Question

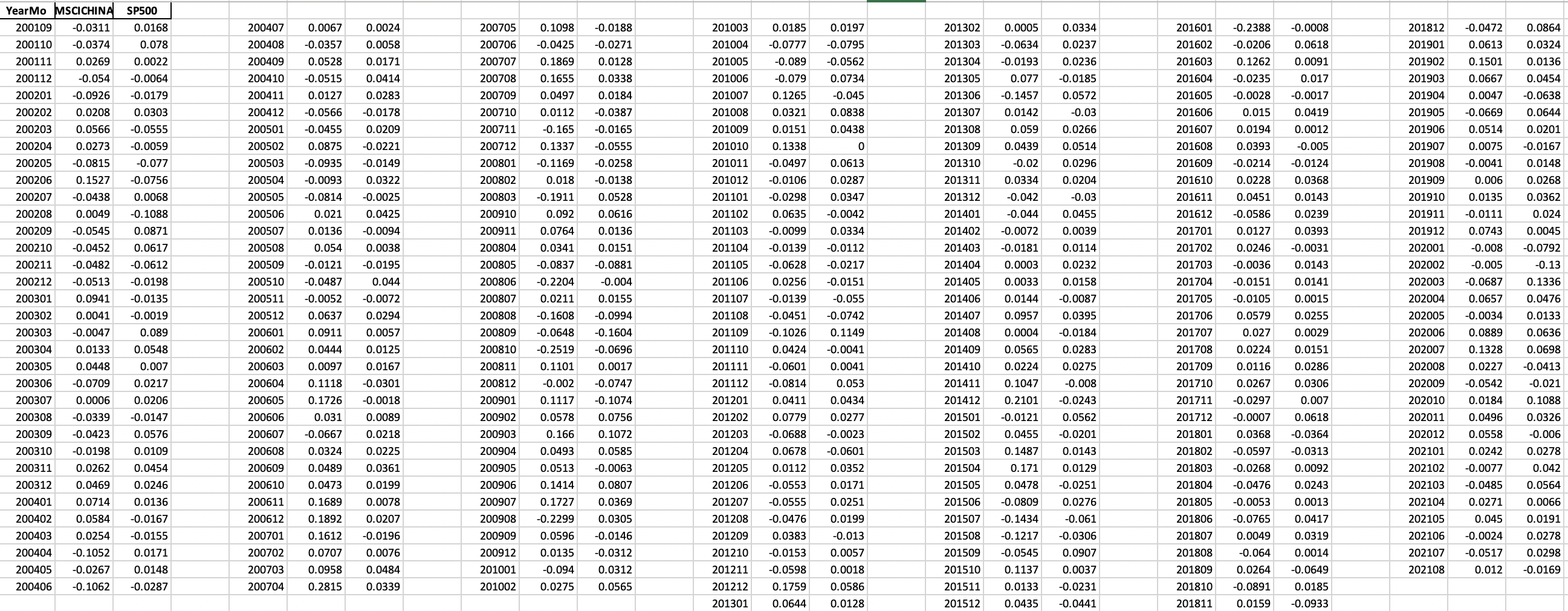

You receive an excel file including past 20 years monthly returns for SP 500 and MSCI China A, The riskfree rate is 0.12% (per month).

You receive an excel file including past 20 years monthly returns for SP 500 and MSCI China A, The riskfree rate is 0.12% (per month). Calculate:

You receive an excel file including past 20 years monthly returns for SP 500 and MSCI China A, The riskfree rate is 0.12% (per month). Calculate:

A) What are the monthly risk premia for SP500 and MSCI China A? What are the Sharpe ratios for SP500 and MSCI China As monthly returns?

B) Assume simple returns, what are the annualized standard deviations for SP500 and MSCI China A? What are the Sharpe ratios for the two annualized returns?

C) Use compounded returns, what are the annualized risk premia for SP500 and MSCI China A? What are the Sharpe ratios for the annualized returns? Hint: compounded annualized risk premia equals expected annual return (compounded) minus compounded annual risk-free rate.

