Answered step by step

Verified Expert Solution

Question

1 Approved Answer

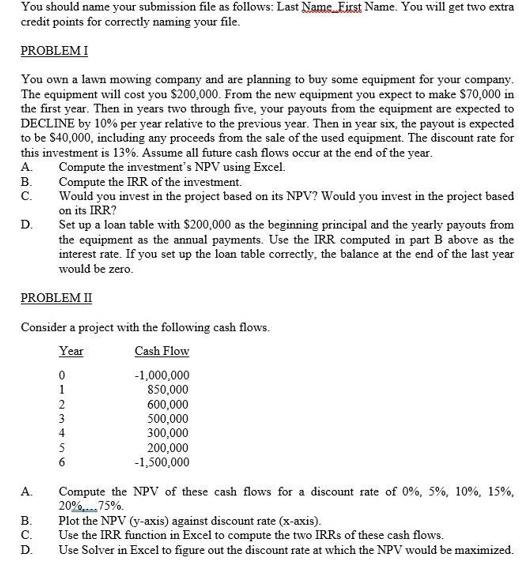

You should name your submission file as follows: Last Name First Name. You will get two extra credit points for correctly naming your file.

You should name your submission file as follows: Last Name First Name. You will get two extra credit points for correctly naming your file. PROBLEM I You own a lawn mowing company and are planning to buy some equipment for your company. The equipment will cost you $200,000. From the new equipment you expect to make $70,000 in the first year. Then in years two through five, your payouts from the equipment are expected to DECLINE by 10% per year relative to the previous year. Then in year six, the payout is expected to be $40,000, including any proceeds from the sale of the used equipment. The discount rate for this investment is 13%. Assume all future cash flows occur at the end of the year. Compute the investment's NPV using Excel. A. B. C. D. Compute the IRR of the investment. Would you invest in the project based on its NPV? Would you invest in the project based on its IRR? Set up a loan table with $200,000 as the beginning principal and the yearly payouts from the equipment as the annual payments. Use the IRR computed in part B above as the interest rate. If you set up the loan table correctly, the balance at the end of the last year would be zero. PROBLEM II Consider a project with the following cash flows. Year Cash Flow 0123456 A. BOD B. C. D. -1,000,000 850,000 600,000 500,000 300,000 200,000 -1,500,000 Compute the NPV of these cash flows for a discount rate of 0%, 5%, 10%, 15%, 20%...75%. Plot the NPV (y-axis) against discount rate (x-axis). Use the IRR function in Excel to compute the two IRRS of these cash flows. Use Solver in Excel to figure out the discount rate at which the NPV would be maximized.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started