Question: You talk to Sally about getting paid for the work you're doing. You suggest $25 an hour and she agrees. You are only doing

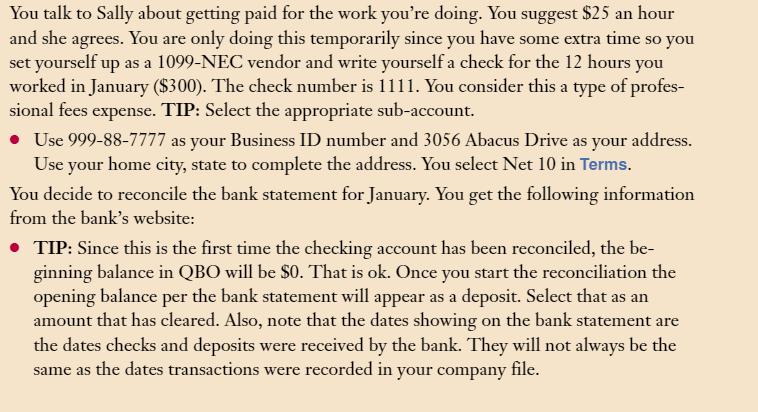

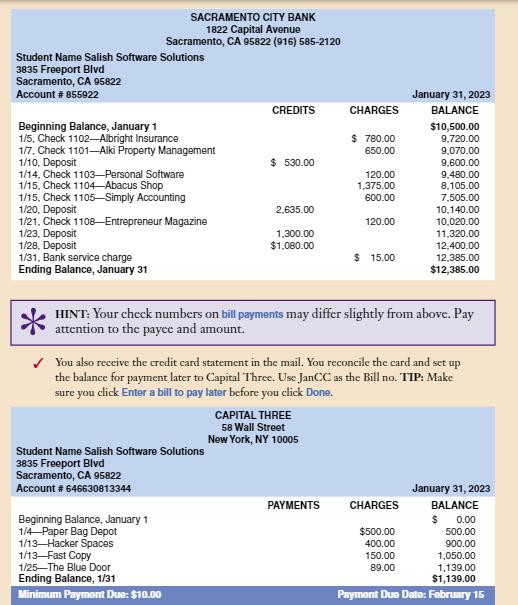

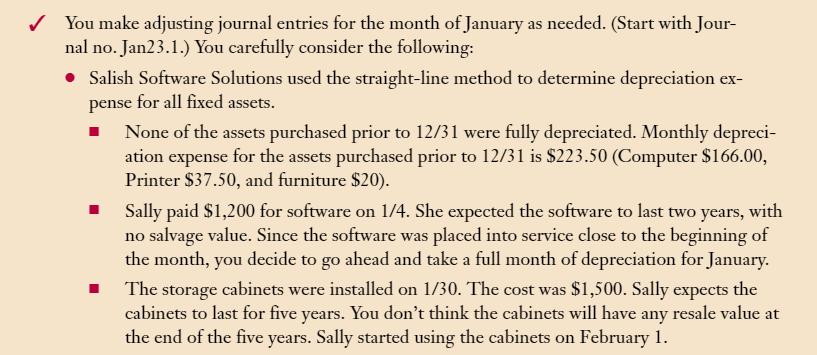

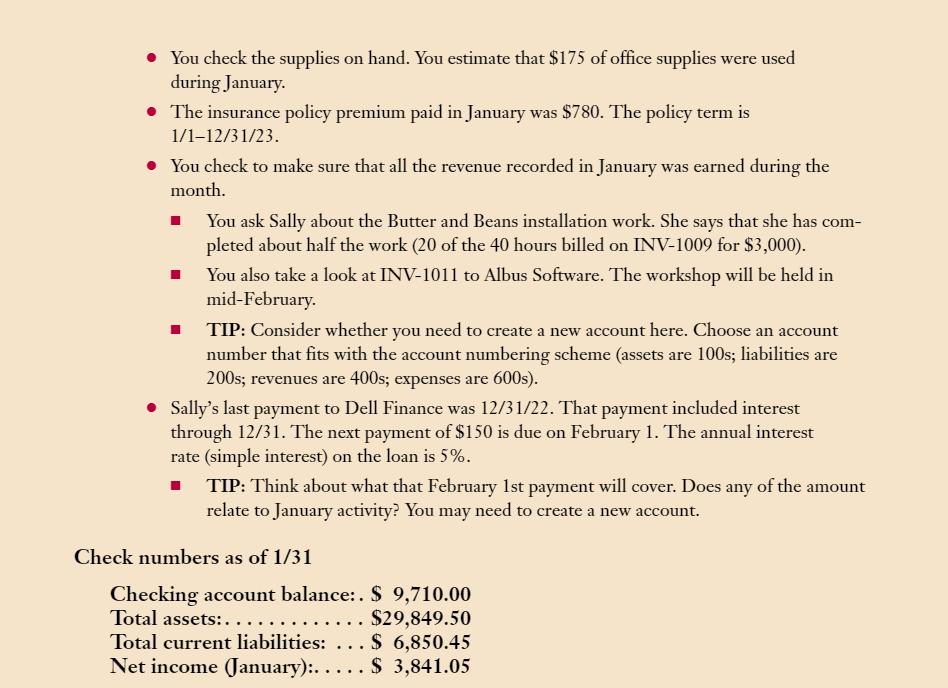

You talk to Sally about getting paid for the work you're doing. You suggest $25 an hour and she agrees. You are only doing this temporarily since you have some extra time so you set yourself up as a 1099-NEC vendor and write yourself a check for the 12 hours you worked in January ($300). The check number is 1111. You consider this a type of profes- sional fees expense. TIP: Select the appropriate sub-account. Use 999-88-7777 as your Business ID number and 3056 Abacus Drive as your address. Use your home city, state to complete the address. You select Net 10 in Terms. You decide to reconcile the bank statement for January. You get the following information from the bank's website: TIP: Since this is the first time the checking account has been reconciled, the be- ginning balance in QBO will be $0. That is ok. Once you start the reconciliation the opening balance per the bank statement will appear as a deposit. Select that as an amount that has cleared. Also, note that the dates showing on the bank statement are the dates checks and deposits were received by the bank. They will not always be the same as the dates transactions were recorded in your company file. SACRAMENTO CITY BANK 1822 Capital Avenue Sacramento, CA 95822 (916) 585-2120 Student Name Salish Software Solutions 3835 Freeport Blvd Sacramento, CA 95822 Account # 855922 Beginning Balance, January 1 1/5, Check 1102-Albright Insurance 1/7, Check 1101-Alki Property Management 1/10. Deposit 1/14, Check 1103-Personal Software 1/15, Check 1104- Abacus Shop 1/15, Check 1105-Simply Accounting 1/20, Deposit 1/21. Check 1108-Entrepreneur Magazine 1/23, Deposit 1/28, Deposit 1/31, Bank service charge Ending Balance, January 31 CREDITS Student Name Salish Software Solutions 3835 Freeport Blvd Sacramento, CA 95822 Account # 646630813344 Beginning Balance, January 1 1/4 Paper Bag Depot 1/13-Hacker Spaces 1/13-Fast Copy 1/25 The Blue Door Ending Balance, 1/31 Minimum Payment Due: $10.00 $530.00 2,635.00 1,300.00 $1,080.00 CHARGES CAPITAL THREE 58 Wall Street New York, NY 10005 $780.00 650.00 PAYMENTS 120.00 1,375.00 600.00 120.00 $15.00 HINT: Your check numbers on bill payments may differ slightly from above. Pay attention to the payee and amount. January 31, 2023 BALANCE You also receive the credit card statement in the mail. You reconcile the card and set up the balance for payment later to Capital Three. Use JanCC as the Bill no. TIP: Make sure you click Enter a bill to pay later before you