Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You were able to obtain the fallowing information from your client, YZ Corporation and the bank statements for November 30 and December 31, 2018.

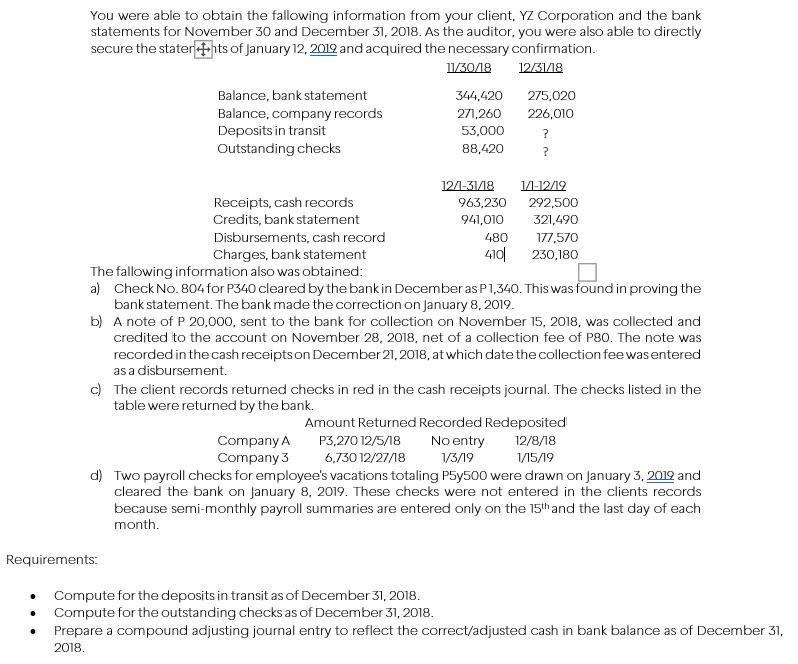

You were able to obtain the fallowing information from your client, YZ Corporation and the bank statements for November 30 and December 31, 2018. As the auditor, you were also able to directly secure the staterthts of January 12, 2019 and acquired the necessary confirmation. 11/30/18 12/31/18 Balance, bank statement 344,420 275,020 Balance, company records Deposits in transit Outstanding checks 271,260 226,010 53,000 ? 88,420 ? 121-31/18 1/1-12/19 Receipts, cash records Credits, bank statement 963,230 292,500 941,010 321,490 Disbursements, cash record 480 177,570 Charges, bank statement 410| 230,180 The fallowing information also was obtained: a) Check No. 804 for P340 cleared by the bank in December as P1,340. This was found in proving the bank statement. The bank made the correction on January 8, 2019. b) A note of P 20,000, sent to the bank for collection on November 15, 2018, was collected and credited to the account on November 28, 2018, net of a collection fee of P80. The note was recorded in the cash receiptson December 21, 2018, at which date the collection fee was entered as a disbursement. c) The client records returned checks in red in the cash receipts journal. The checks listed in the table were returned by the bank. Amount Returned Recorded Redeposited No entry Company A Company 3 P3,270 12/5/18 12/8/18 6,730 12/27/18 1/3/19 1/15/19 d) Two payroll checks for employee's vacations totaling P5y500 were drawn on January 3, 2012 and cleared the bank on January 8, 2019. These checks were not entered in the clients records because semi-monthly payroll summaries are entered only on the 15th and the last day of each month. Requirements: Compute for the deposits in transit as of December 31, 2018. Compute for the outstanding checks as of December 31, 2018. Prepare a compound adjusting journal entry to reflect the correct/adjusted cash in bank balance as of December 31, 2018.

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

my answer is as shown below Step 1 Bank Reconciliation Statement The purpose of preparing the bank r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started