Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you reviewed ratios and analyzed the results from the perspective of an external decision maker. Now consider how a manager would use the same information

you reviewed ratios and analyzed the results from the perspective of an external decision maker. Now consider how a manager would use the same information and how the manager's perspective and decision making would differ when considering investing strategies. Be sure to provide an idea not yet posted by a peer. Participate in follow-up discussion by critiquing the posts provided by your peers or defending their challenges to your post.

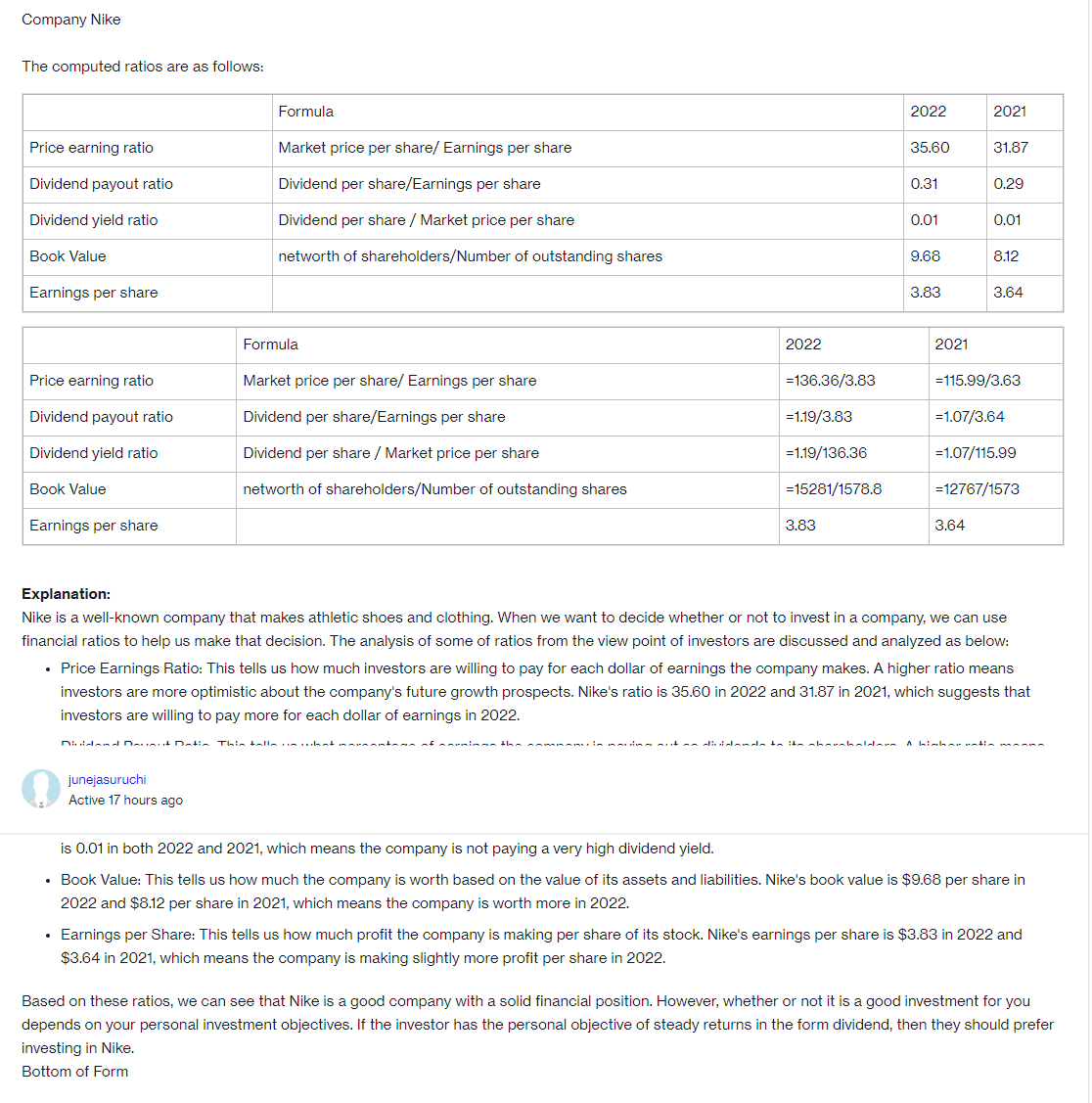

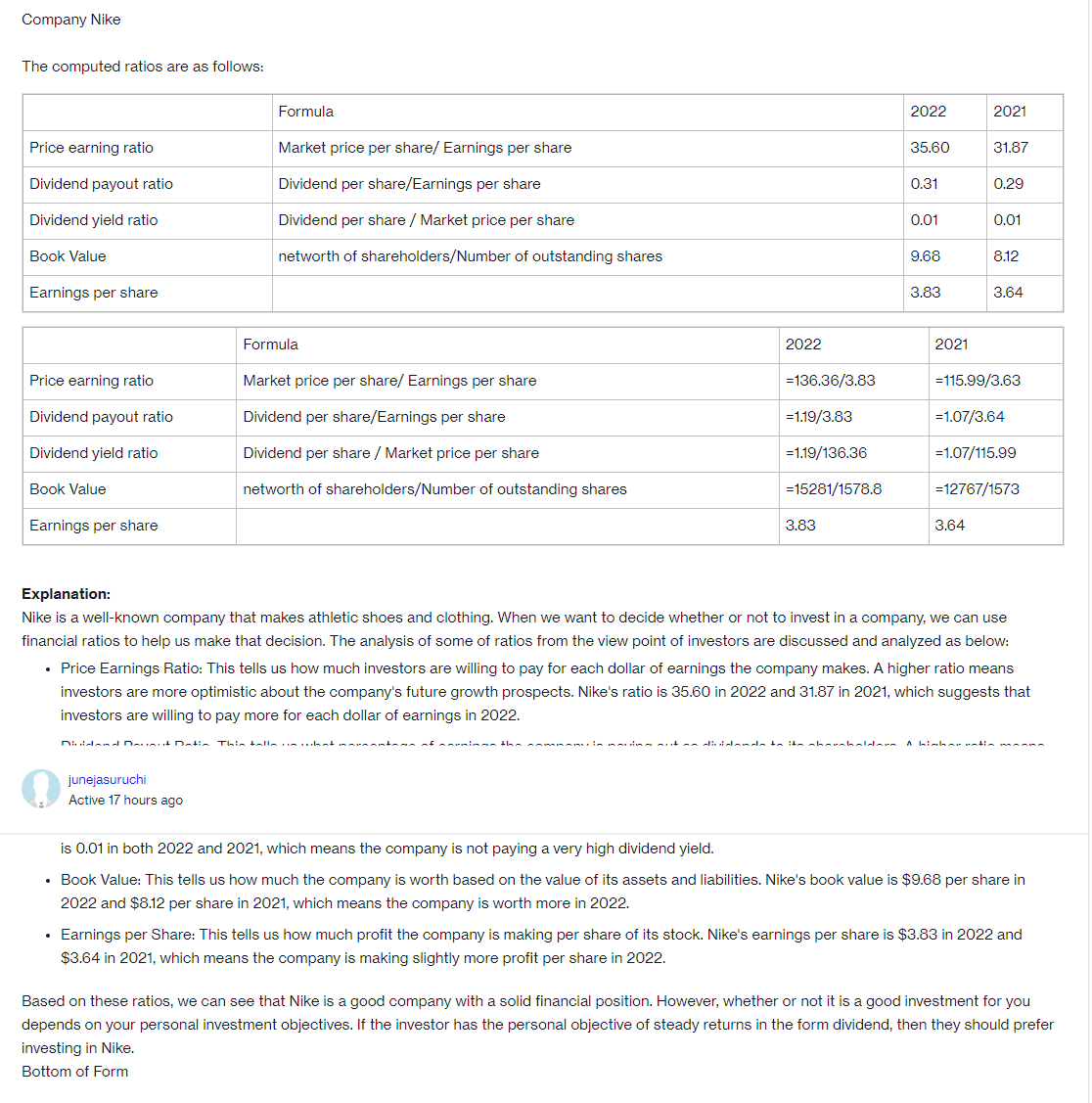

Company Nike The computed ratios are as follows: Price earning ratio Dividend payout ratio Dividend yield ratio Book Value Formula Market price per share/ Earnings per share Dividend per share/Earnings per share Dividend per share / Market price per share networth of shareholders/Number of outstanding shares Earnings per share Formula Price earning ratio Market price per share/ Earnings per share Dividend payout ratio Dividend per share/Earnings per share Dividend yield ratio Book Value Dividend per share / Market price per share networth of shareholders/Number of outstanding shares Earnings per share 2022 2021 35.60 31.87 0.31 0.29 0.01 0.01 9.68 8.12 3.83 3.64 2022 2021 =136.36/3.83 =115.99/3.63 =1.19/3.83 =1.07/3.64 =1.19/136.36 =1.07/115.99 =15281/1578.8 =12767/1573 3.83 3.64 Explanation: Nike is a well-known company that makes athletic shoes and clothing. When we want to decide whether or not to invest