Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax return 1 fact pattern Prepare a 2019 Form 1040 and Form 1040 Schedule 1 for the Smiths from the IRS website, Type your

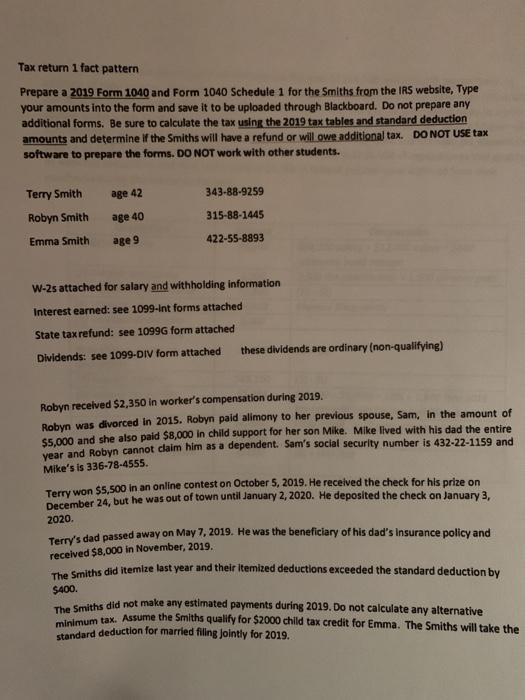

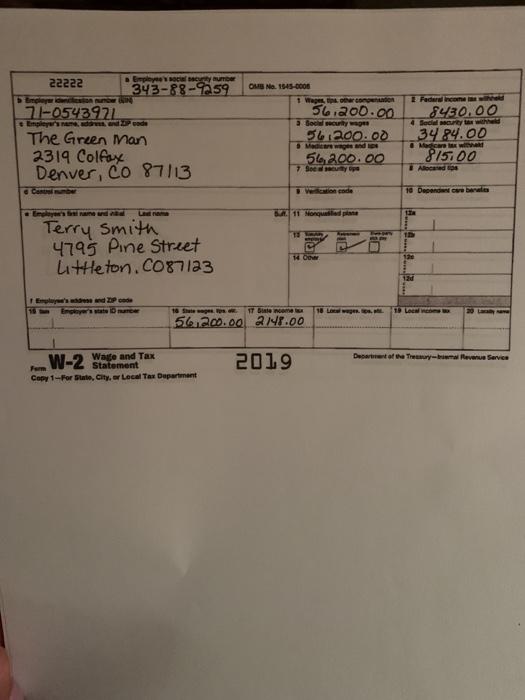

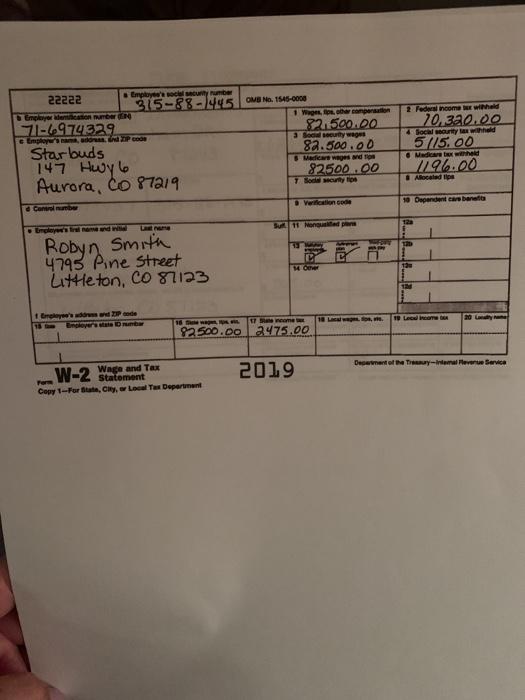

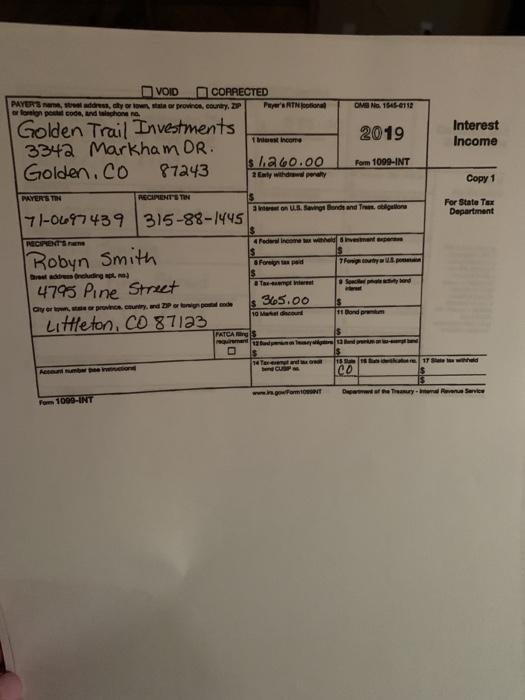

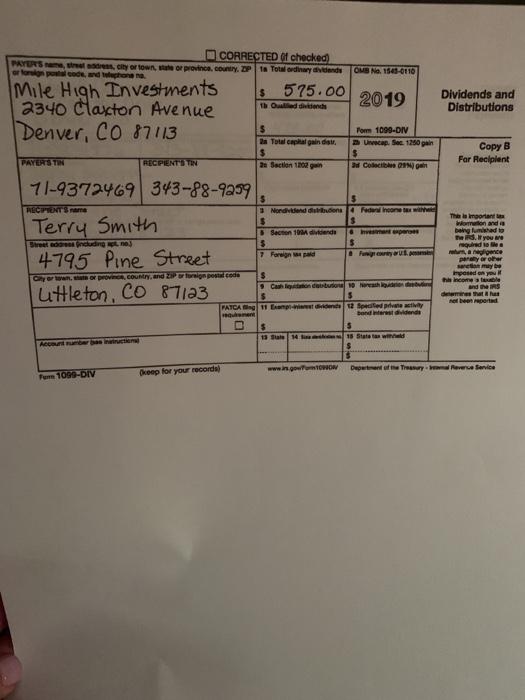

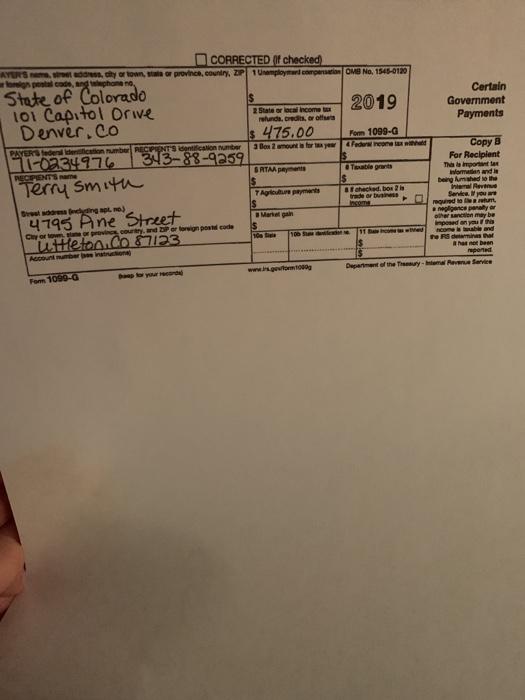

Tax return 1 fact pattern Prepare a 2019 Form 1040 and Form 1040 Schedule 1 for the Smiths from the IRS website, Type your amounts into the form and save it to be uploaded through Blackboard. Do not prepare any additional forms. Be sure to calculate the tax using the 2019 tax tables and standard deduction amounts and determine if the Smiths will have a refund or will owe additional tax. DO NOT USE tax software to prepare the forms. DO NOT work with other students. Terry Smith Robyn Smith Emma Smith age 42 age 40 age 9 343-88-9259 315-88-1445 422-55-8893 W-2s attached for salary and withholding information Interest earned: see 1099-Int forms attached State tax refund: see 1099G form attached Dividends: see 1099-DIV form attached these dividends are ordinary (non-qualifying) Robyn received $2,350 in worker's compensation during 2019. Robyn was divorced in 2015. Robyn paid alimony to her previous spouse, Sam, in the amount of $5,000 and she also paid $8,000 in child support for her son Mike. Mike lived with his dad the entire year and Robyn cannot claim him as a dependent. Sam's social security number is 432-22-1159 and Mike's is 336-78-4555. Terry won $5,500 in an online contest on October 5, 2019. He received the check for his prize on December 24, but he was out of town until January 2, 2020. He deposited the check on January 3, 2020. Terry's dad passed away on May 7, 2019. He was the beneficiary of his dad's Insurance policy and received $8,000 in November, 2019. The Smiths did itemize last year and their itemized deductions exceeded the standard deduction by $400. The Smiths did not make any estimated payments during 2019. Do not calculate any alternative minimum tax. Assume the Smiths qualify for $2000 child tax credit for Emma. The Smiths will take the standard deduction for married filling jointly for 2019. a Employee's social security number 343-88-9259 22222 Employer incision number (N 71-0543971 Employer's name, address and IP code The Green Man 2319 Colfax Denver, CO 87113 Contral number Employee's first name and Terry Smith 4795 Pine Street Littleton. C087123 Last nama Employee's dress and ZIP code Employer's state 10 marer