Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to purchase a house for $150,000. You will make a down payment of 10 percent of the value of the house and

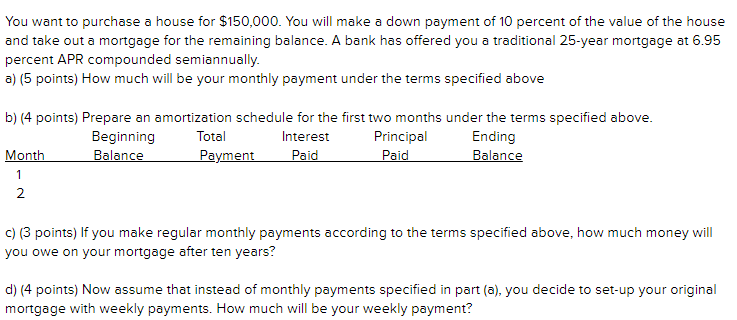

You want to purchase a house for $150,000. You will make a down payment of 10 percent of the value of the house and take out a mortgage for the remaining balance. A bank has offered you a traditional 25-year mortgage at 6.95 percent APR compounded semiannually. a) (5 points) How much will be your monthly payment under the terms specified above b) (4 points) Prepare an amortization schedule for the first two months under the terms specified above. Month 1 2 Beginning Balance Total Payment Interest Paid Principal Paid Ending Balance c) (3 points) If you make regular monthly payments according to the terms specified above, how much money will you owe on your mortgage after ten years? d) (4 points) Now assume that instead of monthly payments specified in part (a), you decide to set-up your original mortgage with weekly payments. How much will be your weekly payment?

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the monthly payment P 150000 010 15000 down payment Principal loan amount 150000 1500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started