D) Form a portfolio with 50% in SP500 and 50% in MSCI China A, and we rebalance monthly to make sure that the weights are 50-50 at the beginning of every month. What is the Sharpe ratio of this portfolios monthly returns? Assume simple returns, what is the standard deviation of its 5-year holding period returns? and the Sharpe ratio of its 5-year holding period returns?

200407 200408 200409 0.0067 -0.0357 201003 201004 0.1098 -0.0425 0.1869 0.0185 -0.0777 0.0197 -0.0795 201302 201303 0.0005 -0.0634 0.0334 0.0237 0.0024 0.0058 0.0171 0.0414 201812 201901 200705 200706 200707 200708 201601 201602 201603 0.0864 0.0324 -0.0188 -0.0271 0.0128 0.0338 0.0184 -0.0472 0.0613 0.1501 -0.0008 0.0618 0.0091 0.017 201304 -0.0562 0.0734 -0.0193 0.077 201305 201604 -0.2388 -0.0206 0.1262 -0.0235 -0.0028 0.015 0.0528 -0.0515 0.0127 -0.0566 -0.0455 200410 200411 0.0667 201005 201006 201007 201008 201009 0.0236 -0.0185 0.0572 -0.03 201902 201903 201904 -0.089 -0.079 0.1265 0.0321 0.0151 0.0283 -0.0178 -0.045 0.1655 0.0497 0.0112 -0.165 -0.1457 200709 200710 200711 200712 201306 201307 201905 200412 200501 -0.0387 -0.0165 -0.0555 0.0838 0.0438 0.0142 0.059 0.0047 -0.0669 0.0514 201308 0.0266 0.0514 200502 0.0875 0.1337 0 0.0136 0.0454 -0.0638 0.0644 0.0201 -0.0167 0.0148 0.0268 0.0362 0.024 201309 0.0439 201605 201606 201607 201608 201609 201610 201611 0.0075 200503 -0.0935 -0.0093 -0.1169 0.018 201310 201311 0.0613 0.0287 0.0347 200504 200505 0.0209 -0.0221 -0.0149 0.0322 -0.0025 0.0425 -0.0094 0.0038 -0.0195 0.044 0.1338 -0.0497 -0.0106 -0.0298 0.0635 -0.0099 0.0296 0.0204 -0.03 201906 201907 201908 201909 201910 201911 201010 201011 201012 201101 201102 201103 201104 201105 201312 201401 0.0194 0.0393 -0.0214 0.0228 0.0451 -0.0586 0.0127 0.0246 -0.0036 -0.0151 -0.0041 0.006 0.0135 -0.0111 0.0743 -0.008 -0.0042 -0.0258 -0.0138 0.0528 0.0616 0.0136 0.0151 -0.0881 -0.004 0.0455 -0.0017 0.0419 0.0012 -0.005 -0.0124 0.0368 0.0143 0.0239 0.0393 -0.0031 0.0143 0.0141 0.0015 200506 200507 0.0334 201402 201403 200801 200802 200803 200910 200911 200804 200805 200806 200807 200808 200809 200810 200811 0.0039 0.0114 200508 200509 200510 201612 201701 201702 201703 -0.0814 0.021 0.0136 0.054 -0.0121 -0.0487 -0.0052 0.0637 0.0911 0.0444 -0.0112 -0.0217 201912 202001 202002 YearMo MSCICHINA SP500 200109 -0.0311 0.0168 200110 -0.0374 0.078 200111 0.0269 0.0022 200112 -0.054 -0.0064 200201 -0.0926 -0.0179 200202 0.0208 0.0303 200203 0.0566 -0.0555 200204 0.0273 -0.0059 200205 -0.0815 -0.077 200206 0.1527 -0.0756 200207 -0.0438 0.0068 200208 0.0049 -0.1088 200209 -0.0545 0.0871 200210 -0.0452 0.0617 200211 -0.0482 -0.0612 200212 -0.0513 -0.0198 200301 0.0941 -0.0135 200302 0.0041 -0.0019 