Answered step by step

Verified Expert Solution

Question

1 Approved Answer

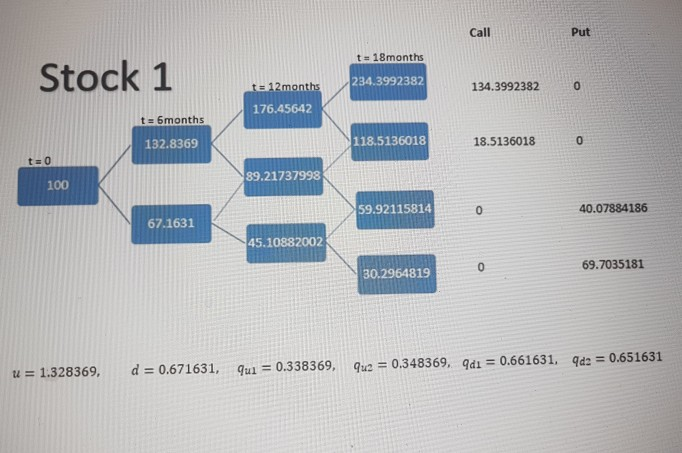

You sell a European option with a current value of 100. The maturity time is 18 months, and a risk-free interest rate of 1%. The

You sell a European option with a current value of 100. The maturity time is 18 months, and a risk-free interest rate of 1%. The three options are:

1. Call with strike 100 2. Put with strike 100 3. Butterfly-like option with a payoff at maturity time of (S)=exp-(S-100)^2/75, where S is the final value of the stock.

Compute the price of these options. Use the diagram in the picture.

Call Put t = 18 months Stock 1 te 12 months 234.3992382 134.3992382 0 176.45642 t = 6months 132.8369 118.5136018 18.51360180 89.21737998 100 59.92115814 40.07884186 67.1631 45.10882002 69.7035181 30.2964819 t = 1.328369, d = 0.671631, qui = 0.338369, que = 0.348369, 9d1 = 0.661631, 9de = 0.651631

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started