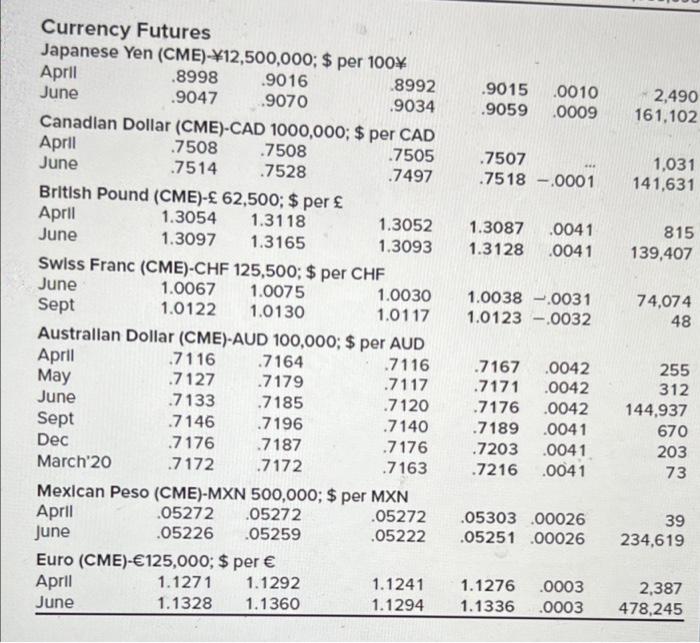

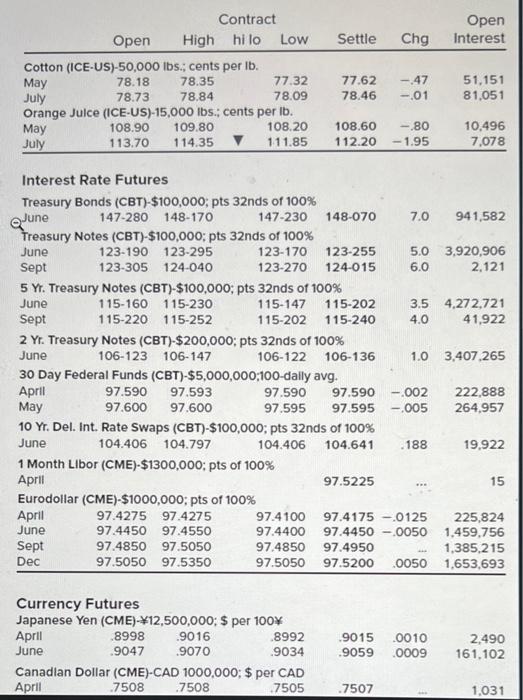

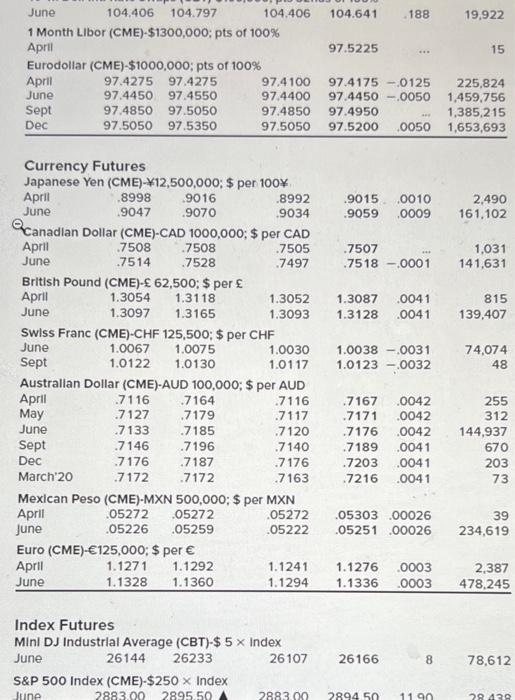

You shorted 10 June 2019 Japanese yen futures contracts at the high price for the day. Looking back at Figure 14.1, if you closed your position at the settle price on this day, what was your profit? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Profit .9015 .9059 .0010 .0009 2,490 161,102 .7507 .7518 -.0001 1,031 141,631 1.3087 1.3128 .0041 .0041 815 139,407 Currency Futures Japanese Yen (CME)- 12,500,000; $ per 100+ April .8998 .9016 .8992 June .9047 9070 .9034 Canadian Dollar (CME)-CAD 1000,000; $ per CAD April .7508 .7508 .7505 June .7514 .7528 .7497 British Pound (CME)- 62,500; $ per April 1.3054 1.3118 1.3052 June 1.3097 1.3165 1.3093 Swiss Franc (CME)-CHF 125,500; $ per CHF June 1.0067 1.0075 1.0030 Sept 1.0122 1.0130 1.0117 Australian Dollar (CME)-AUD 100,000; $ per AUD April .7116 .7164 .7116 May .7127 .7179 .7117 June .7133 .7185 .7120 Sept .7146 .7196 .7140 Dec .7176 .7187 .7176 March 20 .7172 .7172 .7163 Mexican Peso (CME)-MXN 500,000; $ per MXN April .05272 .05272 05272 June .05226 .05259 .05222 Euro (CME)-125,000; $ per April 1.1271 1.1292 1.1241 June 1.1328 1.1360 1.1294 1.0038 -.0031 1.0123 - 0032 74,074 48 .7167 .0042 .7171.0042 .7176 0042 .7189 .0041 .7203 .0041 .7216 0041 255 312 144,937 670 203 73 .05303.00026 .05251 00026 39 234,619 1.1276 1.1336 .0003 .0003 2,387 478,245 Open Interest Settle Chg Contract Open High hilo Low Cotton (ICE-US)-50,000 lbs., cents per ib. May 78.18 78.35 77.32 July 78.73 78.84 78.09 Orange Juice (ICE-US)-15,000 lbs.: cents per lb. May 108.90 109.80 108.20 July 113.70 114.35 111.85 77.62 78.46 -.47 -.01 51.151 81.051 108.60 112.20 -.80 -1.95 10,496 7,078 June Interest Rate Futures Treasury Bonds (CBT)-$100,000; pts 32nds of 100% 147-280 148-170 147-230 148-070 7.0 94 1,582 Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 123-190 123-295 123-170 123-255 5.0 3.920,906 Sept 123-305 124-040 123-270 124-015 6.0 2.121 5 Y. Treasury Notes (CBT)-$100,000; pts 32nds of 100% June 115-160 115-230 115-147 115-202 3.5 4,272,721 Sept 115-220 115-252 115-202 115-240 4.0 41,922 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% June 106-123 106-147 106-122 106-136 1.0 3,407,265 30 Day Federal Funds (CBT)-$5,000,000:100-daily