Question

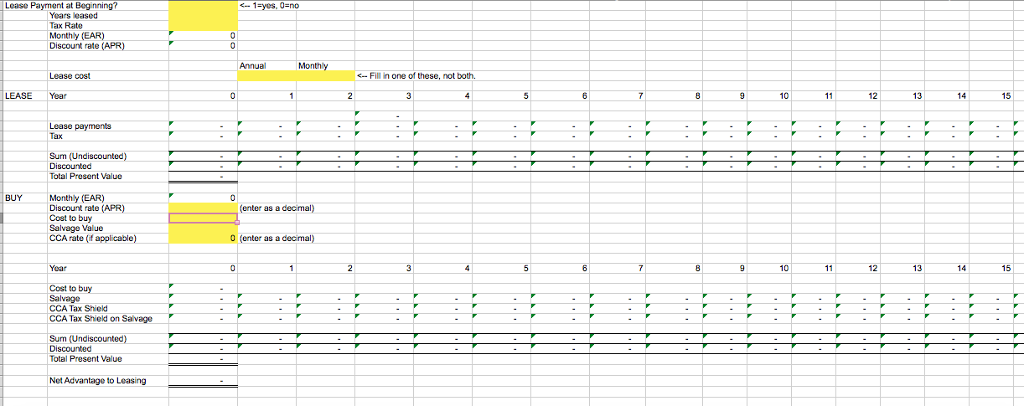

You want to buy a new car, but you're not sure whether you should lease it or buy it. You can buy it for $50,000,

You want to buy a new car, but you're not sure whether you should lease it or buy it. You can buy it for $50,000, and you expect that it will be worth $20,000 after you use it for 3 years. Alternatively, you could lease it for payments of $650 per month for the 3-year term, with the first payment due immediately. The lease company did not tell you what interest rate they're using to calculate the monthly payments, but you know you could borrow money from your banker at an annual percentage rate (APR) of 8%.

A. Calculate the present value of the lease payments, assuming monthly compounding at the given APR of 8%.

B. Calculate the present value of the $20,000 salvage value, again using monthly compounding and the given APR of 8%. Which option do you prefer, lease or buy?

C. Calculate the amount of the salvage value which would make you indifferent between leasing and buying.

D. If you were able to use this car 100% for business, rendering the lease payments tax-deductible, or alternatively, allowing you to deduct depreciation, and assuming your tax rate is 40%, would you prefer to buy or lease the car?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started