Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to purchase a car for $16,000. Two of the loans you are considering are listed below. As is the case here, it

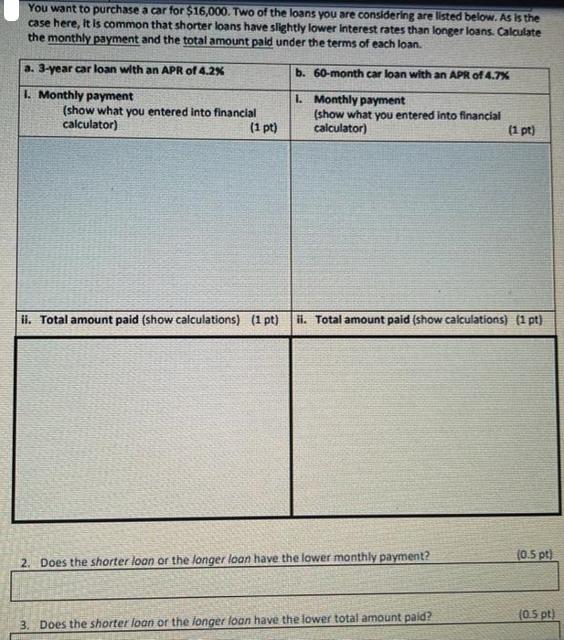

You want to purchase a car for $16,000. Two of the loans you are considering are listed below. As is the case here, it is common that shorter loans have slightly lower interest rates than longer loans. Calculate the monthly payment and the total amount paid under the terms of each loan. a. 3-year car loan with an APR of 4.2% 1. Monthly payment (show what you entered into financial calculator) (1 pt) b. 1. 60-month car loan with an APR of 4.7% Monthly payment (show what you entered into financial calculator) ii. Total amount paid (show calculations) (1 pt) ii. Total amount paid (show calculations) (1 pt) 2. Does the shorter loan or the longer loan have the lower monthly payment? (1 pt) 3. Does the shorter loan or the longer loan have the lower total amount paid? (0.5 pt) (0.5 pt)

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a For the 3 year 36 months loan ra04212 0035 Na36 Ma16000003...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started