You require inventory and accounts receivable collateral for all C&I loans. You have a guideline of an advance rate of 70% for customer receivables

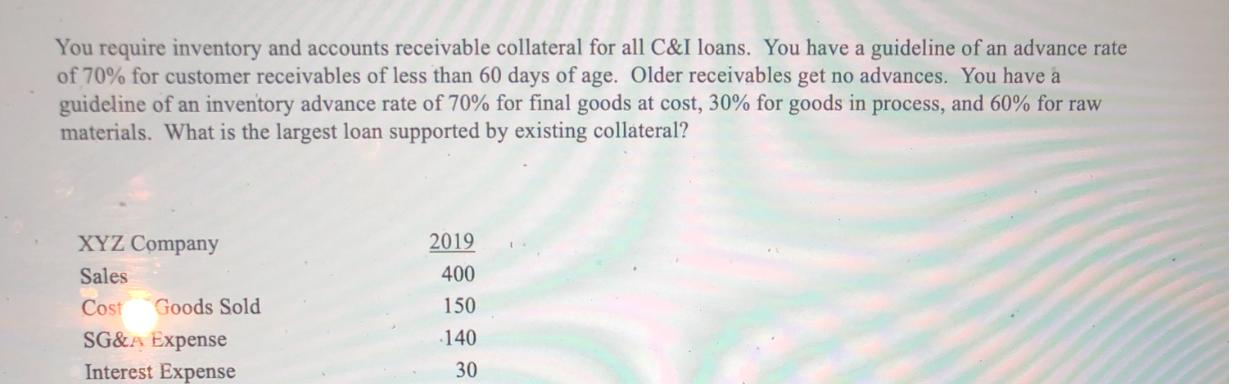

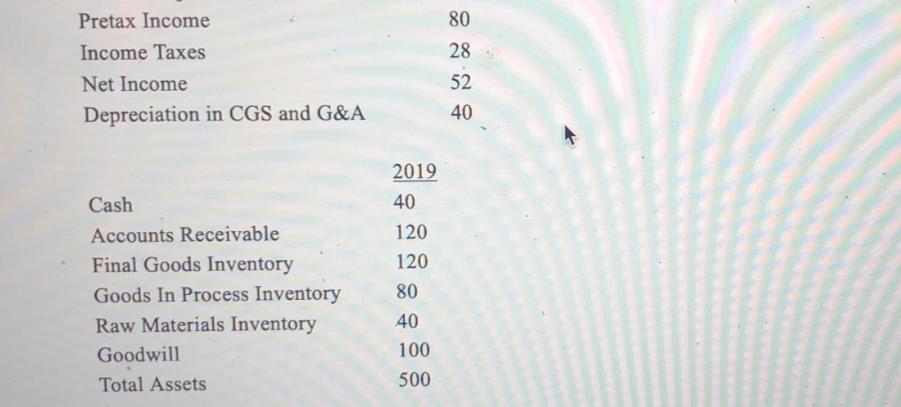

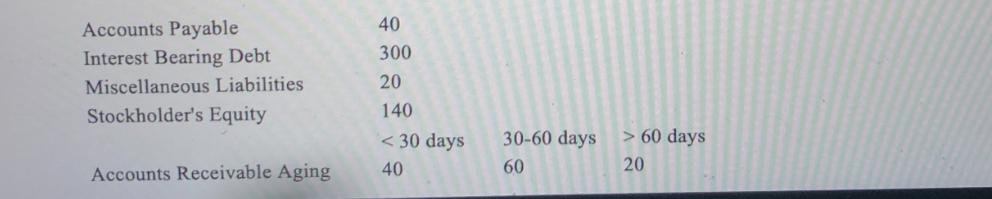

You require inventory and accounts receivable collateral for all C&I loans. You have a guideline of an advance rate of 70% for customer receivables of less than 60 days of age. Older receivables get no advances. You have a guideline of an inventory advance rate of 70% for final goods at cost, 30% for goods in process, and 60% for raw materials. What is the largest loan supported by existing collateral? XYZ Company Sales Cost Goods Sold SG&A Expense Interest Expense 2019 400 150 140 30 Pretax Income Income Taxes Net Income Depreciation in CGS and G&A Cash Accounts Receivable Final Goods Inventory Goods In Process Inventory Raw Materials Inventory Goodwill Total Assets 2019 40 120 120 80 40 100 500 80 28 52 40 Accounts Payable Interest Bearing Debt Miscellaneous Liabilities Stockholder's Equity Accounts Receivable Aging 40 300 20 140 < 30 days 40 30-60 days 60 > 60 days 20

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the largest loan supported by existing collateral we need to calculate the collateral value based on the guidelines provided for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started