Question

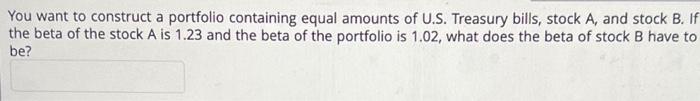

You want to construct a portfolio containing equal amounts of U.S. Treasury bills, stock A, and stock B. If the beta of the stock

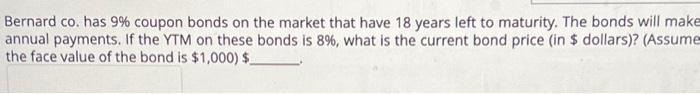

You want to construct a portfolio containing equal amounts of U.S. Treasury bills, stock A, and stock B. If the beta of the stock A is 1.23 and the beta of the portfolio is 1.02, what does the beta of stock B have to be? Bernard co. has 9% coupon bonds on the market that have 18 years left to maturity. The bonds will make annual payments. If the YTM on these bonds is 8%, what is the current bond price (in $ dollars)? (Assume the face value of the bond is $1,000) $_

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i We may begin by using the formula for a portfolios beta which is portfolio wA A wB B where wA wB a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

General Chemistry

Authors: Darrell Ebbing, Steven D. Gammon

9th edition

978-0618857487, 618857486, 143904399X , 978-1439043998

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App