Answered step by step

Verified Expert Solution

Question

1 Approved Answer

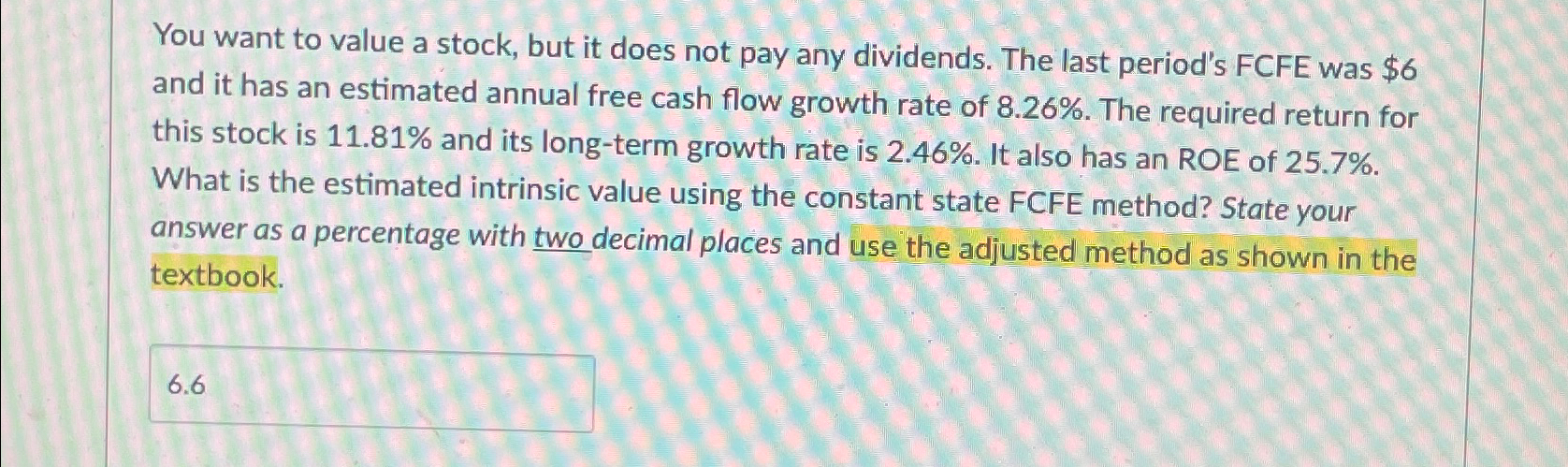

You want to value a stock, but it does not pay any dividends. The last period's FCFE was $ 6 and it has an estimated

You want to value a stock, but it does not pay any dividends. The last period's FCFE was $ and it has an estimated annual free cash flow growth rate of The required return for this stock is and its longterm growth rate is It also has an ROE of What is the estimated intrinsic value using the constant state FCFE method? State your answer as a percentage with two decimal places and use the adjusted method as shown in the textbook.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started