Question

You take out an $80 000 mortgage (denoted by A) at 9% compounded semi-annually with a 25-year amortization period (denoted by n). a) Determine the

You take out an $80 000 mortgage (denoted by A) at 9% compounded semi-annually with a 25-year amortization period (denoted by n).

a) Determine the monthly payment (denoted by R) required. (Already answered)

b) Determine the reduced final payment. (rounding the monthly payment to the next dime, will result in a smaller final payment)

c) At the end of 4 years, you pay down an additional $2500 (no penalty).

i) How much sooner will the mortgage be paid off? (Already answered)

ii) What would be the difference in total payments over the life of the mortgage?

Please help me solve b) finding the reduced final payment and c) ii) and include the steps if possible. Thanks for any help!

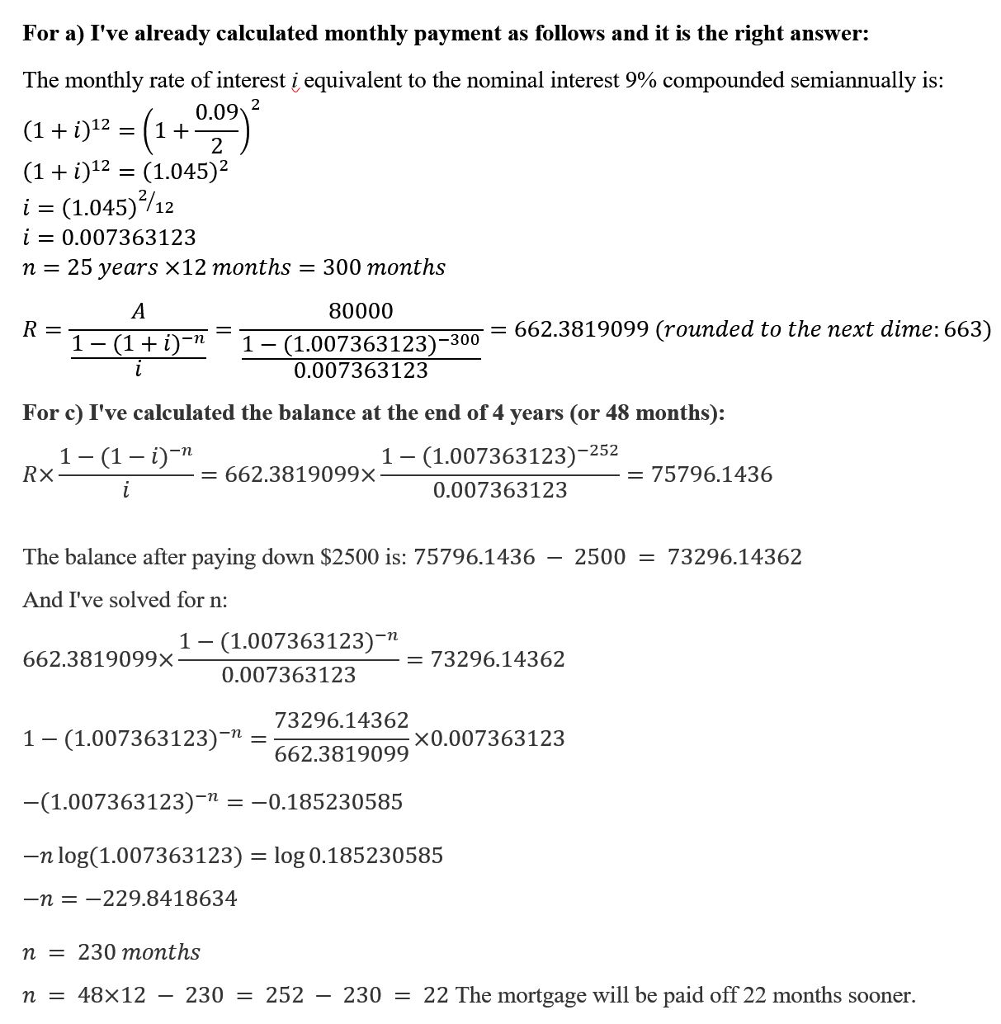

For a) I've already calculated monthly payment as follows and it is the right answer: The monthly rate of interest iequivalent to the nominal interest 9% compounded semiannually is: 0.09 12 (1 i) (1 i) 12 (1.045) i 1.045) 12 i 0.00 7363123 25 years x12 months 300 months 80000 662.3819099 (rounded to the next dime: 663) 1 (1 i) n 1 1.007363123 300 0.007363123 For c) I've calculated the balance at the end of 4 years (or 48 months): 1 (1 i) 662 3819099X 1 (1.007363123) 252 0.00 7363123 75796.1436 RX The balance after paying down $2500 is: 75796.1436 2500 73296.14362 And I've solved for n: 1 (1.007363123) 662 3819099X 73296.14362 0.007363123 73296.14362 1 (1.007363123) 662.3819099 X0.007 363123 (1.007363123) 0.185230585 -n log (1.007363123) log 0.185230585 -n 229.8418634 n 230 months n 48x12 230 252 230 22 The mortgage will be paid off 22 months soonerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started