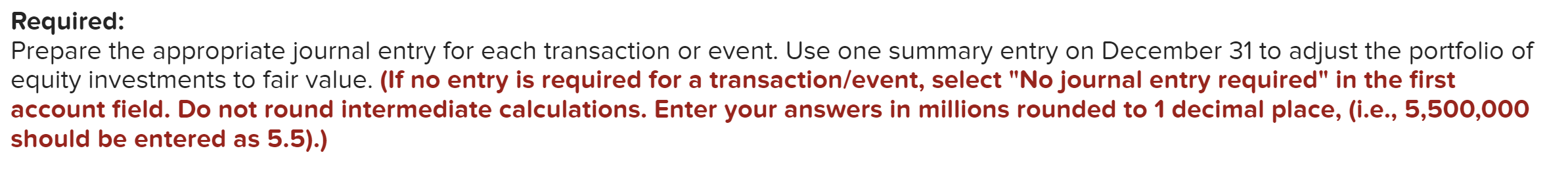

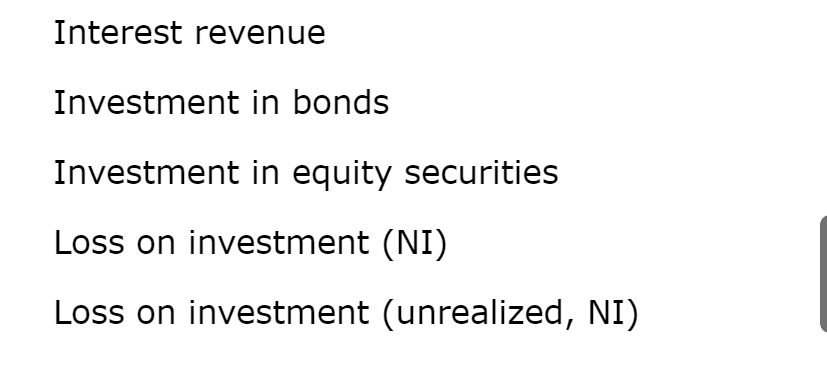

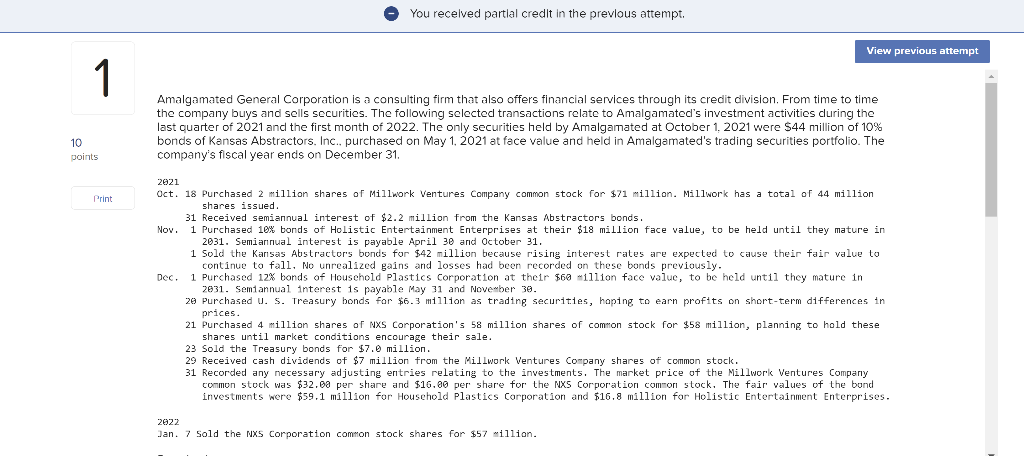

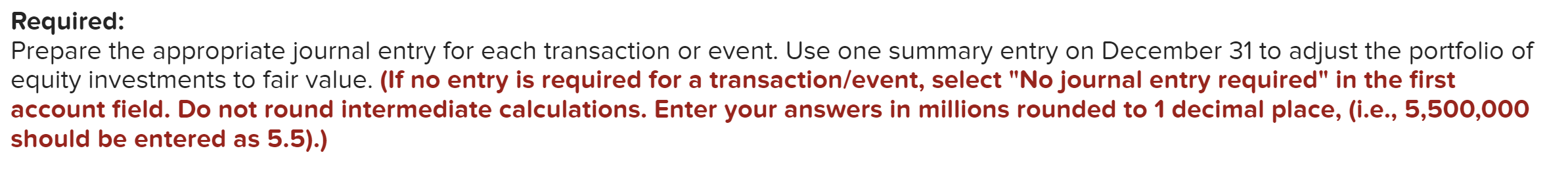

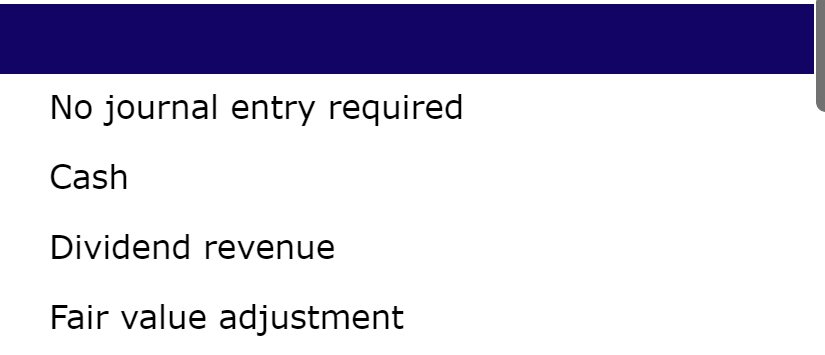

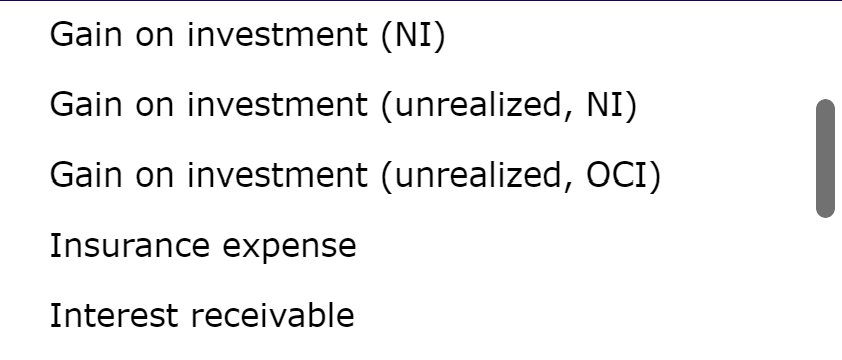

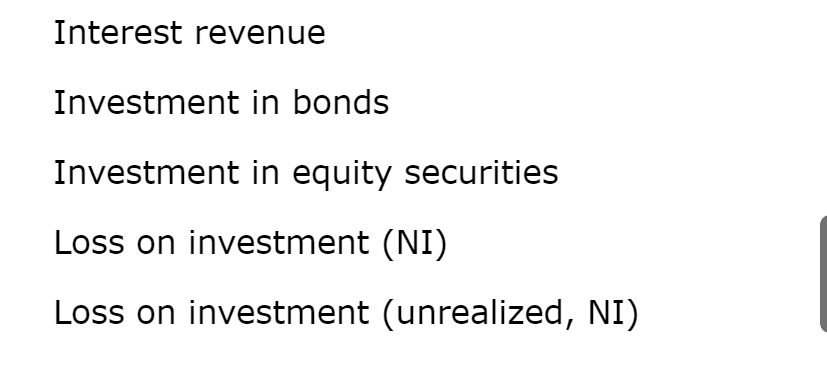

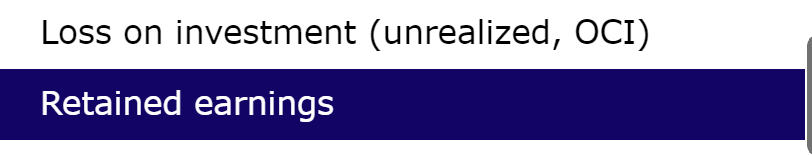

You received partial credit in the previous attempt. View previous attempt 1 Amalgamated General Corporation is a consulting firm that also offers financial services through its credit division. From time to time the company buys and sells securities. The following selected transactions relate to Amalgamated's investment activities during the last quarter of 2021 and the first month of 2022. The only securities held by Amalgamated at October 1, 2021 were $44 million of 10% bonds of Kansas Abstractors, Inc., purchased on May 1, 2021 at face value and held in Amalgamated's trading securities portfolio. The company's fiscal year ends on December 31. 10 points Print 2021 Oct. 18 Purchased 2 million shares of Millwork Ventures Company common stock for $71 million. Millwork has a total of 44 million shares issued 31 Received semiannual interest of $2.2 million from the Kansas Abstractors bonds. Nov. 1 Purchased 10% bonds of Holistic Entertainment Enterprises at their $18 million face value, to be held until they mature in 2031. Semiannual interest is payable April 30 and October 31. 