Question

You want to start funding your retirement. You plan to do this by making 60 semi- annual deposits of $4,000 beginning today, your 30th

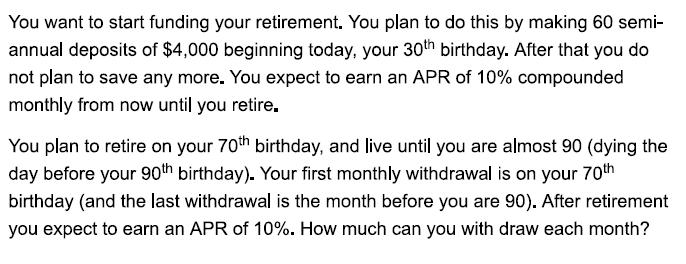

You want to start funding your retirement. You plan to do this by making 60 semi- annual deposits of $4,000 beginning today, your 30th birthday. After that you do not plan to save any more. You expect to earn an APR of 10% compounded monthly from now until you retire. You plan to retire on your 70th birthday, and live until you are almost 90 (dying the day before your 90th birthday). Your first monthly withdrawal is on your 70th birthday (and the last withdrawal is the month before you are 90). After retirement you expect to earn an APR of 10%. How much can you with draw each month?

Step by Step Solution

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

60 semiannual payments of 4000 is 60x4000 240000 APR 10 compounded m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Gordon Ro

7th Canadian Edition

007090653X, 978-0070906532, 978-0071339575

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App