Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This assignment concerns with a sensitivity analysis for a retirement account. You are making some anticipatory calculations to invest in your retirement account. You

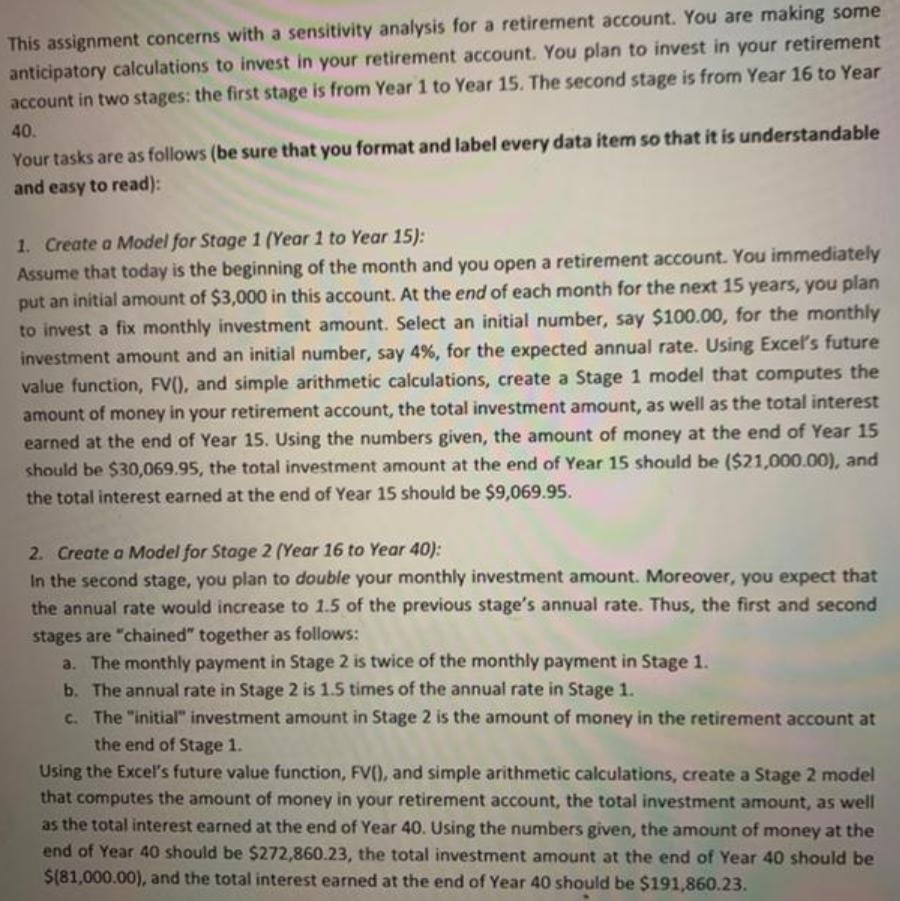

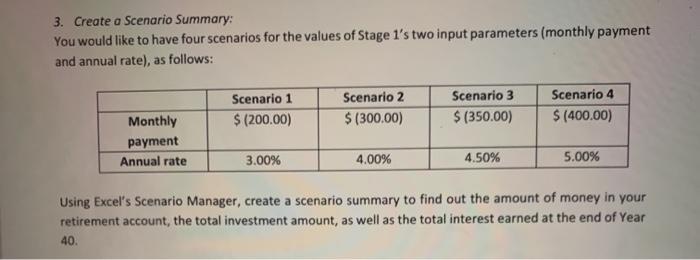

This assignment concerns with a sensitivity analysis for a retirement account. You are making some anticipatory calculations to invest in your retirement account. You plan to invest in your retirement account in two stages: the first stage is from Year 1 to Year 15. The second stage is from Year 16 to Year 40. Your tasks are as follows (be sure that you format and label every data item so that it is understandable and easy to read): 1. Create a Model for Stage 1 (Year 1 to Year 15): Assume that today is the beginning of the month and you open a retirement account. You immediately put an initial amount of $3,000 in this account. At the end of each month for the next 15 years, you plan to invest a fix monthly investment amount. Select an initial number, say $100.00, for the monthly investment amount and an initial number, say 4%, for the expected annual rate. Using Excel's future value function, FV(), and simple arithmetic calculations, create a Stage 1 model that computes the amount of money in your retirement account, the total investment amount, as well as the total interest earned at the end of Year 15. Using the numbers given, the amount of money at the end of Year 15 should be $30,069.95, the total investment amount at the end of Year 15 should be ($21,000.00), and the total interest earned at the end of Year 15 should be $9,069.95. 2. Create a Model for Stage 2 (Year 16 to Year 40): In the second stage, you plan to double your monthly investment amount. Moreover, you expect that the annual rate would increase to 1.5 of the previous stage's annual rate. Thus, the first and second stages are "chained" together as follows: a. The monthly payment in Stage 2 is twice of the monthly payment in Stage 1. b. The annual rate in Stage 2 is 1.5 times of the annual rate in Stage 1. c. The "initial" investment amount in Stage 2 is the amount of money in the retirement account at the end of Stage 1. Using the Excel's future value function, FV(), and simple arithmetic calculations, create a Stage 2 model that computes the amount of money in your retirement account, the total investment amount, as well as the total interest earned at the end of Year 40. Using the numbers given, the amount of money at the end of Year 40 should be $272,860.23, the total investment amount at the end of Year 40 should be $(81,000.00), and the total interest earned at the end of Year 40 should be $191,860.23. 3. Create a Scenario Summary: You would like to have four scenarios for the values of Stage 1's two input parameters (monthly payment and annual rate), as follows: Scenario 1 Scenario 2 Scenario 3 Scenario 4 Monthly $ (200.00) $ (300.00) $ (350.00) $ (400.00) payment Annual rate 3.00% 4.00% 4.50% 5.00% Using Excel's Scenario Manager, create a scenario summary to find out the amount of money in retirement account, the total investment amount, as well as the total interest earned at the end of Year your 40.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Stage 1 1 Create a new sheet with below data labels and values D12 fe A B 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started