200303 -0.0047 0.089 200304 0.0133 0.0548 200305 0.0448 0.007 200306 -0.0709 0.0217 200307 0.0006 0.0206 200308 -0.0339 -0.0147 200309 -0.0423 0.0576 200310 -0.0198 0.0109 200311 0.0262 0.0454 200312 0.0469 0.0246 200401 0.0714 0.0136 200402 0.0584 -0.0167 200403 0.0254 -0.0155 200404 -0.1052 0.0171 200405 -0.0267 0.0148 200406 -0.1062 -0.0287 -0.02 0.0334 -0.042 -0.044 -0.0072 -0.0181 0.0003 0.0033 0.0144 0.0957 0.0004 0.0565 0.0224 -0.1911 0.092 0.0764 0.0341 -0.0837 -0.2204 0.0211 -0.1608 -0.0648 -0.2519 0.1101 0.0045 -0.0792 -0.13 201404 -0.005 -0.0687 201405 201406 202003 202004 -0.0072 0.0232 0.0158 -0.0087 0.0395 -0.0151 -0.055 -0.0742 201106 201107 201108 201109 200511 200512 -0.0105 -0.0139 -0.0628 0.0256 -0.0139 -0.0451 -0.1026 0.0424 -0.0601 -0.0814 0.0579 201407 201408 0.0255 0.0029 200601 0.1149 0.027 0.0155 -0.0994 -0.1604 -0.0696 0.0017 -0.0747 -0.1074 202005 202006 202007 202008 200602 0.1336 0.0476 0.0133 0.0636 0.0698 -0.0413 -0.021 -0.0184 0.0283 0.0275 -0.0041 0.0097 0.0041 200603 200604 201110 201111 201112 201201 201409 201410 201411 201412 200812 0.053 0.1118 0.1726 0.031 202009 202010 200605 200606 200901 200902 200903 0.0434 0.0277 0.0294 0.0057 0.0125 0.0167 -0.0301 -0.0018 0.0089 0.0218 0.0225 0.0361 0.0199 0.0078 0.0207 -0.0196 0.0076 -0.002 0.1117 0.0578 0.166 0.0493 0.0513 0.0151 0.0286 0.0306 0.007 0.0618 -0.0364 0.0756 0.1072 0.1047 0.2101 -0.0121 0.0455 0.1487 0.171 -0.008 -0.0243 0.0562 -0.0201 0.0143 0.0129 0.0411 0.0779 -0.0688 0.0678 0.0112 201704 201705 201706 201707 201708 201709 201710 201711 201712 201801 201802 201803 201804 201805 201806 201807 201808 201202 201203 201204 201205 0.0224 0.0116 0.0267 -0.0297 -0.0007 0.0368 -0.0597 -0.0268 -0.0476 202011 202012 200607 200608 -0.0667 0.0324 0.0489 0.1088 0.0326 -0.006 0.0657 -0.0034 0.0889 0.1328 0.0227 -0.0542 0.0184 0.0496 0.0558 0.0242 -0.0077 -0.0485 0.0271 0.045 -0.0024 -0.0517 0.012 -0.0023 -0.0601 0.0352 0.0171 200904 200609 200610 200611 200905 200906 -0.0313 0.0092 0.0243 201501 201502 201503 201504 201505 201506 201507 201508 201509 -0.0553 0.0278 0.042 0.0564 0.0066 0.0478 0.0473 0.1689 0.1892 -0.0251 0.1414 0.1727 202101 202102 202103 202104 202105 0.0251 0.0276 -0.0053 0.0013 200907 200908 200909 0.0585 -0.0063 0.0807 0.0369 0.0305 -0.0146 -0.0312 0.0312 0.0565 -0.0555 -0.0476 0.0199 200612 200701 200702 200703 200704 -0.0765 0.0049 201206 201207 201208 201209 201210 201211 201212 201301 -0.2299 0.0596 0.0135 -0.094 0.0275 0.1612 0.0707 0.0958 0.2815 0.0383 -0.0153 -0.064 -0.0809 -0.1434 -0.1217 -0.0545 0.1137 0.0133 0.0435 200912 201001 201002 -0.061 -0.0306 0.0907 0.0037 -0.0231 -0.0441 -0.013 0.0057 0.0018 0.0586 0.0128 0.0417 0.0319 0.0014 -0.0649 0.0185 -0.0933 0.0191 0.0278 0.0298 -0.0169 202106 202107 202108 -0.0598 0.0484 0.0339 201809 201510 201511 0.1759 201810 201811 0.0264 -0.0891 0.0159 0.0644 201512 200407 200408 200409 0.0067 -0.0357 201003 201004 0.1098 -0.0425 0.1869 0.0185 -0.0777 0.0197 -0.0795 201302 201303 0.0005 -0.0634 0.0334 0.0237 0.0024 0.0058 0.0171 0.0414 201812 201901 200705 200706 200707 200708 201601 201602 201603 0.0864 0.0324 -0.0188 -0.0271 0.0128 0.0338 0.0184 -0.0472 0.0613 0.1501 -0.0008 0.0618 0.0091 0.017 201304 -0.0562 0.0734 -0.0193 0.077 201305 201604 -0.2388 -0.0206 0.1262 -0.0235 -0.0028 0.015 0.0528 -0.0515 0.0127 -0.0566 -0.0455 200410 200411 0.0667 201005 201006 201007 201008 201009 0.0236 -0.0185 0.0572 -0.03 201902 201903 201904 -0.089 -0.079 0.1265 0.0321 0.0151 0.0283 -0.0178 -0.045 0.1655 0.0497 0.0112 -0.165 -0.1457 200709 200710 200711 200712 201306 201307 201905 200412 200501 -0.0387 -0.0165 -0.0555 0.0838 0.0438 0.0142 0.059 0.0047 -0.0669 0.0514 201308 0.0266 0.0514 200502 0.0875 0.1337 0 0.0136 0.0454 -0.0638 0.0644 0.0201 -0.0167 0.0148 0.0268 0.0362 0.024 201309 0.0439 201605 201606 201607 201608 201609 201610 201611 0.0075 200503 -0.0935 -0.0093 -0.1169 0.018 201310 201311 0.0613 0.0287 0.0347 200504 200505 0.0209 -0.0221 -0.0149 0.0322 -0.0025 0.0425 -0.0094 0.0038 -0.0195 0.044 0.1338 -0.0497 -0.0106 -0.0298 0.0635 -0.0099 0.0296 0.0204 -0.03 201906 201907 201908 201909 201910 201911 201010 201011 201012 201101 201102 201103 201104 201105 201312 201401 0.0194 0.0393 -0.0214 0.0228 0.0451 -0.0586 0.0127 0.0246 -0.0036 -0.0151 -0.0041 0.006 0.0135 -0.0111 0.0743 -0.008 -0.0042 -0.0258 -0.0138 0.0528 0.0616 0.0136 0.0151 -0.0881 -0.004 0.0455 -0.0017 0.0419 0.0012 -0.005 -0.0124 0.0368 0.0143 0.0239 0.0393 -0.0031 0.0143 0.0141 0.0015 200506 200507 0.0334 201402 201403 200801 200802 200803 200910 200911 200804 200805 200806 200807 200808 200809 200810 200811 0.0039 0.0114 200508 200509 200510 201612 201701 201702 201703 -0.0814 0.021 0.0136 0.054 -0.0121 -0.0487 -0.0052 0.0637 0.0911 0.0444 -0.0112 -0.0217 201912 202001 202002 YearMo MSCICHINA SP500 200109 -0.0311 0.0168 200110 -0.0374 0.078 200111 0.0269 0.0022 200112 -0.054 -0.0064 200201 -0.0926 -0.0179 200202 0.0208 0.0303 200203 0.0566 -0.0555 200204 0.0273 -0.0059 200205 -0.0815 -0.077 200206 0.1527 -0.0756 200207 -0.0438 0.0068 200208 0.0049 -0.1088 200209 -0.0545 0.0871 200210 -0.0452 0.0617 200211 -0.0482 -0.0612 200212 -0.0513 -0.0198 200301 0.0941 -0.0135 200302 0.0041 -0.0019 200303 -0.0047 0.089 200304 0.0133 0.0548 200305 0.0448 0.007 200306 -0.0709 0.0217 200307 0.0006 0.0206 200308 -0.0339 -0.0147 200309 -0.0423 0.0576 200310 -0.0198 0.0109 200311 0.0262 0.0454 200312 0.0469 0.0246 200401 