in a company, we can use financial ratios to help us make that decision. The analysis of some of ratios from the view point of investors are discussed and analyzed as below: Price Earnings Ratio: This tells us how much investors are willing to pay for each dollar of earnings the company makes. A higher ratio means investors are more optimistic about the company's future growth prospects. Nike's ratio is 35.60 in 2022 and 31.87 in 2021, which suggests that investors are willing to pay more for each dollar of earnings in 2022. Dividend Davant Datin. This talla un vichat manmanton of carminan the junejasuruchi vinn mat an disialanda to its shanahaldara A higher untin man Active 17 hours ago is 0.01 in both 2022 and 2021, which means the company is not paying a very high dividend yield. Book Value: This tells us how much the company is worth based on the value of its assets and liabilities. Nike's book value is $9.68 per share in 2022 and $8.12 per share in 2021, which means the company is worth more in 2022. Earnings per Share: This tells us how much profit the company is making per share of its stock. Nike's earnings per share is $3.83 in 2022 and $3.64 in 2021, which means the company is making slightly more profit per share in 2022. Based on these ratios, we can see that Nike is a good company with a solid financial position. However, whether or not it is a good investment for you depends on your personal investment objectives. If the investor has the personal objective of steady returns in the form dividend, then they should prefer investing in Nike. Bottom of Form

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started