Question

You subscribe, today, to a bond loan, repayment in 4 years, bearing a nominal interest of 5% (Par value: 100). One year later, on

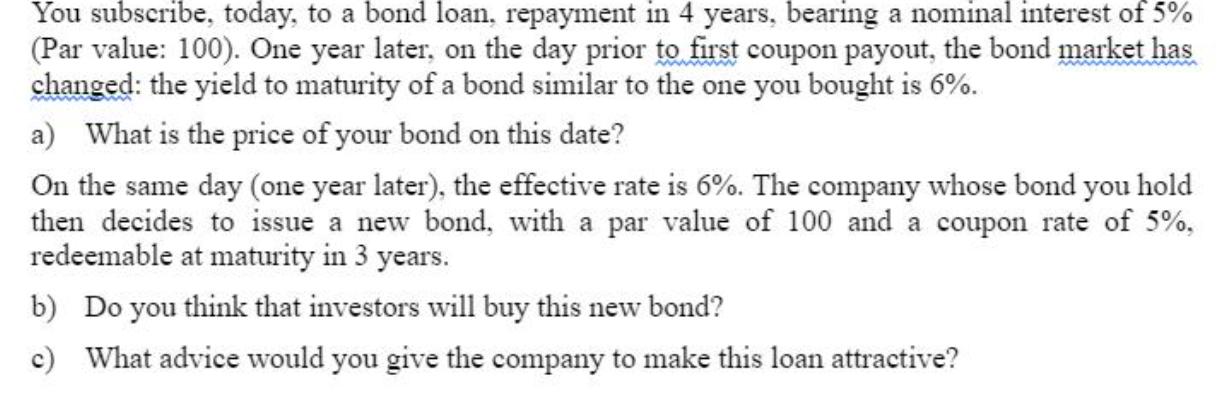

You subscribe, today, to a bond loan, repayment in 4 years, bearing a nominal interest of 5% (Par value: 100). One year later, on the day prior to first coupon payout, the bond market has changed: the yield to maturity of a bond similar to the one you bought is 6%. a) What is the price of your bond on this date? On the same day (one year later), the effective rate is 6%. The company whose bond you hold then decides to issue a new bond, with a par value of 100 and a coupon rate of 5%, redeemable at maturity in 3 years. b) Do you think that investors will buy this new bond? c) What advice would you give the company to make this loan attractive?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the price of the bond one year later we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Charles E. Davis, Elizabeth Davis

2nd edition

1118548639, 9781118800713, 1118338448, 9781118548639, 1118800710, 978-1118338445

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App