0.0714 0.0136 200402 0.0584 -0.0167 200403 0.0254 -0.0155 200404 -0.1052 0.0171 200405 -0.0267 0.0148 200406 -0.1062 -0.0287 -0.02 0.0334 -0.042 -0.044 -0.0072 -0.0181 0.0003 0.0033 0.0144 0.0957 0.0004 0.0565 0.0224 -0.1911 0.092 0.0764 0.0341 -0.0837 -0.2204 0.0211 -0.1608 -0.0648 -0.2519 0.1101 0.0045 -0.0792 -0.13 201404 -0.005 -0.0687 201405 201406 202003 202004 -0.0072 0.0232 0.0158 -0.0087 0.0395 -0.0151 -0.055 -0.0742 201106 201107 201108 201109 200511 200512 -0.0105 -0.0139 -0.0628 0.0256 -0.0139 -0.0451 -0.1026 0.0424 -0.0601 -0.0814 0.0579 201407 201408 0.0255 0.0029 200601 0.1149 0.027 0.0155 -0.0994 -0.1604 -0.0696 0.0017 -0.0747 -0.1074 202005 202006 202007 202008 200602 0.1336 0.0476 0.0133 0.0636 0.0698 -0.0413 -0.021 -0.0184 0.0283 0.0275 -0.0041 0.0097 0.0041 200603 200604 201110 201111 201112 201201 201409 201410 201411 201412 200812 0.053 0.1118 0.1726 0.031 202009 202010 200605 200606 200901 200902 200903 0.0434 0.0277 0.0294 0.0057 0.0125 0.0167 -0.0301 -0.0018 0.0089 0.0218 0.0225 0.0361 0.0199 0.0078 0.0207 -0.0196 0.0076 -0.002 0.1117 0.0578 0.166 0.0493 0.0513 0.0151 0.0286 0.0306 0.007 0.0618 -0.0364 0.0756 0.1072 0.1047 0.2101 -0.0121 0.0455 0.1487 0.171 -0.008 -0.0243 0.0562 -0.0201 0.0143 0.0129 0.0411 0.0779 -0.0688 0.0678 0.0112 201704 201705 201706 201707 201708 201709 201710 201711 201712 201801 201802 201803 201804 201805 201806 201807 201808 201202 201203 201204 201205 0.0224 0.0116 0.0267 -0.0297 -0.0007 0.0368 -0.0597 -0.0268 -0.0476 202011 202012 200607 200608 -0.0667 0.0324 0.0489 0.1088 0.0326 -0.006 0.0657 -0.0034 0.0889 0.1328 0.0227 -0.0542 0.0184 0.0496 0.0558 0.0242 -0.0077 -0.0485 0.0271 0.045 -0.0024 -0.0517 0.012 -0.0023 -0.0601 0.0352 0.0171 200904 200609 200610 200611 200905 200906 -0.0313 0.0092 0.0243 201501 201502 201503 201504 201505 201506 201507 201508 201509 -0.0553 0.0278 0.042 0.0564 0.0066 0.0478 0.0473 0.1689 0.1892 -0.0251 0.1414 0.1727 202101 202102 202103 202104 202105 0.0251 0.0276 -0.0053 0.0013 200907 200908 200909 0.0585 -0.0063 0.0807 0.0369 0.0305 -0.0146 -0.0312 0.0312 0.0565 -0.0555 -0.0476 0.0199 200612 200701 200702 200703 200704 -0.0765 0.0049 201206 201207 201208 201209 201210 201211 201212 201301 -0.2299 0.0596 0.0135 -0.094 0.0275 0.1612 0.0707 0.0958 0.2815 0.0383 -0.0153 -0.064 -0.0809 -0.1434 -0.1217 -0.0545 0.1137 0.0133 0.0435 200912 201001 201002 -0.061 -0.0306 0.0907 0.0037 -0.0231 -0.0441 -0.013 0.0057 0.0018 0.0586 0.0128 0.0417 0.0319 0.0014 -0.0649 0.0185 -0.0933 0.0191 0.0278 0.0298 -0.0169 202106 202107 202108 -0.0598 0.0484 0.0339 201809 201510 201511 0.1759 201810 201811 0.0264 -0.0891 0.0159 0.0644 201512Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started