Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shao and Dong were each shareholders of ShaoDong Corp., a C corporation. They decided to completely liquidate ShaoDong Corp. this year. After liquidating its

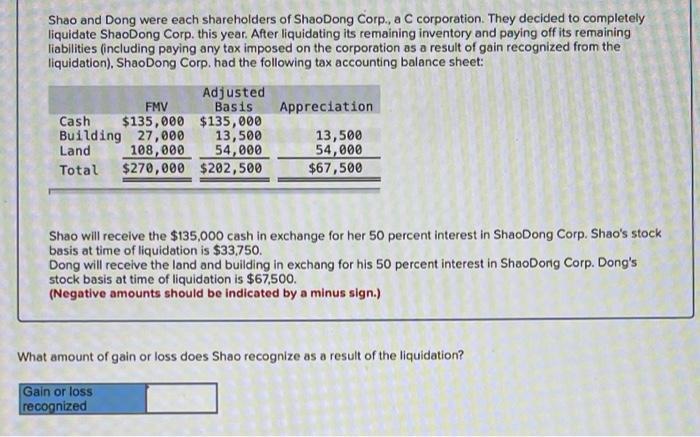

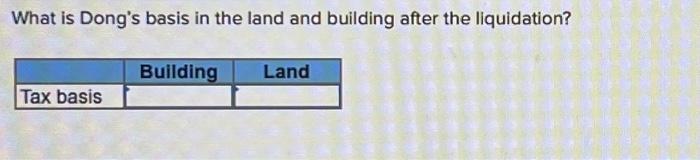

Shao and Dong were each shareholders of ShaoDong Corp., a C corporation. They decided to completely liquidate ShaoDong Corp. this year. After liquidating its remaining inventory and paying off its remaining liabilities (including paying any tax imposed on the corporation as a result of gain recognized from the liquidation), ShaoDong Corp. had the following tax accounting balance sheet: Adjusted Basis $135,000 $135,000 13,500 54,000 $270,000 $202,500 FMV Appreciation Cash Building 27,000 Land 13,500 54,000 $67,500 108,000 Total Shao will receive the $135,000 cash in exchange for her 50 percent interest in ShaoDong Corp. Shao's stock basis at time of liquidation is $33,750. Dong will receive the land and building in exchang for his 50 percent interest in ShaoDong Corp. Dong's stock basis at time of liquidation is $67,500. (Negative amounts should be indicated by a minus sign.) What amount of gain or loss does Shao recognize as a result of the liquidation? Gain or loss recognized What is Dong's basis in the land and building after the liquidation? Building Land Tax basis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 GAIN OR LOSS RECOGNIZED BY SHAO AS A RESULT OF LIQUIDATION ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started