avg. April 97.590 97.593 97.590 97.590-002 222,888 May 97.600 97.600 97.595 97.595 -,005 264.957 10 Yr. Del. Int. Rate Swaps (CBT)-$100,000; pts 32nds of 100% June 104.406 104.797 104.406 104.641 .188 19,922 1 Month Libor (CME)-$1300,000: pts of 100% April 97.5225 15 Eurodollar (CME)-$1000,000; pts of 100% April 97.4275 97.4275 97.4100 97.4175 -0125 225,824 June 97.4450 97.4550 97.4400 97.4450 -.0050 1,459,756 Sept 97.4850 97.5050 97.4850 97.4950 1,385,215 Dec 97.5050 97.5350 97.5050 97.5200 .0050 1.653,693 Currency Futures Japanese Yen (CME)- 12,500,000; $ per 1004 April .8998 .9016 8992 June .9047 .9070 .9034 Canadian Dollar (CME)-CAD 1000,000; $ per CAD April .7508 .7508 .7505 .9015 .9059 .0010 .0009 2,490 161.102 .7507 1,031 104.641 188 19,922 97.5225 15 June 104.406 104.797 104.406 1 Month Libor (CME)-$1300,000; pts of 100% April Eurodollar (CME) $1000,000; pts of 100% April 97.4275 97.4275 97,4100 June 97.4450 97.4550 97.4400 Sept 97.4850 97.5050 97.4850 Dec 97.5050 97.5350 97.5050 97.4175 -.0125 225,824 97.4450 -.0050 1.459.756 97.4950 1,385,215 97.5200 .0050 1,653,693 90150010 9059 .0009 2.490 161.102 .7507 .7518 - 0001 1,031 141,631 1.3087 1.3128 0041 .0041 815 139,407 Currency Futures Japanese Yen (CME)- 12,500,000; $ per 100 April .8998 .9016 .8992 June .9047 .9070 .9034 canadian Dollar (CME)-CAD 1000,000; $ per CAD April .7508 .7508 .7505 June .7514 .7528 .7497 British Pound (CME)- 62,500; $ per April 1.3054 1.3118 1.3052 June 1.3097 1.3165 1.3093 Swiss Franc (CME)-CHF 125,500; $ per CHF June 1.0067 1.0075 1.0030 Sept 1.0122 1.0130 1.0117 Australian Dollar (CME)-AUD 100,000; $ per AUD April .7116 .7164 .7116 May .7127 7179 .7117 June .7133 .7185 .7120 Sept .7146 .7196 .7140 Dec .7176 .7187 .7176 March 20 7172 .7172 .7163 Mexican Peso (CME)-MXN 500,000; $ per MXN April 05272 05272 .05272 June .05226 .05259 .05222 Euro (CME)-125,000: $ per April 1.1271 1.1292 1.1241 June 1.1328 1.1360 1.1294 1.0038 -0031 1.0123 - 0032 74,074 48 .7167 .0042 .7171 0042 7176 0042 .7189 .0041 .7203 .0041 .7216 0041 255 312 144,937 670 203 73 .05303 .00026 .05251 .00026 39 234,619 1.1276 .0003 1.1336 .0003 2.387 478,245 Index Futures Mini DJ Industrial Average (CBT)-$ 5 x Index June 26144 26233 26107 S&P 500 Index (CME)-$250 x Index June 2883.00 2895.50 2883.00 26166 8 78,612 2894 50 1190 28 438