You run Kona Air, a small entrant in the Hawaii inter-island airline market. The market is currently dominated by a single incumbent airline, Hawaiian

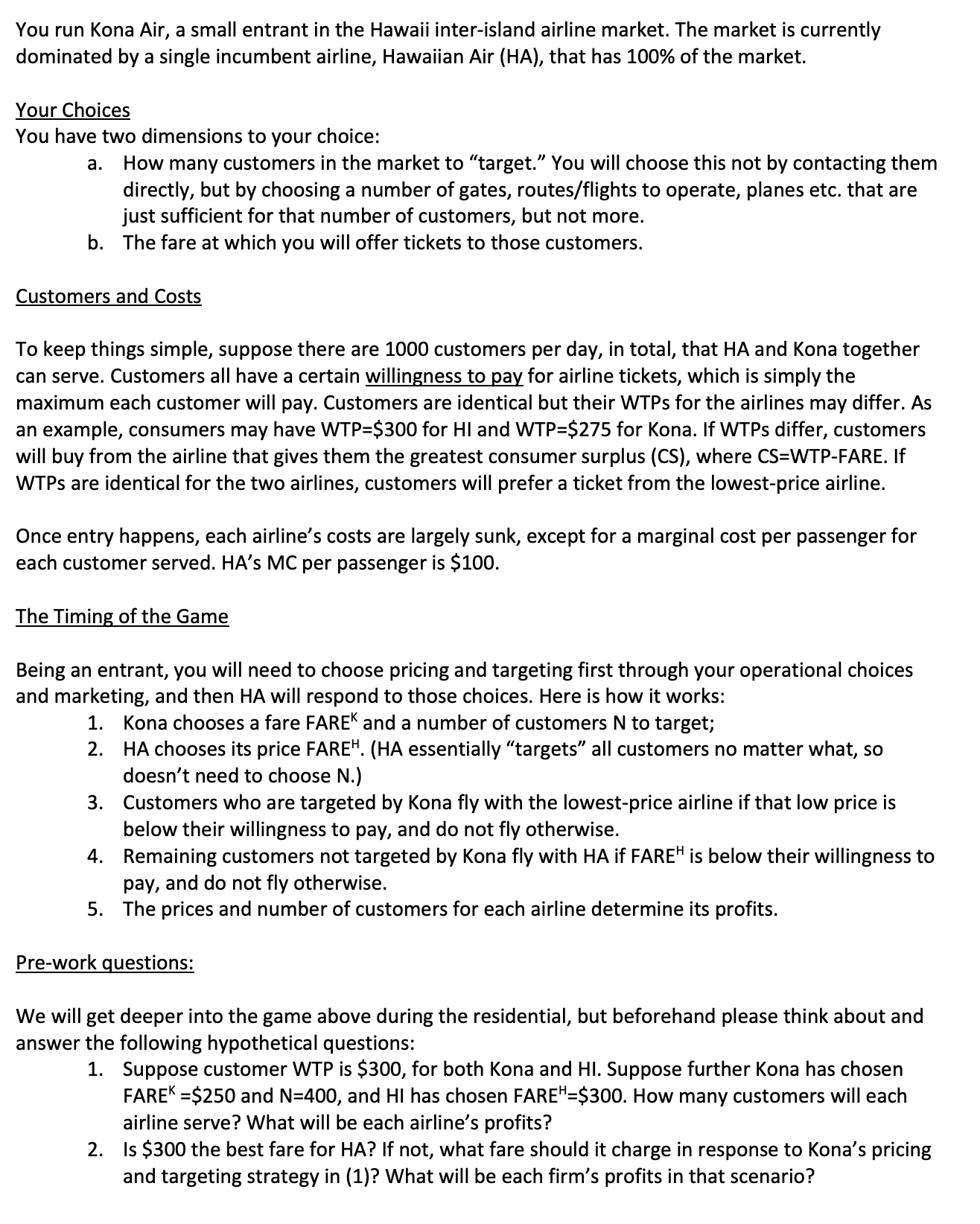

You run Kona Air, a small entrant in the Hawaii inter-island airline market. The market is currently dominated by a single incumbent airline, Hawaiian Air (HA), that has 100% of the market. Your Choices You have two dimensions to your choice: a. How many customers in the market to "target." You will choose this not by contacting them directly, but by choosing a number of gates, routes/flights to operate, planes etc. that are just sufficient for that number of customers, but not more. b. The fare at which you will offer tickets to those customers. Customers and Costs To keep things simple, suppose there are 1000 customers per day, in total, that HA and Kona together can serve. Customers all have a certain willingness to pay for airline tickets, which is simply the maximum each customer will pay. Customers are identical but their WTPs for the airlines may differ. As an example, consumers may have WTP=$300 for HI and WTP=$275 for Kona. If WTPs differ, customers will buy from the airline that gives them the greatest consumer surplus (CS), where CS=WTP-FARE. If WTPs are identical for the two airlines, customers will prefer a ticket from the lowest-price airline. Once entry happens, each airline's costs are largely sunk, except for a marginal cost per passenger for each customer served. HA's MC per passenger is $100. The Timing of the Game Being an entrant, you will need to choose pricing and targeting first through your operational choices and marketing, and then HA will respond to those choices. Here is how it works: 1. Kona chooses a fare FAREK and a number of customers N to target; 2. HA chooses its price FAREH. (HA essentially "targets" all customers no matter what, so doesn't need to choose N.) 3. Customers who are targeted by Kona fly with the lowest-price airline if that low price is below their willingness to pay, and do not fly otherwise. 4. Remaining customers not targeted by Kona fly with HA if FARE" is below their willingness to pay, and do not fly otherwise. 5. The prices and number of customers for each airline determine its profits. Pre-work questions: We will get deeper into the game above during the residential, but beforehand please think about and answer the following hypothetical questions: 1. Suppose customer WTP is $300, for both Kona and HI. Suppose further Kona has chosen FAREK =$250 and N=400, and HI has chosen FAREH=$300. How many customers will each airline serve? What will be each airline's profits? 2. Is $300 the best fare for HA? If not, what fare should it charge in response to Kona's pricing and targeting strategy in (1)? What will be each firm's profits in that scenario?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started