Answered step by step

Verified Expert Solution

Question

1 Approved Answer

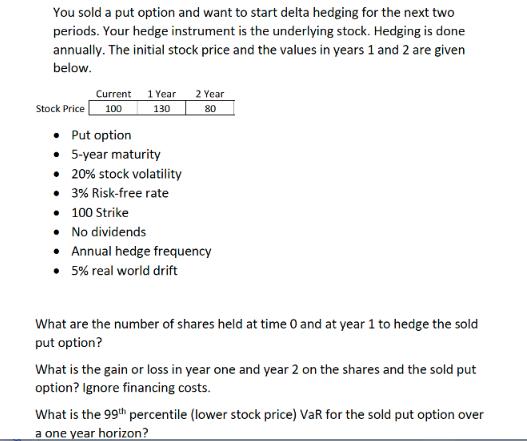

You sold a put option and want to start delta hedging for the next two periods. Your hedge instrument is the underlying stock. Hedging

You sold a put option and want to start delta hedging for the next two periods. Your hedge instrument is the underlying stock. Hedging is done annually. The initial stock price and the values in years 1 and 2 are given below. Current 1 Year 2 Year 130 80 Stock Price 100 Put option 5-year maturity 20% stock volatility 3% Risk-free rate 100 Strike No dividends Annual hedge frequency 5% real world drift What are the number of shares held at time 0 and at year 1 to hedge the sold put option? What is the gain or loss in year one and year 2 on the shares and the sold put option? Ignore financing costs. What is the 99th percentile (lower stock price) VaR for the sold put option over a one year horizon?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started