Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the Thomson One-Business School Edition Online Database to answer the following questions. 1. You want to evaluate the recent investment performance for two

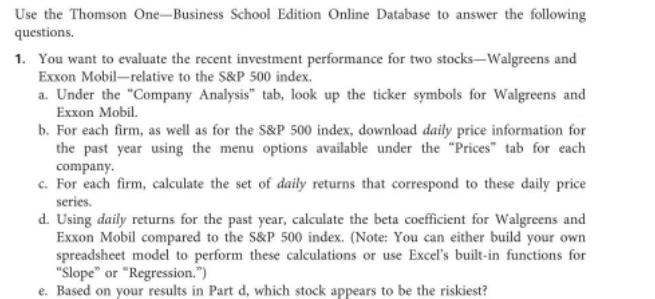

Use the Thomson One-Business School Edition Online Database to answer the following questions. 1. You want to evaluate the recent investment performance for two stocks-Walgreens and Exxon Mobil-relative to the S&P 500 index. a. Under the "Company Analysis" tab, look up the ticker symbols for Walgreens and Exxon Mobil. b. For each firm, as well as for the S&P 500 index, download daily price information for the past year using the menu options available under the "Prices" tab for each company. c. For each firm, calculate the set of daily returns that correspond to these daily price series. d. Using daily returns for the past year, calculate the beta coefficient for Walgreens and Exxon Mobil compared to the S&P 500 index. (Note: You can either build your own spreadsheet model to perform these calculations or use Excel's built-in functions for "Slope" or "Regression.") e. Based on your results in Part d, which stock appears to be the riskiest?

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Walgreens Ticker symbol is WBA Exxon Mobil Ticker symbol is XOM Walgreens 1219 13119 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started