Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You short sell 500 shares of ABC stock at $25/share Initial margin requirement is 50% and maintenance margin requirement is 40% A year later,

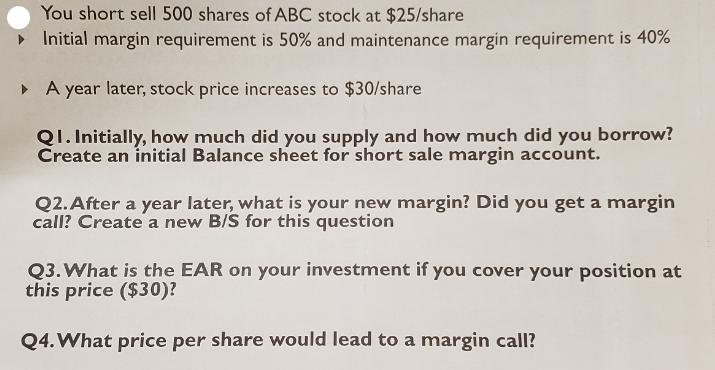

You short sell 500 shares of ABC stock at $25/share Initial margin requirement is 50% and maintenance margin requirement is 40% A year later, stock price increases to $30/share QI. Initially, how much did you supply and how much did you borrow? Create an initial Balance sheet for short sale margin account. Q2. After a year later, what is your new margin? Did you get a margin call? Create a new B/S for this question Q3. What is the EAR on your investment if you cover your position at this price ($30)? Q4. What price per share would lead to a margin call?

Step by Step Solution

★★★★★

3.24 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Initially how much did you supply and how much did you borrow Create an initial balance sheet for the short sale margin account To determine the initial amounts supplied and borrowed we need to con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started