OMB No. 1545-0005 FormW-2 Wage and Tax Statement Copy 1-For State, City, or Local Tax Department 1 Wapes, tips other compensation 56.200.00 3 Social security wages 56,200.00 Madicare wages and spe 56,200.00 7 Soc al security ops Suft. 11 Nonquested plane Verdication code 14 Other 16 State ages. ps d 56,200.00 2148.00 2019 17 Siste income tax 18 Local wages Federal income the weld 8430.00 4 Social security tax withheld 34 84.00 Madicare tax withheld 815.00 Allocated ips 10 Dependent care benetes 12 150 120 12d 19 Local come Department of the Treasury-buemal Revenue Service Employes's social security number 315-88-1445 OMB No. 1545-0008 22222 Employer identication number (0 71-6974329 e Employer's name, address and ZIP code Starbuds 147 Hwy 6 Aurora, CO 87219 Consral number Employee's first name and initial Last name Robyn Smith 4795 Pine Street Littleton, CO 87123 1 Employee's address and ZIP code 15 m Employer's state 10 rumbar 1 Wages, fps, other compensation 82.500.00 W-2 Wage and Tax Form Statement Copy 1-For State, City, or Local Tax Department 3 Social security wages 82.500.00 & Medicare wages and to 7. Social security tips 82500.00 Verification code Su 11 Nonqued pl 13 MAR 16. fste wagen, psi 17 Sate income ex 82500.00 2475.00 14 Other 2019 18 Local wees, FOR 2 Federal income sex withheld 10,320.00 4 Social security tax withheld 5/15.00 6 Medicare tax withheld 1196.00 Allocated p 10 Dependent care benefits 120 120 120 19 Local income 20 L Department of the Treasury-internal Revenue Service VOID CORRECTED PAYER'S name, street address, city or town, stata or province, country, P Payer's RTN otional or foreign postal code, and telephone no Golden Trail Investments 3342 Markham DR. Golden.co 87243 PAYER'S TIN RECIPIENT'S TIN 71-0697439 RECIPENT'S P Robyn Smith Brest address Oncluding apt, no) Account number pee cond 315-88-1445 4795 Pine Street City or town, state or province, country, and ZIP or tonign postal onde Littleton, CO 87123 Form 1000-INT 1 Interest income $ 1.260.00 2 Early withdrawal penalty IS Tax-exempt in $365.00 10 Maret discount 3 Interest on US. Savings Bonds and Trees, obligations $ 4 Federal income tax withheld investment exper $ & Foreign tax paid OMB No 1545-0112 14 Tax-exempt ben CUP 2019 www.sgowForm10 Form 1099-INT 7 Fonign courty a US Spacer pale d i FATCA requirement 12 ad poney 13 and pr O $ 11 Bond prem Interest Income Copy 1 For State Tax Department 15 16 17 te withheld CO De of the Treasury Internal Revenue Service CORRECTED of checked) PAYER'S name, street address, city or town, state or province, country. ZP 1a Total