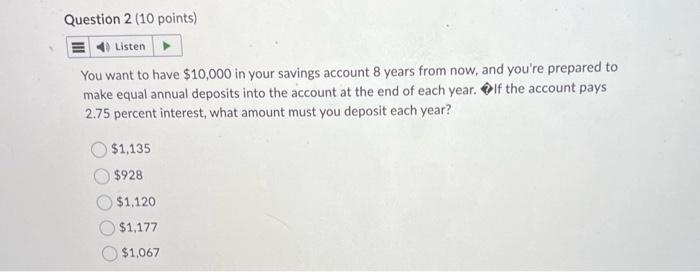

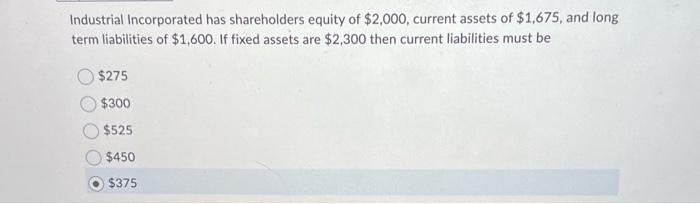

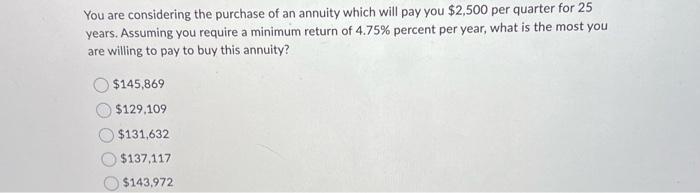

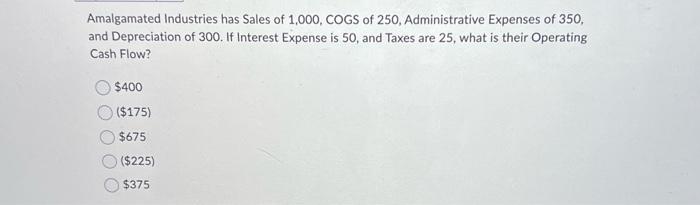

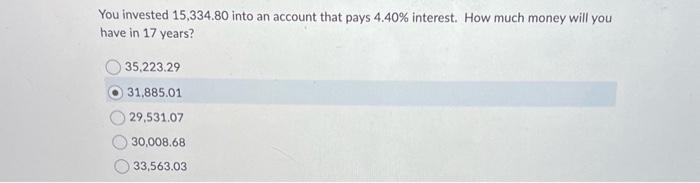

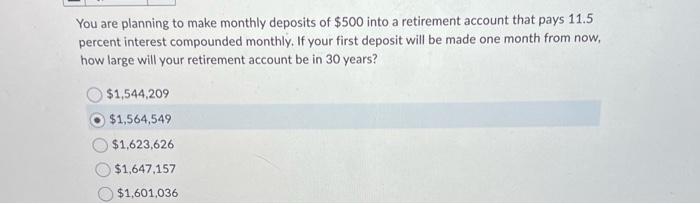

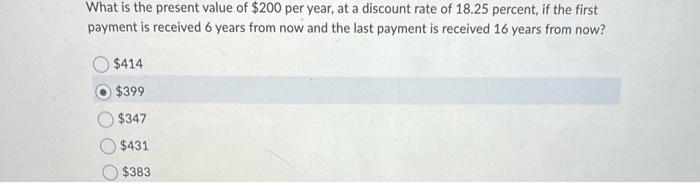

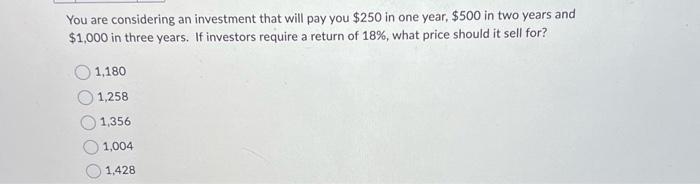

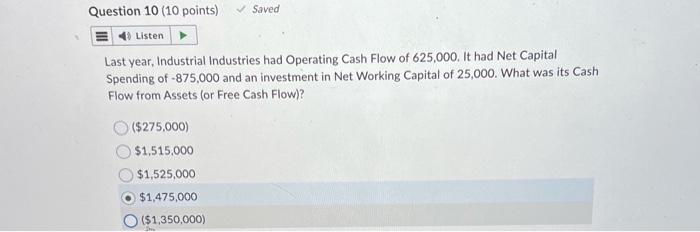

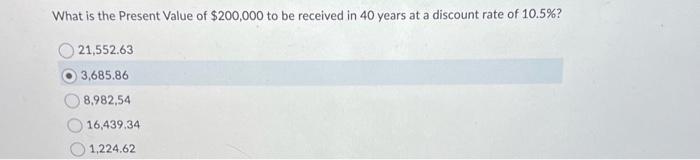

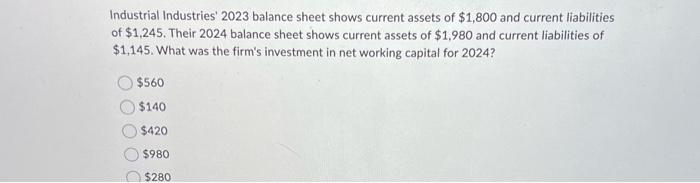

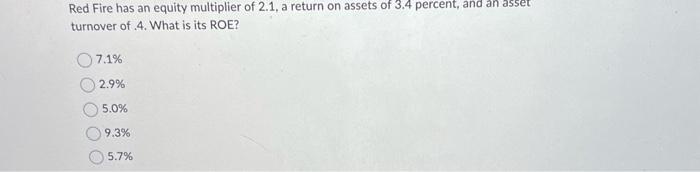

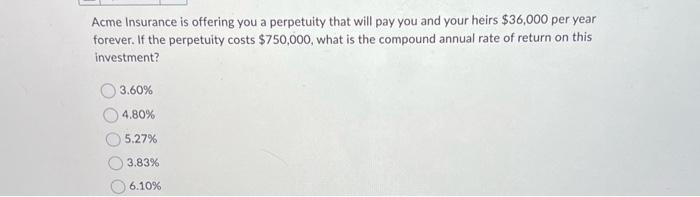

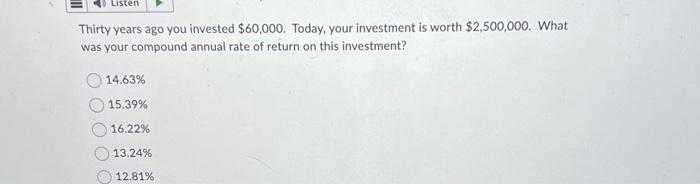

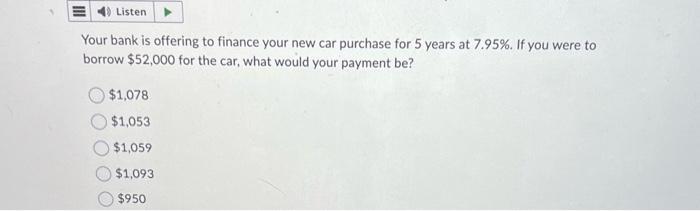

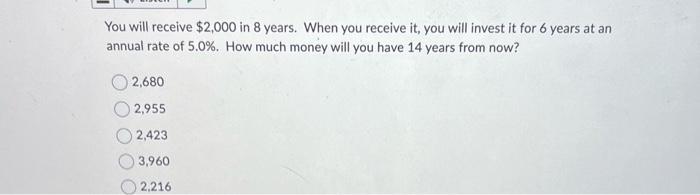

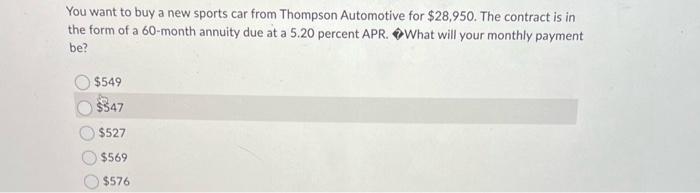

You want to have $10,000 in your savings account 8 years from now, and you're prepared to make equal annual deposits into the account at the end of each year. If the account pays 2.75 percent interest, what amount must you deposit each year? $1,135$928$1,120$1,177$1,067 Industrial Incorporated has shareholders equity of $2,000, current assets of $1,675, and long term liabilities of $1,600. If fixed assets are $2,300 then current liabilities must be $275$300$525$450$375 You are considering the purchase of an annuity which will pay you $2,500 per quarter for 25 years. Assuming you require a minimum return of 4.75% percent per year, what is the most you are willing to pay to buy this annuity? $145,869$129,109$131,632$137,117$143,972 