Answered step by step

Verified Expert Solution

Question

1 Approved Answer

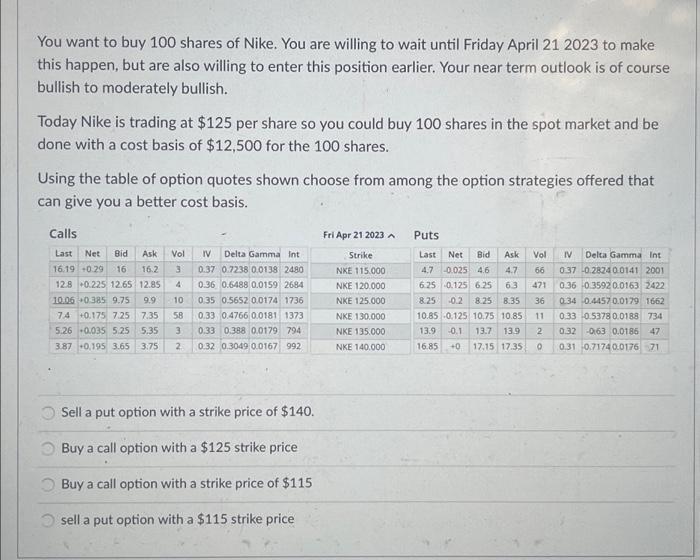

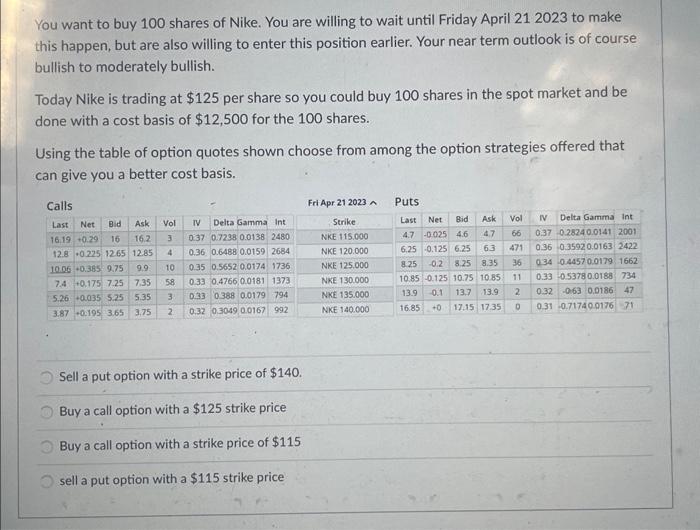

You want to buy 100 shares of Nike. You are willing to wait until Friday April 21 2023 to make this happen, but are also

You want to buy 100 shares of Nike. You are willing to wait until Friday April 21 2023 to make this happen, but are also willing to enter this position earlier. Your near term outlook is of course bullish to moderately bullish. Today Nike is trading at $125 per share so you could buy 100 shares in the spot market and be done with a cost basis of $12,500 for the 100 shares. Using the table of option quotes shown choose from among the option strategies offered that can give you a better cost basis. Calls Ask Vol IV Delta Gamma Int 3 Last Net Bid 16.19 +0.29 16 16.2 0.37 0.7238 0.0138 2480 12.8 +0.225 12.65 12.85 4 0.36 0.6488 0.0159 2684 10.06 +0.385 9.75 9.9 10 0.35 0.5652 0.0174 1736 7.4 +0.175 7.25 7.35 58 0.33 0.4766 0.0181 1373 5.26 +0.035 5.25 5.35 3 0.33 0.388 0.0179 794 3.87 +0.195 3.65 3.75 2 0.32 0.3049 0.0167 992 Sell a put option with a strike price of $140. Buy a call option with a $125 strike price Buy a call option with a strike price of $115 sell a put option with a $115 strike price Fri Apr 21 2023 ^ Strike NKE 115.000 NKE 120.000 NKE 125.000 NKE 130.000 NKE 135.000 NKE 140.000 Puts Last Net Bid Ask Vol 4.7 -0.025 4.6 4.7 66 6.25 -0.125 6.25 6.3 471 8.25 -0.2 8.25 8.35 36 10.85 -0.125 10.75 10.85 11 13.9 -0.1 13.7 13.9 2 16.85 +0 17.15 17.35 0 IV Delta Gamma Int 0.37 -0.2824 0.0141 2001 0.36 0.3592 0.0163 2422 0.34 -0.4457 0.0179 1662 0.33 0.5378 0.0188 734 0.32 -0.63 0.0186 47 71 0.31 0.7174 0.0176

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started