ordinary dividends or forsign postal code, and telephone na Mile High Investments 2340 Claxton Avenue Denver, CO 87113 PAYERS TIN 11-9372469 343-88-9259 RECIPIENT'S name Terry Smith Street address including apt, no 4795 Pine Street RECIPIENTS TIN City or town, state or province, country, and 2 or foreign postal code uttleton, CO 87123 Account sumber bas instructional Fem 1099-DIV (keep for your records) $ 1b Qualled dividends $ 2n Total capital gain distr $ 2 Section 1202 gain $ 575.00 $ $ Section 103 divend $ 7 Foreign pad Cash liquidation distribution $ Nondividend distributions 4 Federal income tax with $ $ FATCA 11 Exampinarest dividends requirement D OMB No. 1543-0110 2019 www.in.goom1OON Form 1099-DIV Unvecap. Soc. 1250 pain $ 3d Collectibles (29) & Investment expenses $ Fuig country or up 10 Norashiquidon debu S 12 Specited private activity bond interest dividends $ S 13 Sale 14 15 State tax wild $ Dividends and Distributions Copy B For Recipient This is important tax information and is being fumishad to the RS. required to retur,a negligence parally or other may be you if ble and the IRS determines that has not been portad imposed the income Department of the Treasury bemal Revenue Service CORRECTED (if checked) AYER'S name, street address, city or town, stata or province, country, ZIP 1 Unemploymard compensation OMB No. 1545-0120 foreign postal code, ang telephone no, 2019 State of Colorado 101 Capitol Drive Denver.co PAYERS federal identification number RECIPIENT'S identification number 343-88-9259 71-0234976 RECIPIENT'S name Terry Smith Brest address including apt, no) 4795 Ane Street City or town slane or province country, and ZIP or toreign postcode Littleton, CO 87123 Account number instructions) For 1090-G bap for your record $ 2 State or local income tax refunds, credits, or offers $ 475.00 For 1099-G 3 Box 2 amount is for tax year4Federat income tax wild SATAA payments $ 7 Agriculture payments S $ 10 Market gain www.is.getom1000g $ Copy B For Recipient This is important information and in being Aumshed to the Internal Revenue required to m Service. If you ar negligence penalty or other sanction may be imposed on you thi ncome is table and determines that has not been reported Department of the Treasury-Intermal Revenue Service Txable grants checked. box 2 in trade or business Income 100 Stedele 11 come Certain Government Payments the

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The Smiths will not have to pay any additional tax for the 2019 tax year They will receive a r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started