1 Sold the Karisas Abstractors bonds for $42 million because rising interest rates are expected to cause their fair value to continue to fall, No unrealized gains and losses had been recorded on these bonds previously. Dec. 1 Purchased 12% bonds of Household Plastics Corporation at their $60 million face value, to be held until they mature in 2831. Semiannual interest is payable May and November 30. 20 Purchased u. S. Treasury bonds for $6.3 million as trading securities, hoping to earn profits on short-term differences in prices. 21 Purchased 4 million shares of NXS Corporation's 58 million shares of common stock for $58 million, planning to hold these shares until market conditions encourage their sale. 23 Sold the Treasury bonds for $7.0 million. 29 Received cash dividends of $7 million from the Millwork Ventures Company shares of common stock. 31 Recorded any necessary adjusting entries relating to the investments. The market price of the Millwork Ventures Company common stock was $32.ba per share and $16.00 per share for the NXS Corporation common stock. The fair values of the bond investments were $59.1 million for Household Plastics Corporation and $16.8 million for Holistic Entertainment Enterprises. 2022 Jan. 7 Sold the NXS Corporation common stock shares for $57 million. Required: Prepare the appropriate journal entry for each transaction or event. Use one summary entry on December 31 to adjust the portfolio of equity investments to fair value. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) a No Date General Journal Debit Credit 1 Oct 18, 2021 71.0 Investment in equity securities Cash 00 71.0 2 Oct 31, 2021 Cash 2.2 Interest revenue 2.2 | 3 Nov 01, 2021 Investment in bonds 18.0 Cash 18.0 4 Nov 01, 2021 x 2.0 Loss on investment (NI) Investment in equity securities XX x 2.0 5 Nov 01, 2021 Cash 42.0 00 x 2.0 Loss on investment (NI) Investment in equity securities x 44.0 6 Dec 01, 2021 Investment in bonds 60.0 Cash 60.0 7 Dec 20, 2021 Investment in bonds 6.3 Cash 6.3 8 Dec 21, 2021 58.0 > Investment in equity securities Cash lo 58.0 9 Dec 23, 2021 x 0.7 > Gain on investment (NI) Investment in bonds x 0.7 10 Dec 23, 2021 Cash 7.0 Investment in bonds Gain on investment (NI) 6.3 0.7 x 11 Dec 29, 2021 Cash 7.0 Dividend revenue 7.0 12 Dec 31, 2021 Interest receivable 0.3 Interest revenue 0.3 13 Dec 31, 2021 Interest receivable 0.6 Dividend revenue x 0.6 14 Dec 31, 2021 3.0 X Loss on investment (unrealized, OCI) Investment in equity securities X 3.0 x 15 Jan 07, 2022 X 7.0 Fair value adjustment Investment in equity securities x 7.0 16 Jan 07, 2022 x x x No journal entry required Cash Dividend revenue Fair value adjustment Gain on investment (NI) Gain on investment (unrealized, NI) Gain on investment (unrealized, OCI) Insurance expense Interest receivable Interest revenue Investment in bonds Investment in equity securities Loss on investment (NI) Loss on investment (unrealized, NI) Loss on investment (unrealized, OCI) Retained earnings