Answered step by step

Verified Expert Solution

Question

1 Approved Answer

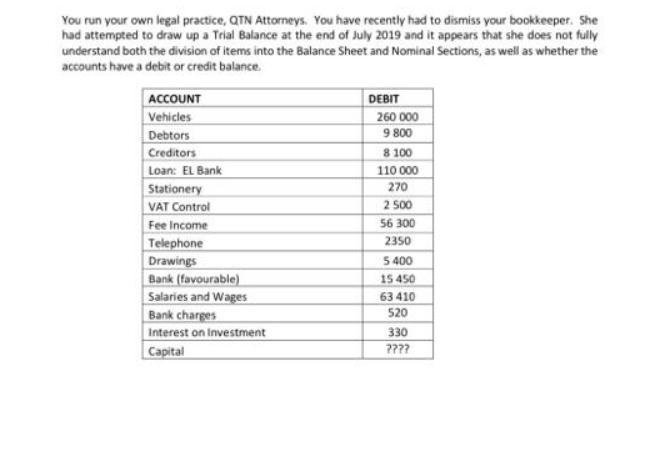

You run your own legal practice, QTN Attorneys. You have recently had to dismiss your bookkeeper. She had attempted to draw up a Trial

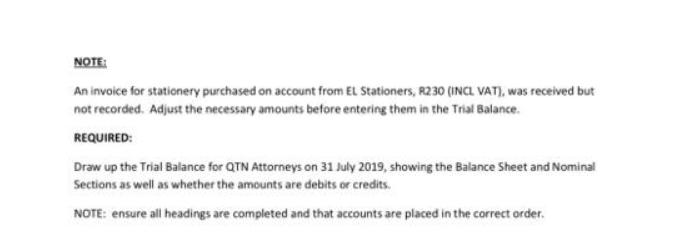

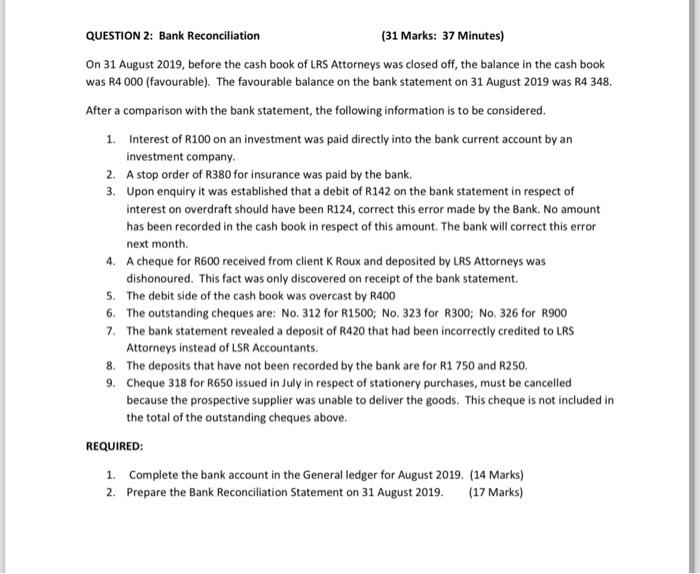

You run your own legal practice, QTN Attorneys. You have recently had to dismiss your bookkeeper. She had attempted to draw up a Trial Balance at the end of July 2019 and it appears that she does not fully understand both the division of items into the Balance Sheet and Nominal Sections, as well as whether the accounts have a debit or credit balance. ACCOUNT Vehicles Debtors Creditors Loan: El Bank Stationery VAT Control Fee Income Telephone Drawings Bank (favourable) Salaries and Wages Bank charges Interest on Investment Capital DEBIT 260 000 9 800 8 100 110 000 270 2 500 56 300 2350 5400 15 450 63 410 520 330 ???? NOTE: An invoice for stationery purchased on account from EL Stationers, R230 (INCL VAT), was received but not recorded. Adjust the necessary amounts before entering them in the Trial Balance. REQUIRED: Draw up the Trial Balance for QTN Attorneys on 31 July 2019, showing the Balance Sheet and Nominal Sections as well as whether the amounts are debits or credits. NOTE: ensure all headings are completed and that accounts are placed in the correct order. QUESTION 2: Bank Reconciliation (31 Marks: 37 Minutes) On 31 August 2019, before the cash book of LRS Attorneys was closed off, the balance in the cash book was R4 000 (favourable). The favourable balance on the bank statement on 31 August 2019 was R4 348. After a comparison with the bank statement, the following information is to be considered. 1. Interest of R100 on an investment was paid directly into the bank current account by an investment company. A stop order of R380 for insurance was paid by the bank. Upon enquiry it was established that a debit of R142 on the bank statement in respect of interest on overdraft should have been R124, correct this error made by the Bank. No amount has been recorded in the cash book in respect of this amount. The bank will correct this error next month. 2. 3. 4. A cheque for R600 received from client K Roux and deposited by LRS Attorneys was dishonoured. This fact was only discovered on receipt of the bank statement. 5. The debit side of the cash book was overcast by R400 6. The outstanding cheques are: No. 312 for R1500; No. 323 for R300; No. 326 for R900 7. The bank statement revealed a deposit of R420 that had been incorrectly credited to LRS Attorneys instead of LSR Accountants. 8. The deposits that have not been recorded by the bank are for R1 750 and R250. 9. Cheque 318 for R650 issued in July in respect of stationery purchases, must be cancelled because the prospective supplier was unable to deliver the goods. This cheque is not included in the total of the outstanding cheques above. REQUIRED: 1. Complete the bank account in the General ledger for August 2019. (14 Marks) 2. Prepare the Bank Reconciliation Statement on 31 August 2019. (17 Marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To draw up the Trial Balance for QTN Attorneys on 31 July 2019 we need to determine whether each acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started