Answered step by step

Verified Expert Solution

Question

1 Approved Answer

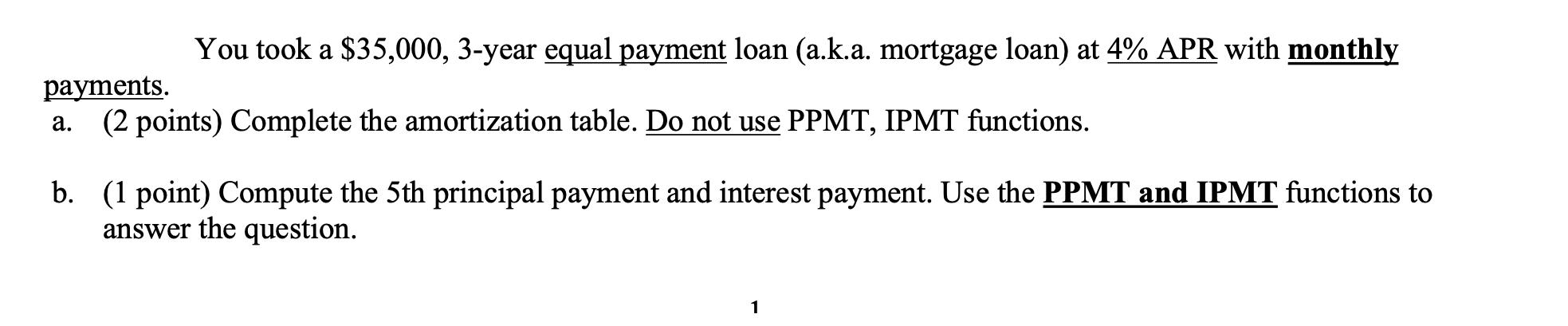

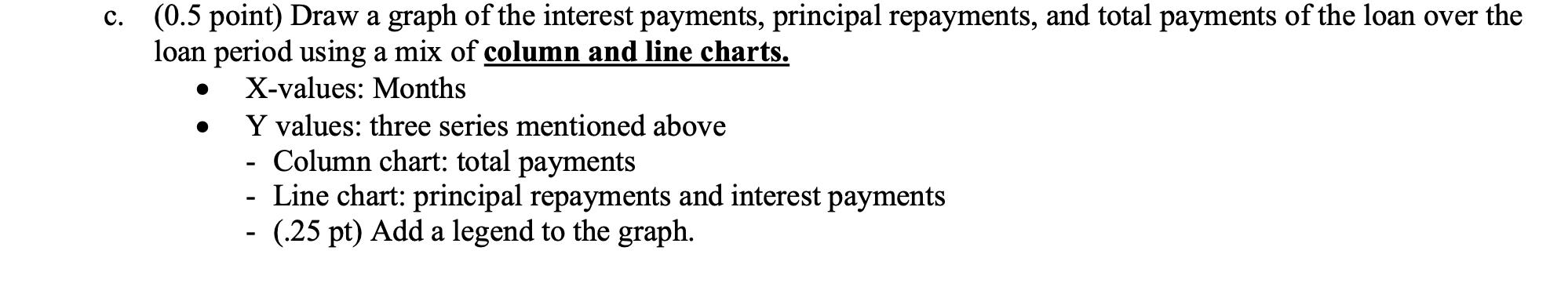

You took a $35,000, 3-year equal payment loan (a.k.a. mortgage loan) at 4% APR with monthly payments. a. (2 points) Complete the amortization table.

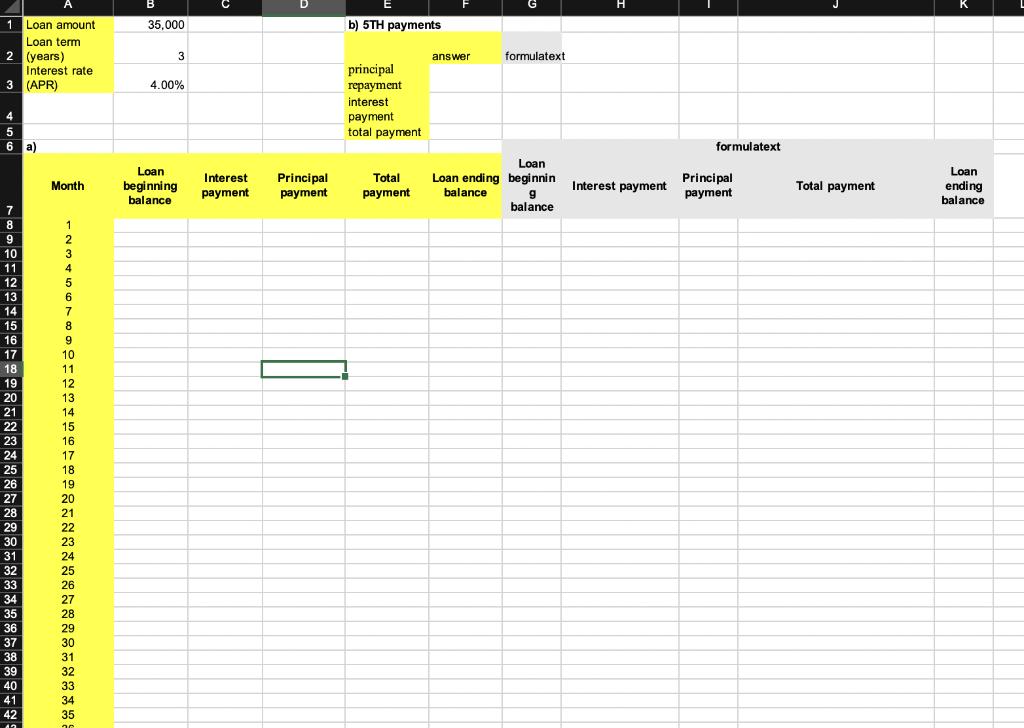

You took a $35,000, 3-year equal payment loan (a.k.a. mortgage loan) at 4% APR with monthly payments. a. (2 points) Complete the amortization table. Do not use PPMT, IPMT functions. b. (1 point) Compute the 5th principal payment and interest payment. Use the PPMT and IPMT functions to answer the question. 1 c. (0.5 point) Draw a graph of the interest payments, principal repayments, and total payments of the loan over the loan period using a mix of column and line charts. X-values: Months Y values: three series mentioned above - Column chart: total payments Line chart: principal repayments and interest payments (.25 pt) Add a legend to the graph. A 1 Loan amount Loan term 2 (years) 3 4 5 6 a) 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Interest rate (APR) 34 35 36 37 38 39 40 41 42 Month wwwNNNNNNGAN CONSGAEN B 35,000 3 4.00% Loan beginning balance Interest Principal payment payment b) 5TH payments principal repayment interest payment total payment Total payment answer Loan ending balance formulatext Loan beginnin 9 balance Interest payment formulatext Principal payment Total payment Loan ending balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the graph with a mix of column and line charts showing the interest payments principal repay...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started