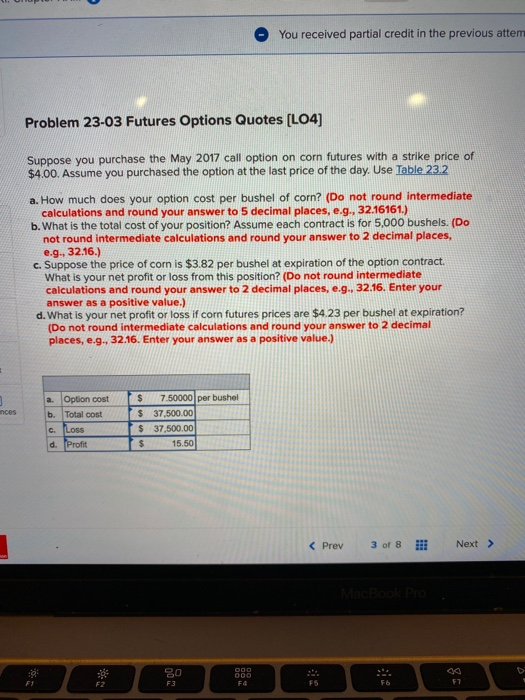

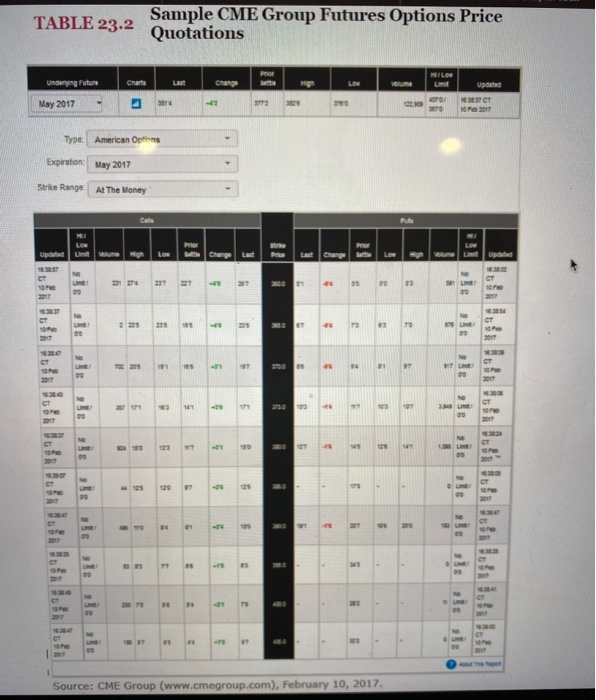

You received partial credit in the previous atten Problem 23-03 Futures Options Quotes (L04) Suppose you purchase the May 2017 call option on corn futures with a strike price of $4.00. Assume you purchased the option at the last price of the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round Intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn is $3.82 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if com futures prices are $4.23 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) inces a. Option cost b. Total cost c. Los d. Profit $ $ $ $ 7.50000 per bushel 37.500.00 37,500.00 15.50 TABLE 23.2 . Sample CME Group Futures Options Price Quotations updated May 2017 Type Expiration Serta Range American Options May 2017 At The Money re Le 22 - 201 - Source: CME Group (www.cmegroup.com), February 10, 2017 You received partial credit in the previous atten Problem 23-03 Futures Options Quotes (L04) Suppose you purchase the May 2017 call option on corn futures with a strike price of $4.00. Assume you purchased the option at the last price of the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round Intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn is $3.82 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if com futures prices are $4.23 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) inces a. Option cost b. Total cost c. Los d. Profit $ $ $ $ 7.50000 per bushel 37.500.00 37,500.00 15.50 TABLE 23.2 . Sample CME Group Futures Options Price Quotations updated May 2017 Type Expiration Serta Range American Options May 2017 At The Money re Le 22 - 201 - Source: CME Group (www.cmegroup.com), February 10, 2017