click Done. $10,500.00 9,720.00 CHARGES $500.00 400.00 150.00 89.00 9,070.00 9,600.00 9.480.00 8,105.00 7,505.00 10.140.00 10,020.00 11,320.00 12,400.00 12,385.00 $12,385.00 January 31, 2023 BALANCE $ 0.00 500.00 900.00 1,050.00 1,139.00 $1,139.00 Payment Due Date: February 15 You make adjusting journal entries for the month of January as needed. (Start with Jour- nal no. Jan23.1.) You carefully consider the following: Salish Software Solutions used the straight-line method to determine depreciation ex- pense for all fixed assets. None of the assets purchased prior to 12/31 were fully depreciated. Monthly depreci- ation expense for the assets purchased prior to 12/31 is $223.50 (Computer $166.00, Printer $37.50, and furniture $20). Sally paid $1,200 for software on 1/4. She expected the software to last two years, with no salvage value. Since the software was placed into service close to the beginning of the month, you decide to go ahead and take a full month of depreciation for January. The storage cabinets were installed on 1/30. The cost was $1,500. Sally expects the cabinets to last for five years. You don't think the cabinets will have any resale value at the end of the five years. Sally started using the cabinets on February 1. You check the supplies on hand. You estimate that $175 of office supplies were used during January. The insurance policy premium paid in January was $780. The policy term is 1/1-12/31/23. You check to make sure that all the revenue recorded in January was earned during the month. You ask Sally about the Butter and Beans installation work. She says that she has com- pleted about half the work (20 of the 40 hours billed on INV-1009 for $3,000). You also take a look at INV-1011 to Albus Software. The workshop will be held in mid-February. TIP: Consider whether you need to create a new account here. Choose an account number that fits with the account numbering scheme (assets are 100s; liabilities are 200s; revenues are 400s; expenses are 600s). Sally's last payment to Dell Finance was 12/31/22. That payment included interest through 12/31. The next payment of $150 is due on February 1. The annual interest rate (simple interest) on the loan is 5%. TIP: Think about what that February 1st payment will cover. Does any of the amount relate to January activity? You may need to create a new account. Check numbers as of 1/31 Checking account balance:. $ 9,710.00 Total assets:.. .. $29,849.50 Total current liabilities: . . . $ 6,850.45 Net income (January):. . . . . $ 3,841.05

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Adjusting journal entries for January 2023 Journal No Date Description Debit Credit Jan231 1312023 Depreciation ... View full answer

Get step-by-step solutions from verified subject matter experts