Amalgamated Industries has Sales of 1,000, COGS of 250, Administrative Expenses of 350 , and Depreciation of 300 . If Interest Expense is 50, and Taxes are 25 , what is their Operating Cash Flow? $400 ($175) $675 ($225) $375 You invested 15,334.80 into an account that pays 4.40% interest. How much money will you have in 17 years? 35,223.2931,885.0129,531.0730,008.6833,563.03 You are planning to make monthly deposits of $500 into a retirement account that pays 11.5 percent interest compounded monthly. If your first deposit will be made one month from now. how large will your retirement account be in 30 years? $1,544,209$1,564,549$1,623,626$1,647,157$1,601,036 What is the present value of $200 per year, at a discount rate of 18.25 percent, if the first payment is received 6 years from now and the last payment is received 16 years from now? $414 $399 $347 $431 $383 You are considering an investment that will pay you $250 in one year, $500 in two years and $1,000 in three years. If investors require a return of 18%, what price should it sell for? 1,1801,2581,3561,0041,428 Last year, Industrial Industries had Operating Cash Flow of 625,000. It had Net Capital Spending of 875,000 and an investment in Net Working Capital of 25,000. What was its Cash Flow from Assets (or Free Cash Flow)? ($275,000)$1,515,000$1,525,000$1,475,000($1,350,000) What is the Present Value of $200,000 to be received in 40 years at a discount rate of 10.5% ? 