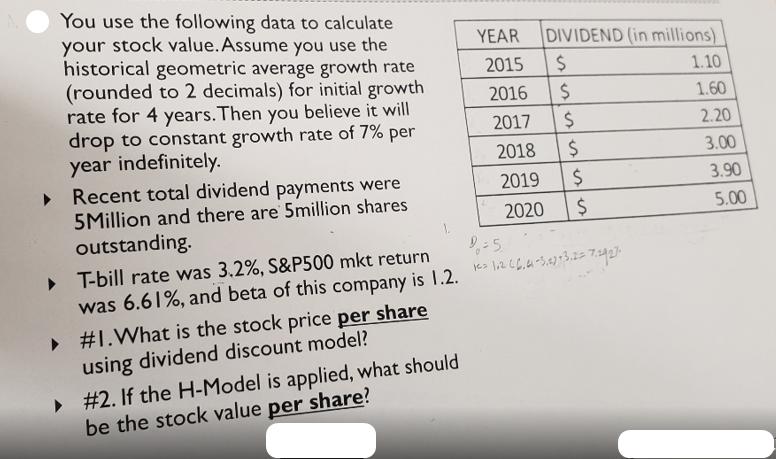

You use the following data to calculate your stock value. Assume you use the historical geometric average growth rate (rounded to 2 decimals) for

You use the following data to calculate your stock value. Assume you use the historical geometric average growth rate (rounded to 2 decimals) for initial growth rate for 4 years. Then you believe it will drop to constant growth rate of 7% per year indefinitely. Recent total dividend payments were 5Million and there are 5million shares outstanding. #1. What is the stock price per share using dividend discount model? YEAR DIVIDEND (in millions) 2015 $ 2016 $ 2017 $ 2018 2019 2020 #2. If the H-Model is applied, what should be the stock value per share? $ S5 $ 9=5 T-bill rate was 3.2%, S&P500 mkt return was 6.61%, and beta of this company is 1.2. 11.266.64-3:27+3.2= 7.3927. $ 1.10 1.60 2.20 3.00 3.90 5.00

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the stock price per share using the Dividend Discount Model DDM we need to sum the pres...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started