Answered step by step

Verified Expert Solution

Question

1 Approved Answer

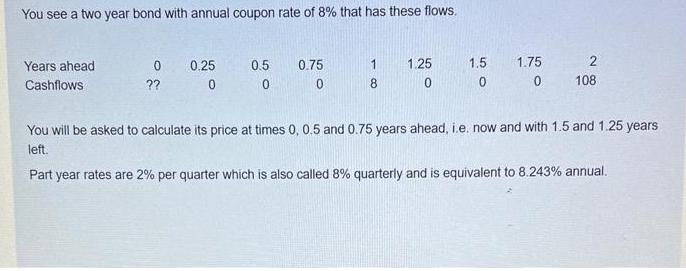

You see a two year bond with annual coupon rate of 8% that has these flows. Years ahead Cashflows 0 ?? 0.25 0 0.5

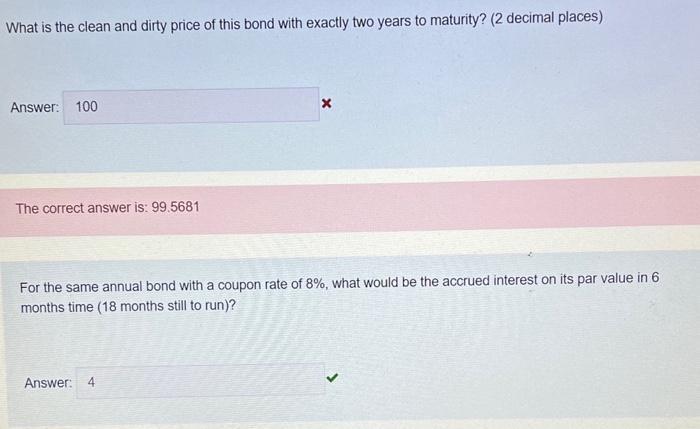

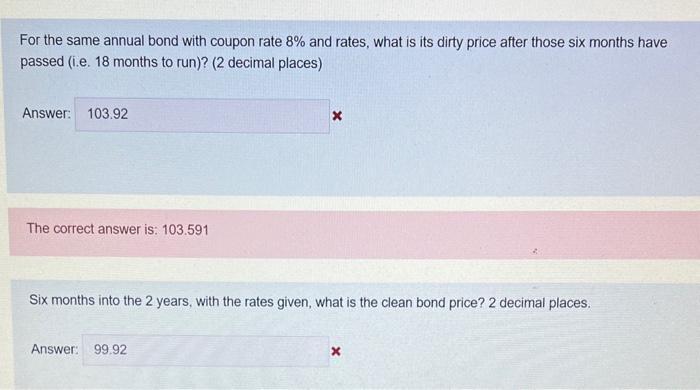

You see a two year bond with annual coupon rate of 8% that has these flows. Years ahead Cashflows 0 ?? 0.25 0 0.5 0 0.75 1 1.25 1.5 1.75 2 8 0 0 0 108 You will be asked to calculate its price at times 0, 0.5 and 0.75 years ahead, i.e. now and with 1.5 and 1.25 years left. Part year rates are 2% per quarter which is also called 8% quarterly and is equivalent to 8.243% annual. What is the clean and dirty price of this bond with exactly two years to maturity? (2 decimal places) Answer: 100 The correct answer is: 99.5681 x For the same annual bond with a coupon rate of 8%, what would be the accrued interest on its par value in 6 months time (18 months still to run)? Answer: 4 For the same annual bond with coupon rate 8% and rates, what is its dirty price after those six months have passed (i.e. 18 months to run)? (2 decimal places) Answer: 103.92 The correct answer is: 103.591 Six months into the 2 years, with the rates given, what is the clean bond price? 2 decimal places. Answer: 99.92 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started