21,552.633,685.868,982,5416,439,341,224.62 Industrial Industries' 2023 balance sheet shows current assets of $1,800 and current liabilities of $1,245. Their 2024 balance sheet shows current assets of $1,980 and current liabilities of $1,145. What was the firm's investment in net working capital for 2024 ? $560$140$420$980$280 Red Fire has an equity multiplier of 2.1 , a return on assets of 3.4 percent, and an asset turnover of .4. What is its ROE? 7.1% 2.9% 5.0% 9.3% 5.7% Acme Insurance is offering you a perpetuity that will pay you and your heirs $36,000 per year forever. If the perpetuity costs $750,000, what is the compound annual rate of return on this investment? 3.60% 4.80% 5.27% 3.83% 6.10% Thirty years ago you invested $60,000. Today, your investment is worth $2,500,000. What was your compound annual rate of return on this investment? 14.63% 15.39% 16.22% 13.24% 12.81% Your bank is offering to finance your new car purchase for 5 years at 7.95%. If you were to borrow $52,000 for the car, what would your payment be? $1,078$1,053$1,059$1,093$950 You will receive $2,000 in 8 years. When you receive it, you will invest it for 6 years at an annual rate of 5.0%. How much money will you have 14 years from now? 2,680 2,955 2,423 3,960 2,216 You want to buy a new sports car from Thompson Automotive for $28,950. The contract is in the form of a 60 -month annuity due at a 5.20 percent APR. \$ What will your monthly payment be? $549$547$527$569$576