Answered step by step

Verified Expert Solution

Question

1 Approved Answer

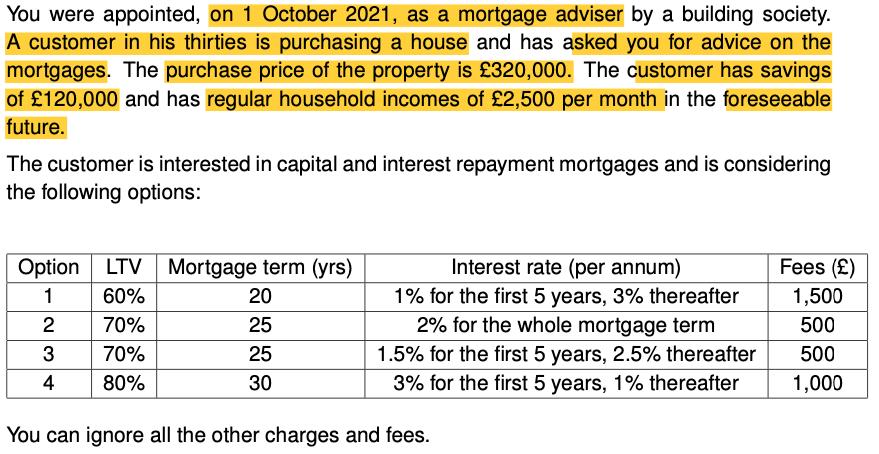

You were appointed, on 1 October 2021, as a mortgage adviser by a building society. A customer in his thirties is purchasing a house

You were appointed, on 1 October 2021, as a mortgage adviser by a building society. A customer in his thirties is purchasing a house and has asked you for advice on the mortgages. The purchase price of the property is 320,000. The customer has savings of 120,000 and has regular household incomes of 2,500 per month in the foreseeable future. The customer is interested in capital and interest repayment mortgages and is considering the following options: Option LTV Mortgage term (yrs) 60% 1 2 70% 3 70% 4 80% 20 25 25 30 Interest rate (per annum) 1% for the first 5 years, 3% thereafter 2% for the whole mortgage term 1.5% for the first 5 years, 2.5% thereafter 3% for the first 5 years, 1% thereafter You can ignore all the other charges and fees. Fees () 1,500 500 500 1,000 Write a report detailing your advice and recommendations. The mathematical methods, calculations and assumptions used should also be described.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Option 1 L TV 60 M ort gage term 20 years Interest rate 1 for the first 5 years 3 thereafter F ees 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started