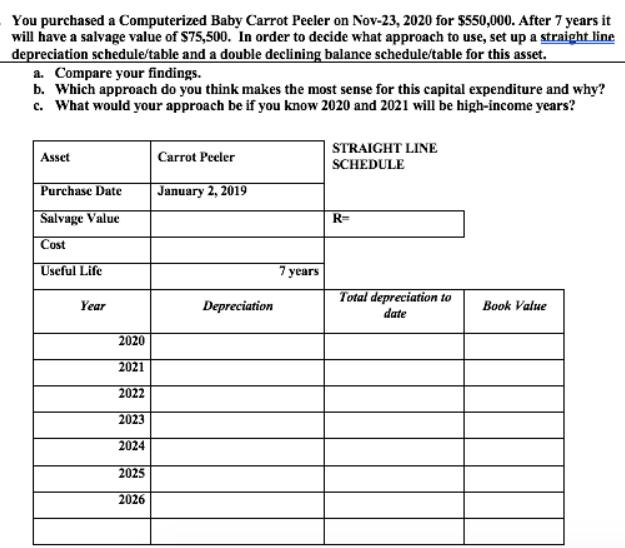

You purchased a Computerized Baby Carrot Peeler on Nov-23, 2020 for $550,000. After 7 years it will have a salvage value of $75,500. In

You purchased a Computerized Baby Carrot Peeler on Nov-23, 2020 for $550,000. After 7 years it will have a salvage value of $75,500. In order to decide what approach to use, set up a straight line depreciation schedule/table and a double declining balance schedule/table for this asset. a. Compare your findings. b. Which approach do you think makes the most sense for this capital expenditure and why? c. What would your approach be if you know 2020 and 2021 will be high-income years? Asset Purchase Date Salvage Value Cost Useful Life Year 2020 2021 2022 2023 2024 2025 2026 Carrot Peeler January 2, 2019 Depreciation 7 years STRAIGHT LINE SCHEDULE R= Total depreciation to date Book Value

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Straight line depreciation method Initial Cost Salvage Value Useful life 375000 75500 7 427857 per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started